Today, the Bank of Japan (BOJ) policy decision meeting results were announced. As expected, they lifted the negative interest rate and set the short-term interest rate target at 0.0-0.1%. They abolished the Yield Curve Control (YCC) and maintained their easing stance by continuing purchases of long-term government bonds. Additionally, they halted new purchases of Exchange-Traded Funds (ETFs). The forex market saw a weakening yen, and the stock market passed through without causing much shock.

In the United States, the Federal Open Market Committee (FOMC) meeting will be held until the 20th. Due to persistent inflationary pressures, there’s a tendency for the timing of rate cuts to be delayed. During this FOMC meeting, the members’ interest rate forecasts (Dot Plot) will be released. Whether there will be any changes compared to previous forecasts is the focus. Also, Chairman Powell’s press conference is crucial. It may contain messages aimed at correcting excessive market expectations. There’s also speculation that a dovish message might emerge based on the assumption of a subdued inflation trend.

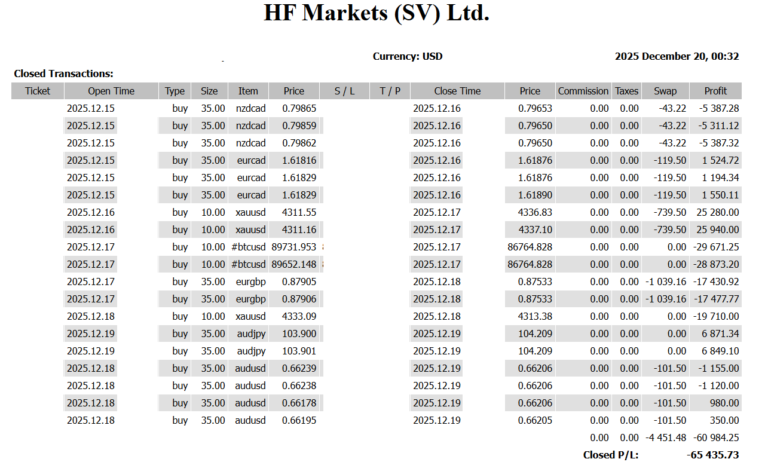

Attention will be on the Canada Consumer Price Index (CPI). We’ll be monitoring the CAD’s movement thereafter.