📊 USD/JPY’s upside capped by intervention fears; U.S. government shutdown risk back in focus

■ Overview

USD/JPY continues to take on the character of a politics-driven market plus intervention-alert market.

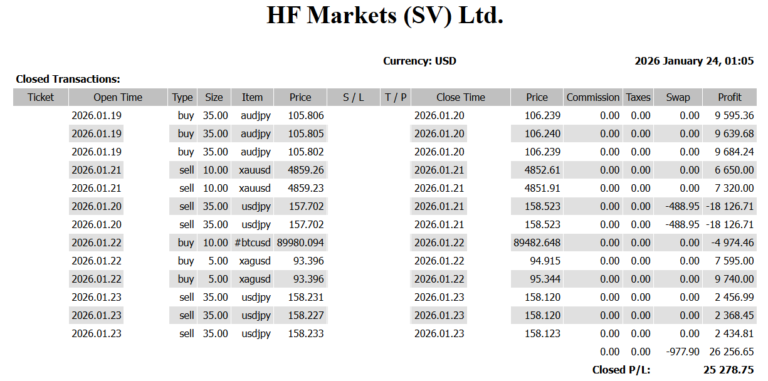

At the end of last week, the pair briefly climbed into the 159s after BOJ Governor Ueda’s press conference, but then plunged by roughly 2 yen. It later returned to the 158s, yet failed to retake the highs, and eventually closed the NY session down in the mid–155s.

That was a 3.6-yen drop from the peak, and the market quickly began pricing in speculation that:

-

Japan’s Ministry of Finance (MoF) / BOJ, and

-

the U.S. Treasury / Federal Reserve

were conducting behind-the-scenes FX coordination and/or rate checks.

As a result:

-

1-week USD/JPY implied volatility surged from ~8% to near ~12%,

pushing the market into a clear “emergency mode.”

■ Start of the week: Yen strength accelerates

In Monday’s Tokyo session, USD/JPY extended its decline:

-

from the mid–155s → below 155,

-

and briefly below 154.

Key drivers included:

-

renewed risk that the U.S. government could shut down again,

-

reports of a shooting/clash involving U.S. federal immigration authorities,

-

a resurgence of U.S. political instability concerns.

Volatility then expanded even further:

-

1-week volatility widened to around ~14%,

a level described as the highest since May 2024.

■ Current market structure

USD/JPY is now a battlefield where opposing forces collide:

| Yen-weakening forces | Yen-strengthening forces |

|---|---|

| Expectations of a continuing Takaichi administration | Heightened FX intervention fears |

| Yen carry trades | “U.S. selling” driven by political instability |

| Japanese equity inflows | Speculation of official rate checks |

However, judging by the late-week price action:

Yen-strengthening pressure is currently dominating.

That shift has pushed the market’s focus to a new question:

-

Is a move toward sub-150 possible?

■ A dangerous week packed with political event risk

This week is loaded with major catalysts:

-

FOMC meeting

-

Japan’s general election (voting day: Feb 8)

-

U.S. budget negotiations (shutdown risk)

-

Trump headline risk

The sharp post-BOJ move last week effectively “printed” the market’s perceived intervention warning line, increasing expectations that authorities may stay highly sensitive around the FOMC as well.

■ Today’s data & events

Economic data

-

Germany: Ifo Business Climate (Jan)

-

Mexico: Employment report (Dec)

-

U.S.: Durable Goods Orders (prelim, Nov)

Speakers

-

Nagel (Bundesbank President)

-

Kocherlakota / Austrian central bank (as listed)

Market events

-

U.S. 2-year Treasury auction (USD 69B)

-

U.S. monetary authorities remain in the blackout period (through the 29th)

■ Early London session: Yen buying returns

In early London trading, yen buying regained traction:

-

USD/JPY: briefly 153.40

-

EUR/JPY: 181.92

-

GBP/JPY: 209.64

Cross-yen pairs were broadly weaker.

Bloomberg reported that no clear evidence of Japan’s FX intervention on the 23rd was confirmed. Even so, market psychology remains:

“Live rounds could fly at any moment.”

■ Summary

-

USD/JPY is fully in intervention-alert mode

-

U.S. shutdown risk + U.S. political instability are adding USD-selling pressure

-

Volatility is at extreme levels (~14%)

-

The biggest theme: Is this a genuine trend shift toward yen strength?

-

This week is an ultra-unstable mix of:

FOMC × Japan election × political headlines × intervention risk

In short:

We’ve entered a phase where fundamentals take a back seat—and states and central banks move the market.