The Bank of Japan (BOJ) has decided to raise the policy interest rate to around 0.25%. In a press conference on the 31st, Governor Kazuo Ueda stated, “As the outlook for the economy and prices is progressing smoothly, we will consider further rate hikes if this outlook materializes.” Regarding the economic impact of additional rate hikes, he expressed the view that “interest rates are still at a very low level and are unlikely to have a significant negative impact on the economy.”

Governor Ueda cited the “ongoing reflection of wage increases from spring negotiations and the expectation that this trend will continue” as the background for the current rate hike, following the shift from large-scale monetary easing in March. However, “real wages,” which account for inflation, have recorded negative figures for 26 consecutive months until May, indicating a lack of strength in personal consumption. This had led some in the market to speculate that the BOJ might refrain from raising rates. However, Governor Ueda emphasized, “Consumption remains solid, and we believe that the movement toward wage increases will support personal consumption.”

The increase in policy rates may lead to higher mortgage and corporate lending rates, potentially impacting the economy. While pointing out the possibility of rising variable mortgage rates, Governor Ueda sought understanding by explaining, “This rate hike decision is made in the context of continued prospects for wage increases.”

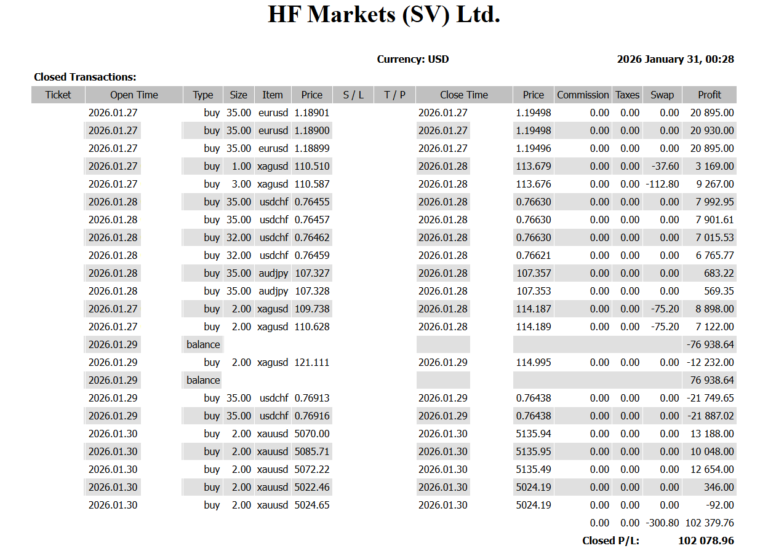

In the U.S. market, further buying of the Japanese yen is expected, and a short position has been taken in AUD/JPY. The focus remains on the continued buying of the Japanese yen this week.