Dollar Market in Turmoil This Week: Will Today’s US PCE Deflator Show a Clear Direction?

This week, the dollar market has been turbulent. While rising US bond yields are exerting upward pressure on the dollar, the unstable stock market is creating disruptions, preventing a clear dollar trend. Additionally, as we approach the end of the month, there are indications that market flows are playing a significant role. Today, the US […]

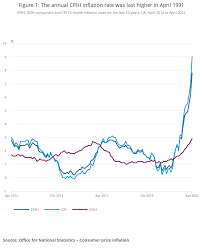

U.S. core PCE deflator

On this day, amidst the London and New York markets being effectively closed for Good Friday, the U.S. Personal Consumption Expenditures (PCE) deflator for February will be announced at 9:30 PM Japan time. The general expectation is for a year-on-year increase of 2.5%, which would mark an acceleration from the previous month’s 2.4% rise. The […]

With a Weakening Dollar Trend, Heading into Christmas Vacation – Today’s Focus on U.S. Durable Goods Orders and PCE Deflator

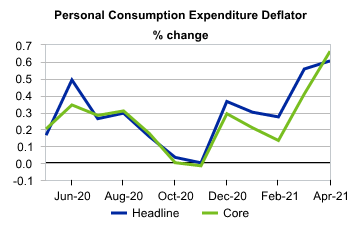

As we approach the Christmas vacation starting this weekend and into the early next week, the market seems to be gradually shifting into a watch-and-see mode. Today, the UK stock market and the US bond market will have shortened trading hours, adding to the Christmas atmosphere. The dollar has been on a weakening trend […]

Key Focus on August US Personal Consumption Expenditure (PCE) and More

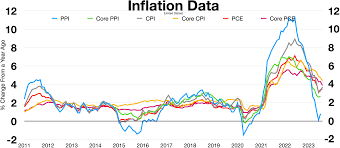

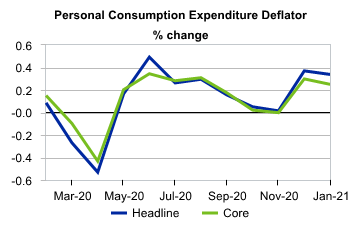

August’s US Personal Consumption Expenditure (PCE) data is set to be released. Most expectations indicate a 0.5% increase month-on-month, and it is anticipated that this will mark the eighth consecutive monthly increase. Earlier on the 14th, August’s US retail sales were published and surpassed expectations. Should August’s PCE data show a similar outcome, it might […]

Signs of Changing Dollar Strength Trend, Balancing Price Movements and Data Releases

This week, there are signs of a potential shift in the strong dollar trend that has been ongoing since July. The Dollar Index has fully dipped below its 10-day moving average and is challenging the support levels of its 21-day and 200-day moving averages. This suggests that the short-term uptrend that has lasted for about […]

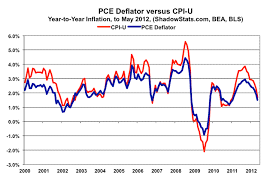

US PCE deflator in June, etc.

The impact of the Bank of Japan’s monetary policy may have sustained effects as the market digests the outcomes of the FOMC, ECB, and BOJ monetary policies. The US personal consumption expenditure (PCE) deflator for June is expected to show a year-on-year increase of around 3.0%, which is a slowdown from the previous month’s 3.8% […]