Yen Appreciation Pauses, Market Trends Towards the Weekend

This week, the foreign exchange market saw rapid yen appreciation. The USD/JPY pair dropped to the 151 yen level, falling about 10 yen from the July 3 high of 161.95 to 151.94. This sharp movement resulted from a combination of factors. Firstly, the Japanese government and the Bank of Japan (BOJ) intervened in the market […]

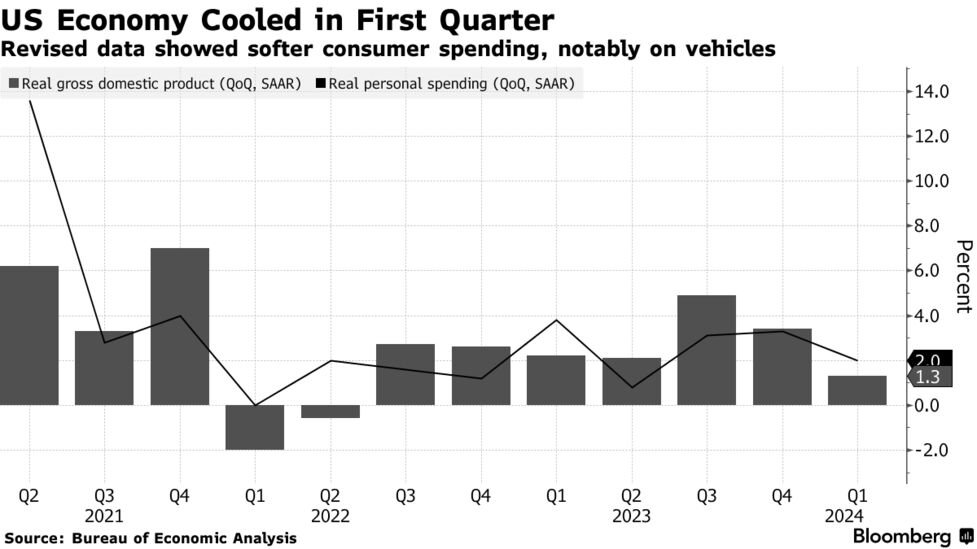

Yen Appreciation Continues, Will U.S. GDP Preliminary Data Affect the Dollar Market?

The forex market this week has consistently seen yen appreciation. Following the weaker-than-expected U.S. Consumer Price Index (CPI), dollar selling has spread, and it is widely believed that the Japanese government and the Bank of Japan intervened by buying yen. Additionally, expectations of a rate hike at the BOJ Monetary Policy Meeting next week have […]

Will the Trend of Yen Appreciation Continue? U.S. Existing Home Sales and Major U.S. Company Earnings Reports in Focus

Today is relatively light on events. The main economic indicator is the U.S. existing home sales (June) to be released. The market expects 3.99 million units, down from the previous 4.11 million units. The expected ratio is -0.3% month-on-month. This forecast could potentially lead to dollar depreciation. Other scheduled economic indicators include the Central […]

USD/JPY Likely to Face Heavy Resistance

USD/JPY fluctuated in the morning session in Tokyo, reaching 157.01 yen in the afternoon. As the London session began, there was a surge in yen buying. Over the weekend, U.S. President Biden announced his withdrawal from the next presidential election, naming Vice President Harris as his successor. Polls have shown that Trump vs. Harris is […]

EUR/USD Forecast: Euro Turns Bearish After ECB Event

Current Trends EUR/USD ended Thursday in a negative state, falling below 1.0900. Early on Friday, dovish comments from ECB officials are putting pressure on the euro, and the deteriorating market mood is making it difficult for the pair to recover. Late Thursday, EUR/USD faced selling pressure, ending a six-day winning streak and closing in negative […]

Yen Strength and Dollar Weakness Pause This Week, Attention Turns to Upcoming U.S. Blackout Period

This week saw a strong trend of yen appreciation and dollar depreciation, but today the trend has reversed, entering an adjustment phase heading into the weekend. The dollar-yen exchange rate has rebounded from the lower 155 yen range in the Tokyo market yesterday to the upper 157 yen range now. Adjustment Factors Trump’s Republican Presidential […]

Focus on Whether ECB Governing Council Will Hint at a September Rate Cut

Today’s key event is the ECB Governing Council meeting. Following the rate cut decided in June, the market expects the policy rate to remain unchanged this time. This meeting will scrutinize whether further rate cuts are necessary. The main point of interest is whether a rate cut in September will be clearly hinted at in […]

Monitoring Fed Officials’ Remarks, Approaching Blackout Period This Weekend

The next FOMC meeting is scheduled for July 31. Ahead of this, Fed officials will enter a “blackout period” starting this weekend, during which they will refrain from commenting on the economic outlook or monetary policy. Therefore, market participants will closely watch their remarks this week for any hints on future policy direction. Key Speeches […]

Authorities Eyeing Reversal in USD/JPY, Focus on US Producer Price Index

Yesterday’s release of the US Consumer Price Index (CPI) proved to be more eventful than expected. The year-over-year CPI rose by +3.0%, and the core CPI increased by +3.3%, indicating a sharper-than-expected slowdown in inflation. This led to a rapid decline in US bond yields and a strong wave of USD selling. Following the initial […]

Stock Rally and Yen Weakness: US CPI Awaits Amid Early Rate Cut Expectations

This week, stock markets worldwide are showing upward momentum. Yesterday, major US stock indices all rose by more than 1%, and the Nikkei 225 also hit new record highs for consecutive days. Today, the Nikkei 225 has again reached a new peak. Several factors are driving this excitement, with the expectation of an early rate […]