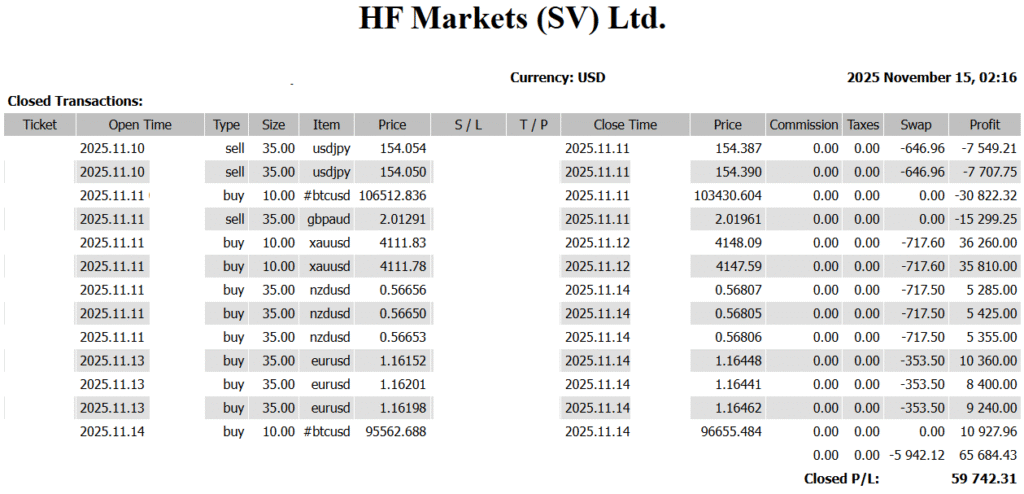

Weekly Profit: $59,740 — Dollar Selling Surge and Gold’s Wild Rally Shake the Markets

Weekly Profit: $59,740 — Dollar Selling Surge and Gold’s Wild Rally Shake the Markets The second week of November closed with a +59,740 USD gain.Gold’s explosive ascent combined with accelerating USD selling pushed the market into full volatility mode. At the same time, Japan effectively entered the Takaichi era, where a shift in fiscal policy […]

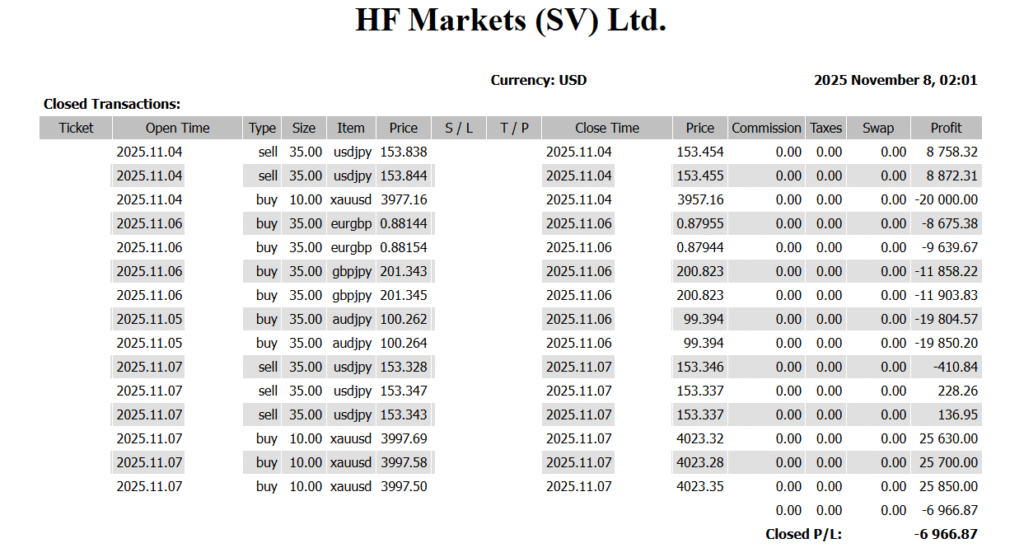

-6,966 USD | Is the $4,000 Gold Market Real? → Pullback Buy Strategy Continues

-6,966 USD | Is the $4,000 Gold Market Real? → Pullback Buy Strategy Continues ✅ Weekly P/L (Nov 3–Nov 7) -6,966 USD The early part of the week saw losses expand due to unfavorable entries in cross-yen pairs.However, those losses were gradually absorbed in the second half of the week as position adjustments and capital […]

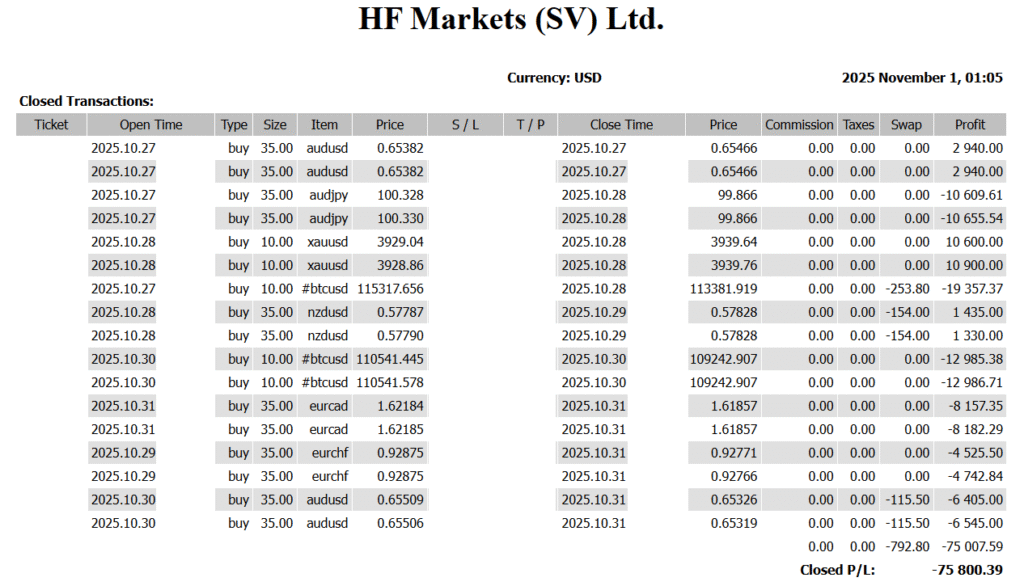

✅ –$75,800 Weekly FX Outlook|“Seismic Signals” in U.S. Labor via ADP & ISM — Tug-of-War Between Yen Carry and the “Takaichi Trade”

✅ Weekly FX Outlook|“Seismic Signals” in U.S. Labor via ADP & ISM — Tug-of-War Between Yen Carry and the “Takaichi Trade” 📊 Weekly Result (Oct 27–31): –$75,800 🧭 Overall Summary (Market Drivers This Week) After clearing the FOMC, Chair Powell reiterated that “A December rate cut is not a foregone conclusion,” keeping the U.S. dollar […]

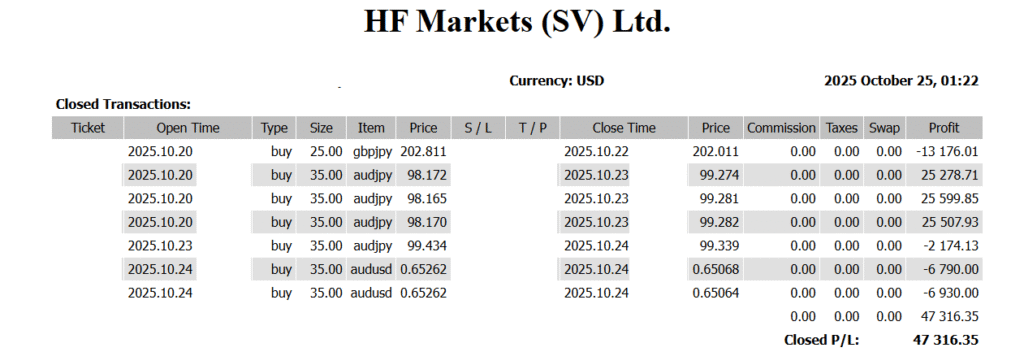

+47,316 USD “Dollar Weakness Meets Yen Weakness as Fed Rate Cut Seen as Certain — A Week Where Monetary Easing and Fiscal Expansion Intertwine”

+47,316 USD Weekly ReportTheme: “Dollar Weakness Meets Yen Weakness as Fed Rate Cut Seen as Certain — A Week Where Monetary Easing and Fiscal Expansion Intertwine” 💰 Weekly Trading Results (October 20–24, 2025) Total Profit: +47,316 USDTheme: Fed rate cut expectations trigger simultaneous dollar and yen weakness, as monetary easing and fiscal expansion collide. 🇯🇵 […]

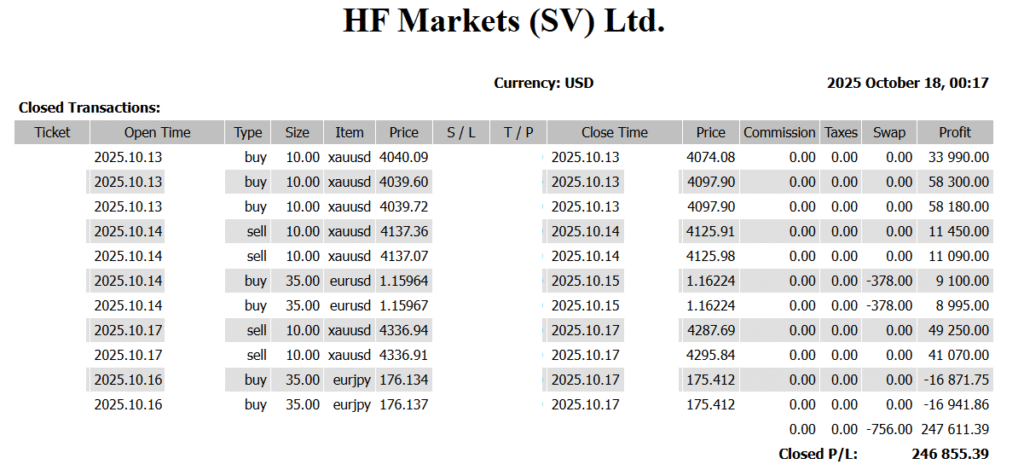

💹 +246,853 USD | USD/JPY & Gold Fully Conquered Amid Political Risk — Strategy Revealed (Oct 13 – Oct 17)

💹 +246,853 USD | USD/JPY & Gold Fully Conquered Amid Political Risk — Strategy Revealed (Oct 13 – Oct 17) 🏛 Japan Politics: Takaichi Administration Set to Take Office — “ Takaichi Trade ” Reignites On the evening of the 18th, the LDP and Japan Innovation Party formally agreed to establish a coalition government.Ishin will […]

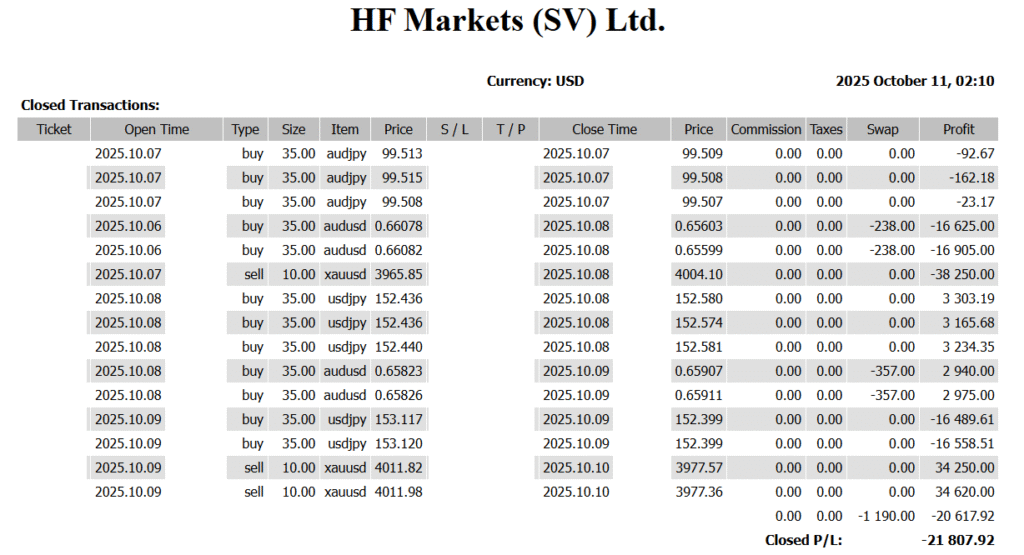

-21,807 USD | Takaichi Government’s Yen Weakness — The Beginning of the End? Exploring the Outlook for USD/JPY, Gold, and the Euro

-21,807 USD | Takaichi Government’s Yen Weakness — The Beginning of the End?Exploring the Outlook for USD/JPY, Gold, and the Euro 💰 Trading Results (Oct 6 – Oct 10) Weekly P/L: –21,807 USD 🌏 Weekly Outlook (Week of Oct 13) — Takaichi Trade Unwinds Loom as Political Instability and Dollar Ambiguity Dominate — 💴 USD/JPY […]

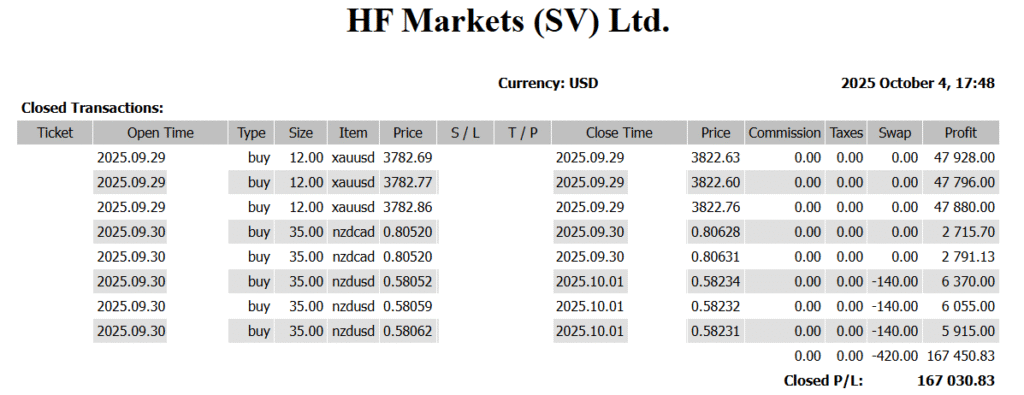

💹 +167,030 USD|Yen Weakness Reignited — A New Market Phase Under the Takaichi Administration

💹 +167,030 USD|Yen Weakness Reignited — A New Market Phase Under the Takaichi Administration 🧾 Weekly Trading Summary (Sep 29 – Oct 3) This week’s strong performance in gold and the resilience of the Oceanian currencies lifted total profit to +167,030 USD. Despite a risk-off environment, steady risk management led to a solid positive close. […]

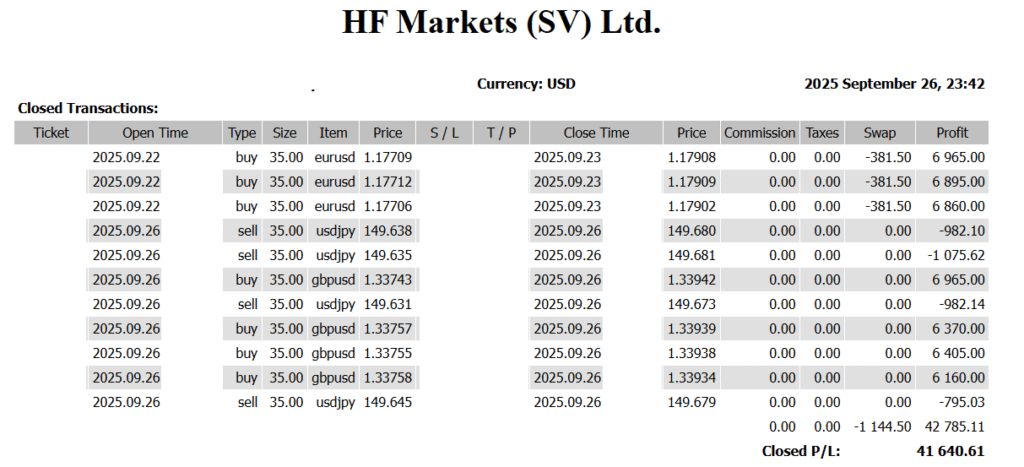

📊 FX Weekly Report: +41,640 USD|Next Week’s Focus: U.S. Jobs Report & LDP Leadership Election

📊 FX Weekly Report: +41,640 USD|Next Week’s Focus: U.S. Jobs Report & LDP Leadership Election ✅ Trading Results (Sep 22 – Sep 26) Weekly P/L: +41,640 USD Gains came mainly from dollar selling, with modest profits. Overall performance ended positive. 🌟 Key Events to Watch Next Week U.S. Nonfarm Payrolls (Oct 3) Weak data → […]

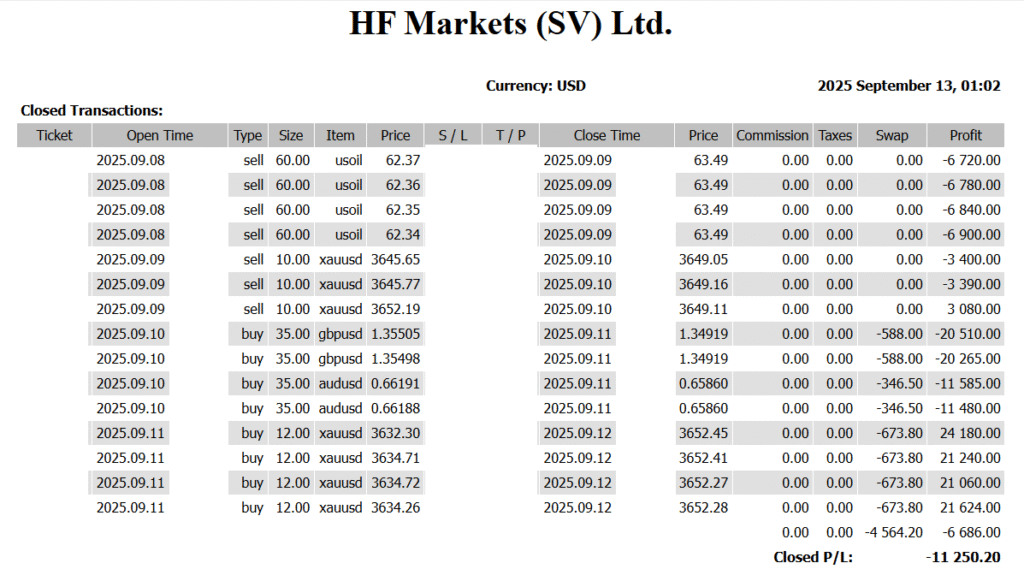

💹 –11,250 USD | FOMC, BOJ, BOC | Weekly FX Report (Sept 8–12)

💹 –11,250 USD | FOMC, BOJ, BOC | Weekly FX Report (Sept 8–12) Net P/L: –11,250 USD 📌 Total Review Losses widened due to adverse moves in crude oil shorts. However, late-week gold longs helped offset part of the drawdown. Looking ahead, with major policy events in the U.S. and Japan, reducing positions […]

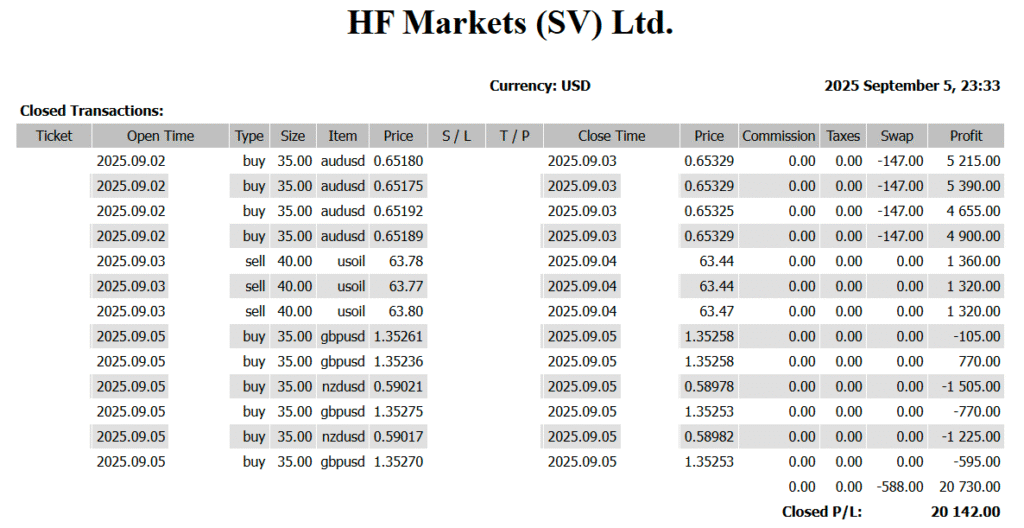

📈 +20,142 USD | September FOMC Rate Cut Seen as Certain

📈 +20,142 USD | September FOMC Rate Cut Seen as Certain Trading Performance Report (Sep 1–5, 2025) Weekly P/L: +20,142 USD 🔎 Weekly Review Gold: Continued to rise without any pullbacks → stayed out. USD Selling: Shifted to selling the U.S. dollar, securing profits in AUD and crude oil. Post-NFP Dollar Drop: Missed locking […]