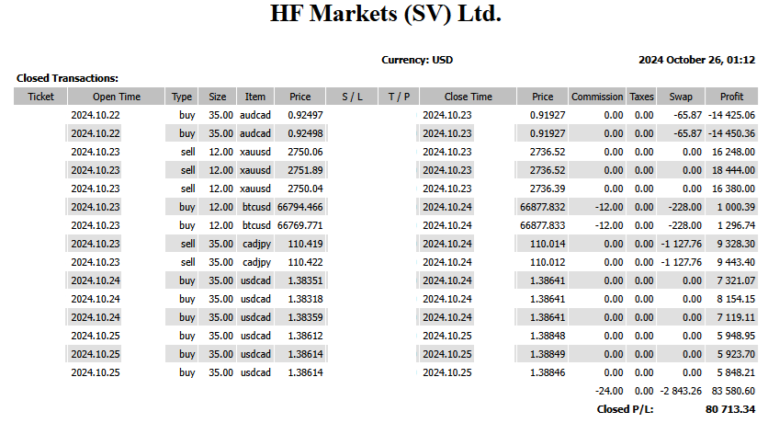

The Japanese stock index’s first high in about 33 years is having an impact on the foreign exchange market in the form of selling pressure on the yen. Selling of the yen to hedge against foreign exchange risk by foreign investors investing in Japanese equities drove the dollar higher and the yen lower in May. The dollar-yen exchange rate was close to its highest level since the beginning of the year (137.91 yen).

Yukio Ishizuki, senior currency strategist at Daiwa Securities, commented on the recent dollar/yen rally, saying that the yen has been falling against currencies other than the dollar, and that not only buyers are buying dollars but also “selling yen on the strength of rising Japanese stocks. According to him, when foreign investors invest in Japanese stocks, they sell yen as a hedge to neutralize the impact of exchange rates. When their holdings rise, they need to sell more yen to maintain a constant hedge ratio.

According to the trading conditions by investment category released by the Japan Exchange Group on May 11, foreign investors have been overbought in both futures and cash as of the first week of May for five consecutive weeks. The correlation between Nikkei 225 futures and the dollar/yen exchange rate has increased sharply since the beginning of May and is the highest since the Corona shock in March 2020. However, the last time this happened was when stocks weakened and the yen strengthened due to risk aversion.

(Source: Bloomberg)

It appears that overseas real money continues to “buy Japanese stocks and hedge the dollar against the yen. Based on this thinking, we assume that stocks will still rise and the yen will continue to weaken.