Directional clarity remains elusive in the forex market post-US CPI release, with fluctuations leading to indecision.

Directional clarity remains elusive in the forex market post-US CPI release, with fluctuations leading to indecision. While there was initially a dollar buying reaction, subsequent intense swings saw a return to dollar weakness. Short-term financial markets have already priced in a potential US rate cut starting in June, and this sentiment has remained unchanged even […]

Yen Eases Off, Focus Shifts to Dollar Market as US Consumer Price Index Released Today

In the Tokyo market, the yen’s strength has eased off. While market speculation regarding the Bank of Japan’s March negative interest rate removal has increased, there have been no direct references from BOJ Governor Ueda today. Rather, remarks expressing concerns about weak consumption have led to movements in favor of yen depreciation. Attention in the […]

No clue today ahead of tomorrow’s U.S. Consumer Price Index

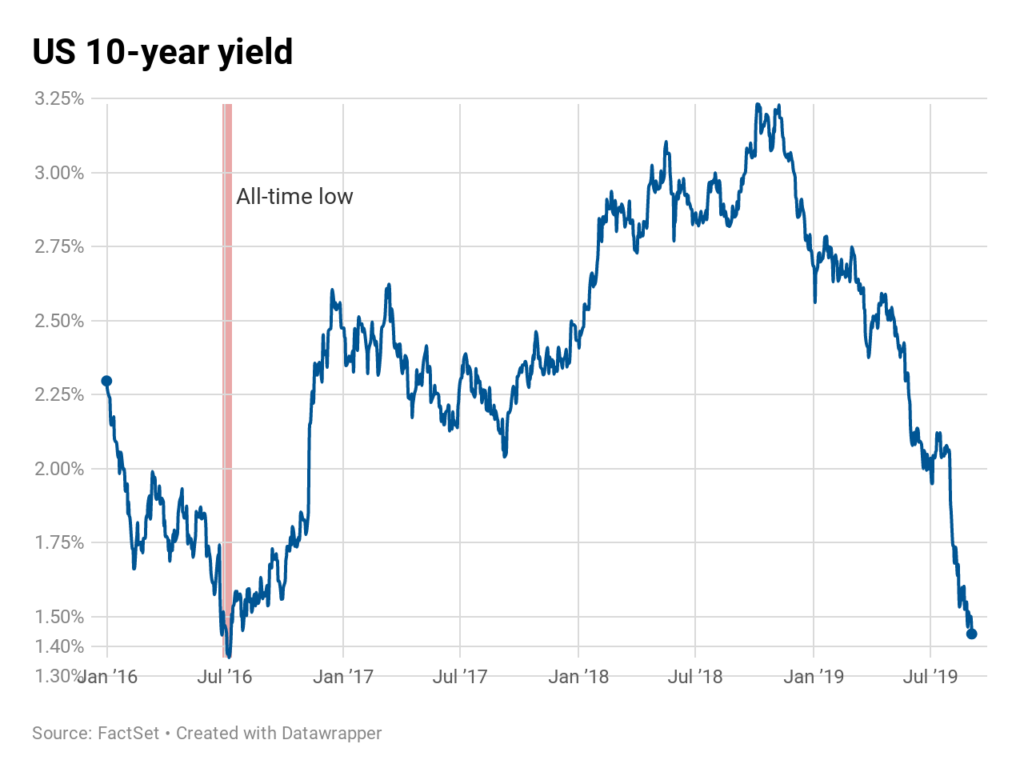

In anticipation of tomorrow’s release of the US Consumer Price Index for August, the market is facing uncertainty today. This CPI report is of particular interest for future actions by US monetary authorities in the autumn. The prevailing market consensus ahead of the September FOMC meeting leans heavily toward no change in policy rates. […]

US Consumer Price Index: Headline figures lower than expected, Core exceeds expectations, causing volatility in the dollar market

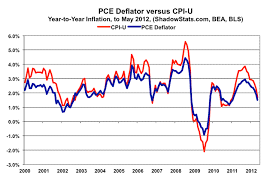

The May US Consumer Price Index showed a slower-than-expected year-on-year increase in the headline figure, coming in at +4.0% compared to the previous +4.9%. On the other hand, the Core year-on-year figure decreased from the previous +5.5% to +5.3%, but still slightly surpassed market expectations. The mixed results led to rapid fluctuations in the […]

Passing through the US Consumer Price Index (CPI) and heading towards the FOMC, the focus will be on changes in July rate hike expectations.

Today, the highly anticipated US Consumer Price Index will be released. Slowing year-on-year growth is expected, which is likely to support the market’s expectation of the Fed keeping interest rates unchanged in the upcoming FOMC meeting. However, depending on the degree of deviation from market expectations, it could impact the strength of rate hike expectations […]

Focus on the US Consumer Price Index: Will Inflation Slow Down?

Today, the US Consumer Price Index for April will be announced. It is well known for its high market attention due to its timeliness as an inflation indicator in the US. In the current market, concerns about the US regional bank failures and sell-offs have subsided, and there is no excessive reaction to the […]

As the US Consumer Price Index announcement is due tomorrow, the market is likely to be driven by adjustments today.

Following yesterday, there are no significant economic indicators scheduled for release today. The market’s focus is on tomorrow’s US Consumer Price Index. Last week’s sharp decline in US regional bank stocks, which had disrupted the market, has shown signs of rebounding at the beginning of this week, indicating a temporary stabilization. Furthermore, the market reacted […]

Pay attention to the US consumer price index, and be careful of even slight fluctuations

Today, the market’s attention is focused on the results of the US consumer price index for November. Until the announcement at 10:30 pm Japan time, a nervous atmosphere is expected with short-term position adjustments, but the direction will not be clear. According to representative market forecasts, the year-on-year increase is +7.3%, and the core […]

Market based on the US consumer price index, possibility of foreign exchange intervention, etc.

The US consumer price index for September will be released today. Prior to that, the market was dominated by a stronger dollar. The dollar/yen exchange rate is hovering around the 147 yen level amid growing concerns over yen-buying interventions. The pound-dollar market is in turmoil over the Bank of England’s temporary purchase of long-term bonds […]

Dollar selling slowed down due to the slowdown in the US consumer price index on the previous day, and today the US producer price index

The July US consumer price index announced yesterday was +8.5% year-on-year, a significant slowdown from +9.1% in June last time. Market expectations were around +8.7%. The core year-on-year growth rate remained at the same level as the previous year at +5.9%, falling short of market expectations of +6.1%. The market was flooded with dollar-selling reactions […]