Today’s Option Landscape (Feb 3, 2026 — NY Cut)

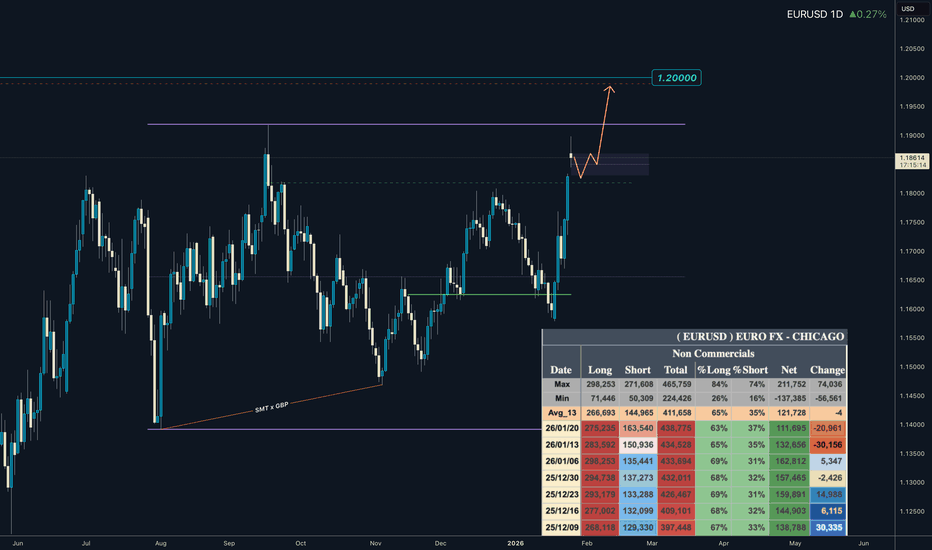

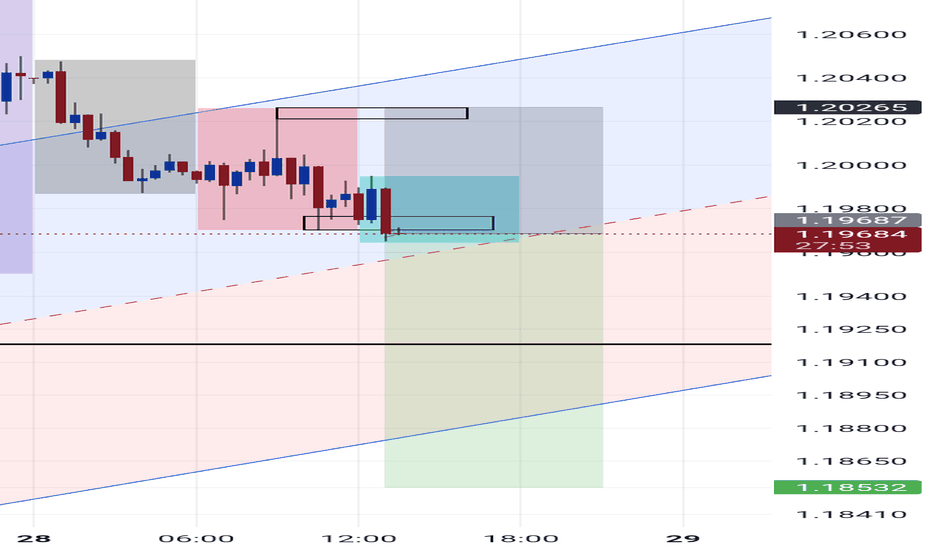

■ EUR/USD (Spot 1.1807)

Tue 03/02 Expiries

-

1.1745 (697M)

-

1.1785 (848M)

-

1.1800 (935M)

-

1.1850 (3.9B) ★ Main magnet

-

1.1865 (616M)

-

1.1890 (714M)

-

1.1900 (551M)

-

1.1935 (1.5B)

-

1.1940 (1.4B)

-

1.1950 (1.1B)

-

1.2000 (1.4B)

Spot is clearly below 1.1850.

Today is a textbook pull toward 1.1850 into the NY cut.

Once reached, layered resistance above suggests price will hover around 1.1850.

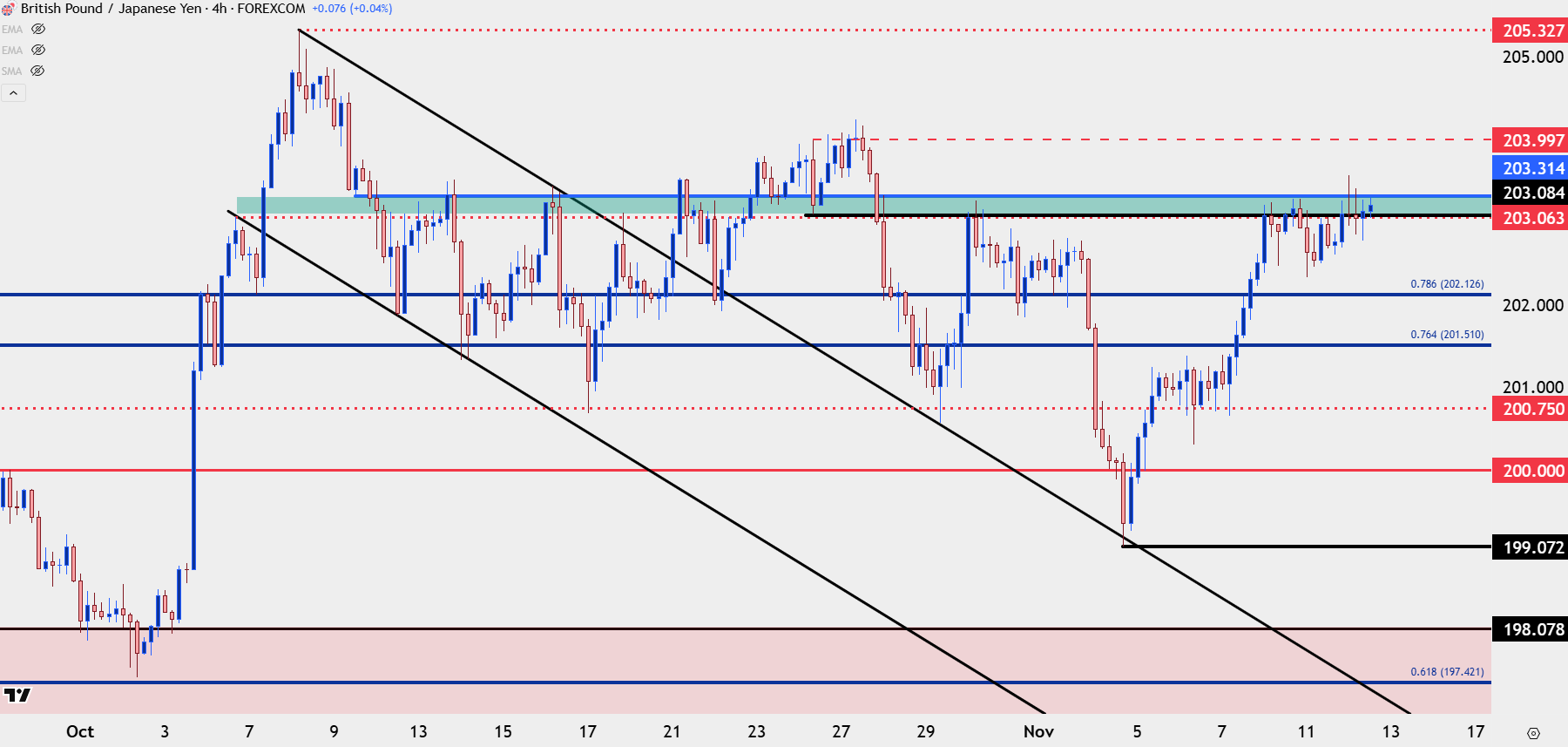

■ USD/JPY (Spot 155.42)

Tue 03/02 Expiry

-

155.75 (952M) ★ Pinpoint magnet

Spot sits almost directly below.

A classic pinning pattern toward 155.75 is likely today.

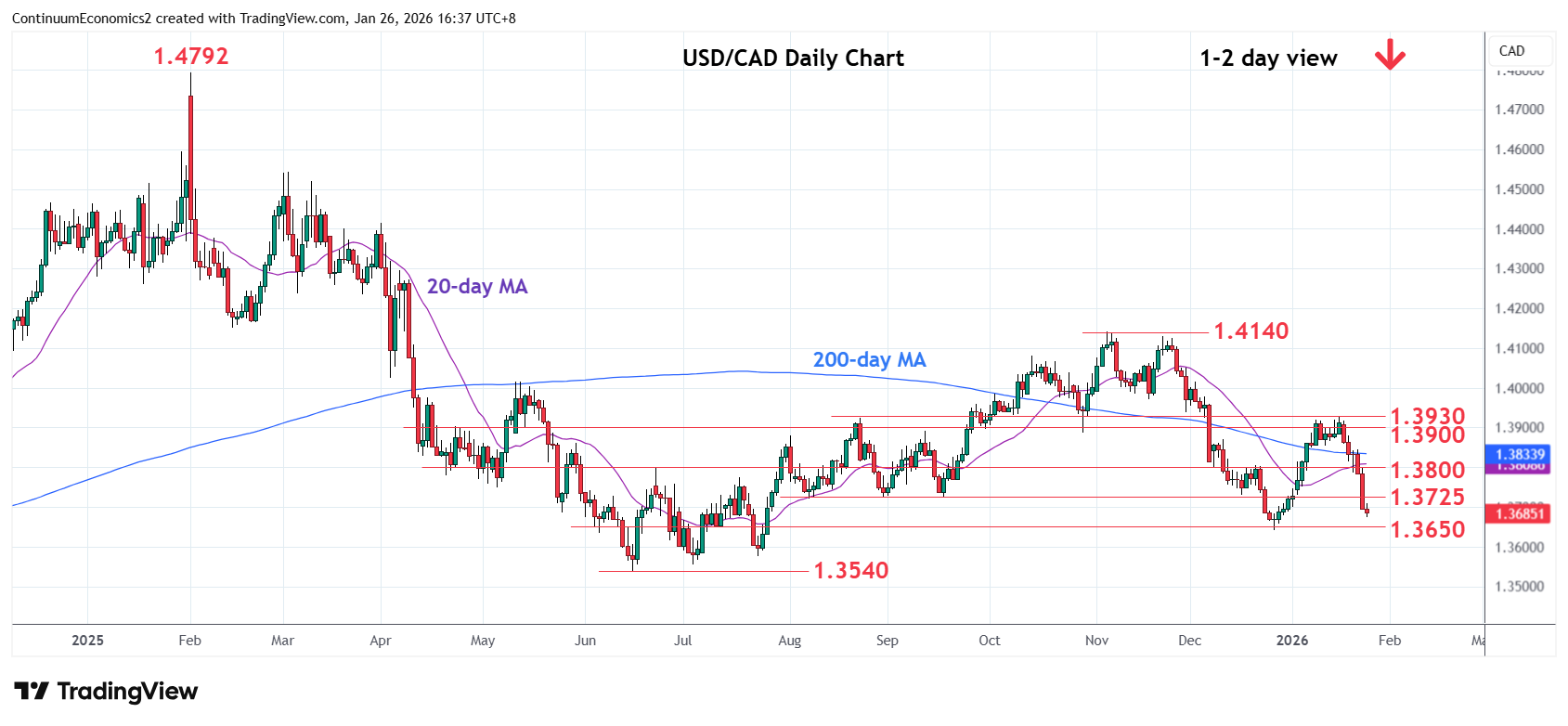

■ USD/CAD (Spot 1.3664)

Tue 03/02 Expiry

-

1.3590 (577M)

Strike lies below spot → mild downward reversion pressure.

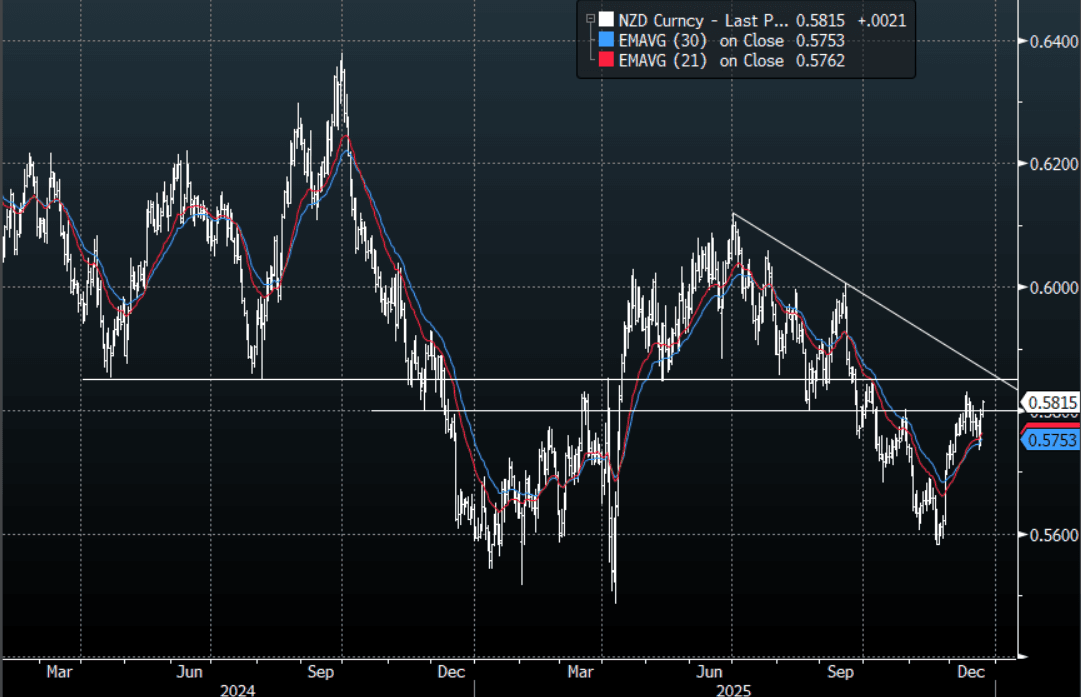

■ NZD/USD (Spot 0.6033)

Tue 03/02 Expiry

-

0.5800 (888M)

Too far to matter today → technicals dominate.

■ Wed 04/02 (Reference)

EUR/USD

-

1.1600 (2.2B)

-

1.1800 (1.2B)

-

1.1850 (1.6B)

-

1.1900 (845M)

-

1.1925 (597M)

-

1.1950 (637M)

-

1.2000 (765M)

→ Likely 1.18–1.19 range lock tomorrow.

USD/JPY

-

153.25 (802M)

-

155.50 (570M)

-

156.25 (713M)

-

156.50 (964M) Main magnet

→ 156.50 becomes tomorrow’s magnet.

AUD/USD

-

0.6950 (2.0B)

-

0.7000 (990M)

-

0.7100 (1.1B)

→ Strong range adhesion expected.

Big Picture

Today is a very clear NY-cut reversion / pinning session.

-

EUR/USD → Drawn toward 1.1850

-

USD/JPY → Pinned near 155.75

-

USD/CAD → Gentle drift lower

-

Others → Limited option impact

Expect option-driven price action.

Rather than chasing breakouts, today favors trades that anticipate reversion toward the strikes.