August 2025 +$345,999

VIP SIGNAL 📊 +22,159 USD — Dollar Under Selling Pressure 💹 +89,248 USD Profit Drivers & Post–Jackson Hole Strategy 💹 +79,597 USD | Jackson Hole Is the Biggest Risk! Winning Plan for Next Week 💵 +73,293 USD – How the Market Moves After the FOMC! Weekly Outlook for August 11, 2025|Key Drivers & Market Recap […]

July 2025 -$47,586

VIP SIGNAL Weekly Report: -$37,136 Loss | Gold’s Turbulence Hurts, Big Events Ahead Next Week! [Weekly Profit: +$71,939] Market Shaken by Fed Chair Ouster Rumor & Next Week’s Key Drivers 【Weekly P/L】 -$18,466|Dollar Strength Continues, Currency Markets Swayed by Tariff Talks and Elections 📉 USD/JPY Volatility Driven by Tariffs and Iran Talks Loss […]

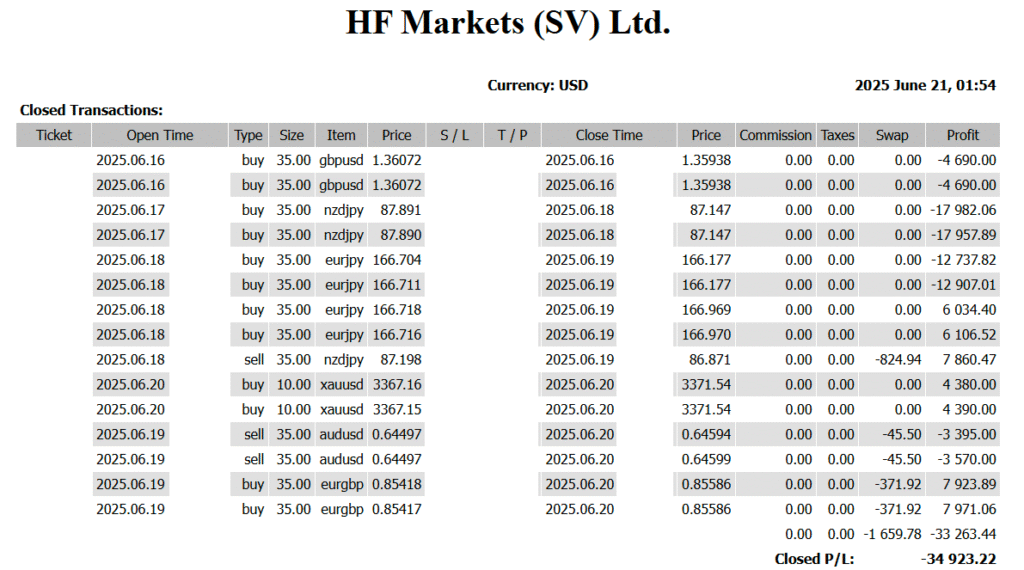

June 2025 +$127,526

VIP SIGNAL +146,171 USD|Riding the Wave of Middle East Ceasefire and Aussie Surge ⬆️ -34,923 USD | Middle East Tensions x Market Shift [Week of June 23] FX Perspectives Amid Rising Geopolitical Risk +15,732 USD 🌍 “War Risk” Dominates the Forex Market! 📉 -10,691 USD | If U.S.-China Talks Collapse, Total Asset Sell-off Possible… […]

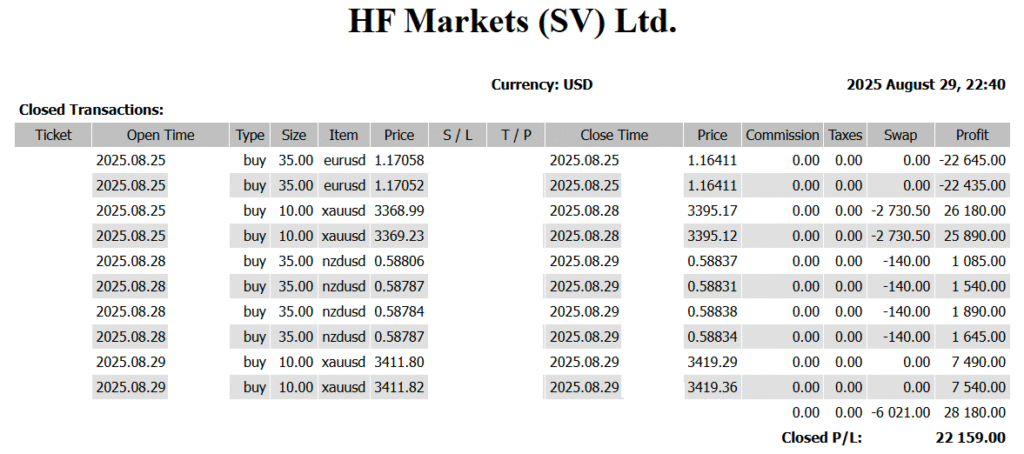

📊 +22,159 USD — Dollar Under Selling Pressure

📊 +22,159 USD — Dollar Under Selling Pressure 📊 Weekly Trading Report (Aug 25–29) Weekly P/L: +22,159 USD ✅ Weekly Review Losses were seen in euro-related trades, but well-timed gold longs during the rally boosted overall results into positive territory. The U.S. dollar faced persistent selling pressure, but direction remained unclear as economic data and […]

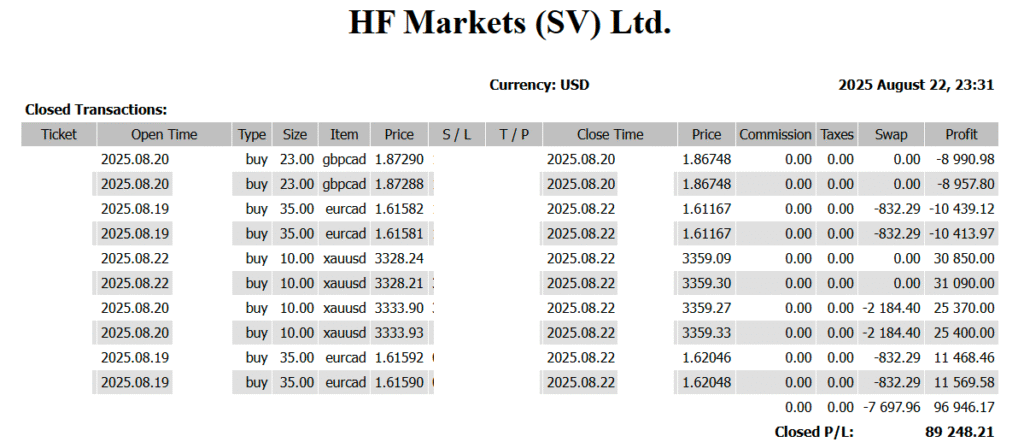

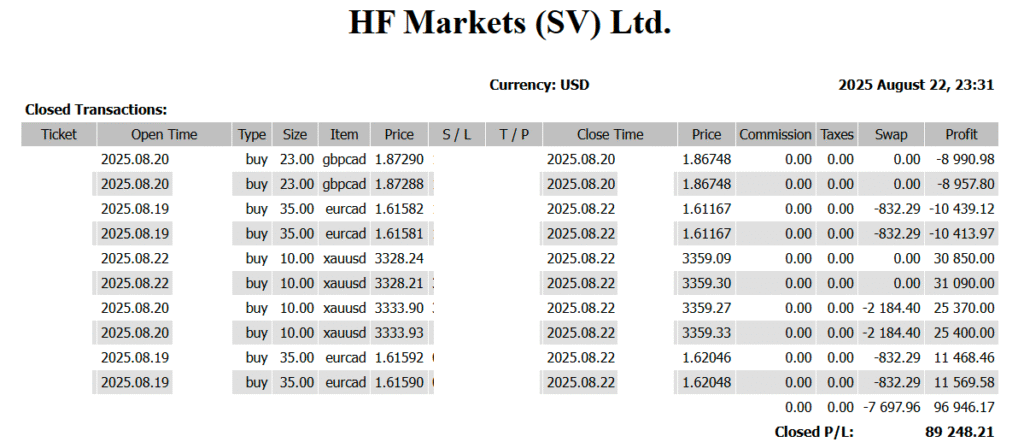

💹 +89,248 USD Profit Drivers & Post–Jackson Hole Strategy

💹 +89,248 USD Profit Drivers & Post–Jackson Hole Strategy ✅ Trading Results (Aug 18 – Aug 22) Weekly Total: +89,248 USD 📌 Key Profit Drivers Gold (XAU/USD): Captured the sharp rally following Powell’s dovish tone and U.S. yield decline. Took profit across multiple positions in the 3370–3378 zone. EUR/USD: Benefited from dollar weakness after payrolls […]

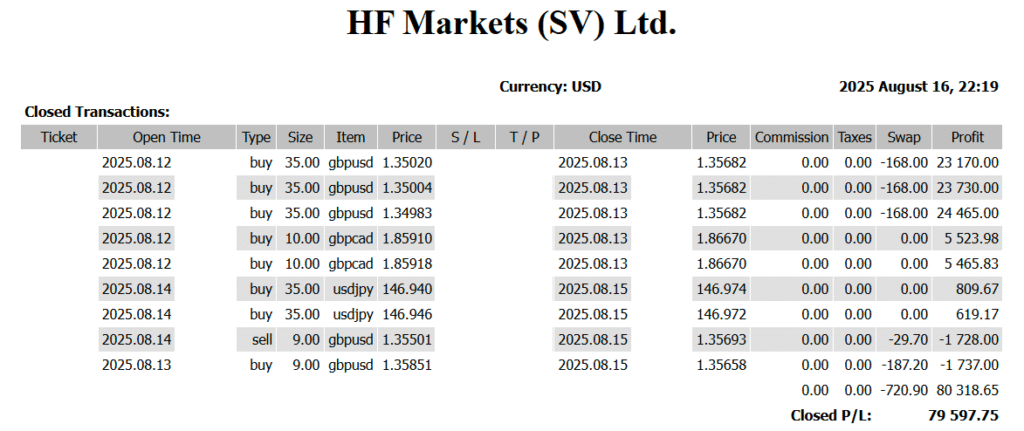

💹 +79,597 USD | Jackson Hole Is the Biggest Risk! Winning Plan for Next Week

💹 +79,597 USD | Jackson Hole Is the Biggest Risk! Winning Plan for Next Week Period: August 11–15, 2025 📈 Trading Results Weekly Total: +79,597 USD Main Profit Drivers: Gains from GBP pairs (GBP/USD, GBP/CAD) Loss/Profit Factors: USD/JPY surged on strong US PPI → Dollar buying spike → Then plunged after Japan GDP beat […]

💵 +73,293 USD – How the Market Moves After the FOMC! Weekly Outlook for August 11, 2025|Key Drivers & Market Recap

💵 +73,293 USD – How the Market Moves After the FOMC!Weekly Outlook for August 11, 2025|Key Drivers & Market Recap ✅ Trade Summary (August 4 – August 8)📊 Weekly P/L: +73,293 USD 🌐 Market Highlights This Week (Aug 4 – Aug 8) USD/JPY: Dropped sharply after the downward revision of July’s U.S. jobs report. Briefly […]

💹 +81,702 USD Will the Dollar Hold Up? U.S. Jobs Data & Nuclear Submarine Tensions Stir the Market

💹 +81,702 USD Profit Weekly FX Review (Aug 1st week) & Market Outlook Title: Will the Dollar Hold Up? U.S. Jobs Data & Nuclear Submarine Tensions Stir the Market ✅ Weekly Trading Summary This week’s market was dominated by a dollar-driven trend fueled by easing trade-related risks and key U.S. economic indicators. At the […]

Weekly Report: -$37,136 Loss | Gold’s Turbulence Hurts, Big Events Ahead Next Week!

Weekly Report: -$37,136 Loss | Gold’s Turbulence Hurts, Big Events Ahead Next Week! Period: July 21–25, 2025 ✅ This Week’s Performance Review Net Result: -37,136 USD Main Cause: Gains from EUR trades were wiped out by a sharp downturn in XAU/USD (Gold), which delivered heavy losses. The “secure profit” scenario collapsed, highlighting the ever-present […]

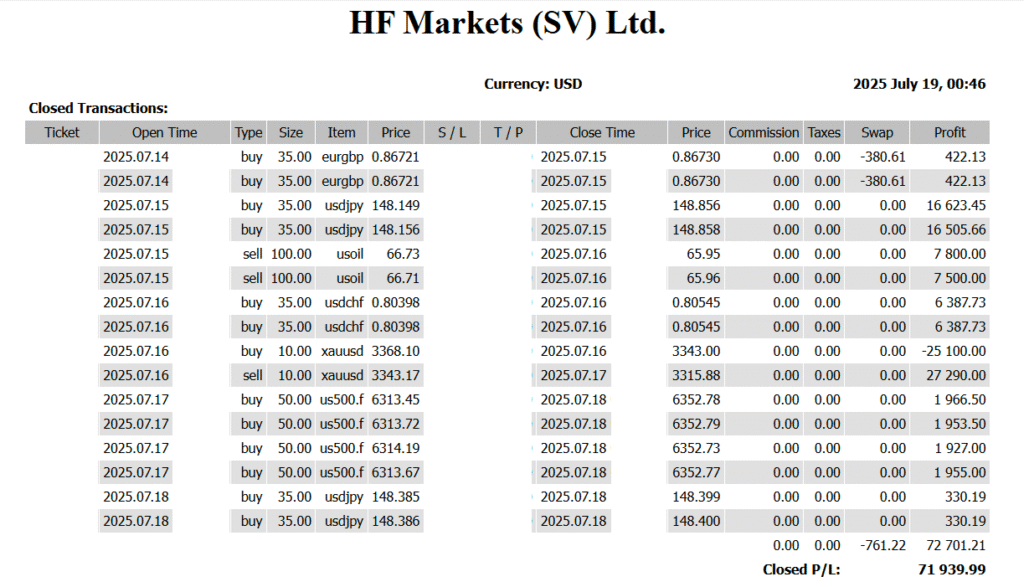

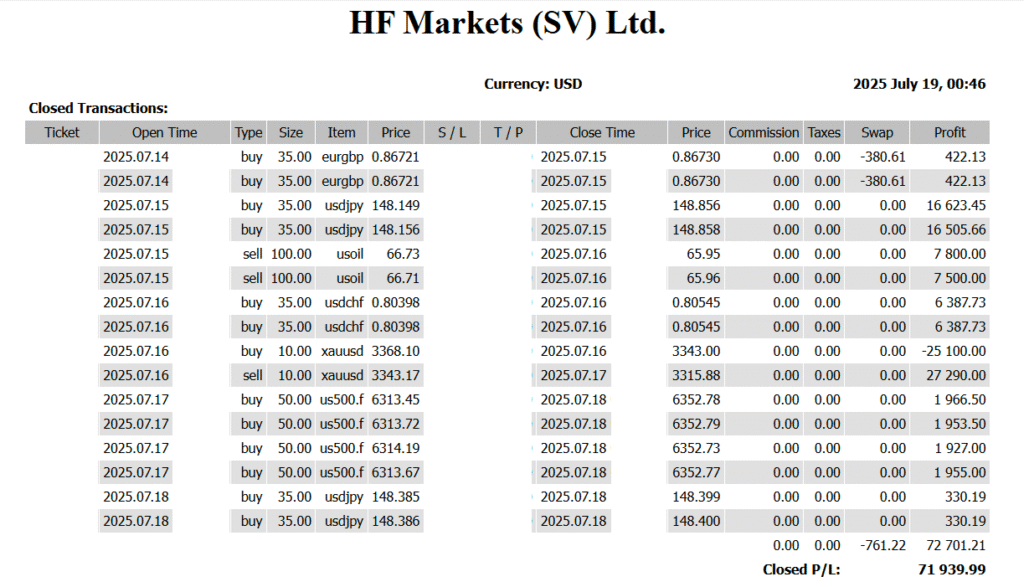

[Weekly Profit: +$71,939] Market Shaken by Fed Chair Ouster Rumor & Next Week’s Key Drivers

[Weekly Profit: +$71,939] Market Shaken by Fed Chair Ouster Rumor & Next Week’s Key Drivers Trading Summary (July 14–18, 2025) & Outlook for July 21 Week ✅ Weekly Performance Net Profit: +71,939 USD Main Driver: Successful crypto buying during the risk-on rebound 🔍 Week in Review This week saw heightened volatility after reports that Fed […]