Today, attention is focused on materials from the United States. While the US Consumer Price Index (CPI) to be released tomorrow is the most anticipated economic statistic, the US Producer Price Index (PPI) will be released today as a prelude. The market expects the year-on-year PPI to rise slightly to +2.2% from the previous +2.1%. The core year-on-year PPI is expected to decelerate slightly to +2.3% from the previous +2.4%. The market reaction will likely be sensitive to the degree of deviation between the actual results and the forecasts. However, looking at the inflation trend, it has bottomed out around July of last year. With year-on-year increases consistently above 2%, there might be an assessment of persistent inflation.

At 11 PM Japan time, Federal Reserve Chair Powell and Dutch Central Bank President Knot will speak at the Association of Foreign Banks in the Netherlands. A Q&A session is also planned, and Powell’s hawkishness will be closely watched. While Knot is also known as a hawk within the ECB, he is expected to endorse a rate cut in June, highlighting potential differences between the two.

The USD/JPY is gradually rising to the 156-yen level. If US bullish factors strengthen the dollar, it could once again be in a tug-of-war with intervention concerns. However, it’s worth noting that US Treasury Secretary Yellen has expressed discomfort with easy interventions. Unless there’s a panic-like price movement similar to when it hit the 160-yen level, the chance of intervention remains low.

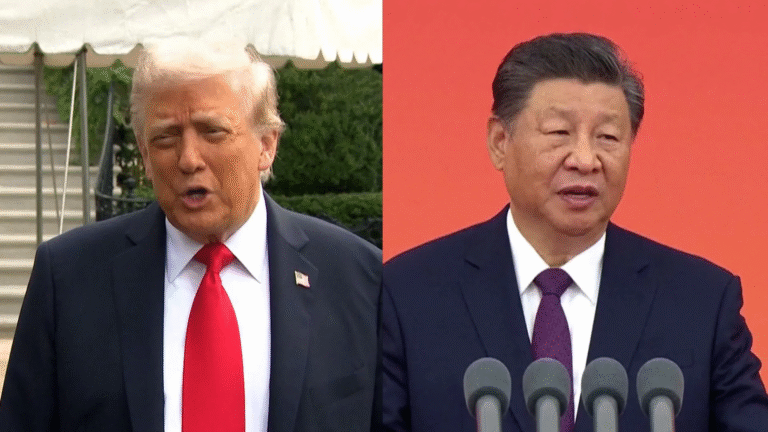

Regarding other speaking events, before Powell’s speech, Bank of England Chief Economist Pill, ECB Board Member Schnabel, and Federal Reserve Board Member Cook are scheduled to speak. President Biden is also expected to deliver a speech on US investment and employment, and announce strengthened tariffs on China.

The result of the US Producer Price Index (PPI) will influence expectations for tomorrow’s US CPI, leading to potential market movements based on the outcome. Pay attention to the subsequent USD trends.