US CPI May Form a Dollar Selling Trend, Focus on US Retail Sales and Producer Prices Today

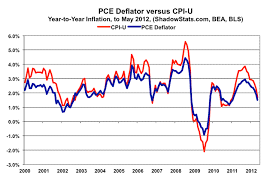

Yesterday, the much-anticipated US Consumer Price Index (CPI) for October was released. The year-on-year growth came in at +3.2%, slightly below expectations by just 0.1%. However, the market reacted strongly with a sharp drop in US bond yields and a strengthening of the dollar selling trend. The stock market surged. While the slower growth was […]

The US dollar saw a strong upward trend in the aftermath of the September US Consumer Price Index (CPI) report that exceeded market expectations.

The result showed a year-on-year increase of 3.7%, surpassing the anticipated 3.6% and reaching levels similar to August. This led to a surge in the US dollar, accompanied by rising bond yields. With the recent release of the Federal Reserve’s FOMC minutes this week, which was interpreted as cautious, and increasing speculation of a pause […]

The trend of a weakening US dollar has continued into October.

This year, the hawkish stance of the US Federal Reserve (FOMC) combined with rising bond yields had established a strong uptrend for the dollar. However, the trend has reversed as we enter the fourth quarter. The US Dollar Index has not only broken below the 10-day moving average, but it has also clearly slipped beneath […]

U.S. CPI today, ECB Governing Council meeting tomorrow

Today’s focal event is the release of the August US Consumer Price Index (CPI). Market expectations are for an increase, with a forecasted month-on-month change of +0.6% and a year-on-year change of +3.6%. However, the core index is expected to show a more modest increase, with a month-on-month change of +0.2% and a year-on-year change […]

No clue today ahead of tomorrow’s U.S. Consumer Price Index

In anticipation of tomorrow’s release of the US Consumer Price Index for August, the market is facing uncertainty today. This CPI report is of particular interest for future actions by US monetary authorities in the autumn. The prevailing market consensus ahead of the September FOMC meeting leans heavily toward no change in policy rates. […]

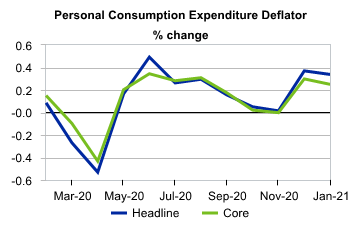

Consumer Price Index (CPI) Annual: 3.2% (Previous: 3.3%, Expected: 3.2%)

Consumer Price Index (CPI) Monthly: +0.2% (Previous: +0.2%, Expected: +0.2%) Consumer Price Index (CPI) Annual: 3.2% (Previous: 3.3%, Expected: 3.2%) Despite the drop in inflation, logically it should lead to USD selling, but currently, the market is experiencing volatility. However, the overall trend is still anticipated to lead towards USD selling in the end.

Today’s release of the US consumer price index, will it lead to a new trend in the dollar exchange rate?

Today, the release of the July US Consumer Price Index (CPI) is anticipated. While the USD/JPY has been notably rising in recent market trends, the prevailing factor seems to be the weaker yen due to ongoing speculation about the Bank of Japan’s continued easing measures. For other major currency pairs such as EUR/USD and GBP/USD, […]

With the announcement of tomorrow’s US Consumer Price Index (CPI) for August pending, the market is expected to remain cautious and hesitant due to uncertainties in risk trends.

Today, it is anticipated that trading will be relatively subdued as investors await the release of the US Consumer Price Index for July, scheduled for tomorrow. Economic indicators to be announced in the later overseas markets include the US MBA Mortgage Applications Index (07/29 – 08/04), Canada’s Housing Construction Permits (June), Brazil’s Retail Sales (June), […]

Today, the focus is on the U.S. Consumer Price Index, with the dollar already weakening and the yen appreciating.

Today, the June US Consumer Price Index (CPI) will be released. Market expectations are for a significant slowdown in the year-on-year CPI, with a forecast of +3.1% compared to the previous +4.0%, and a slowdown in the core year-on-year CPI to +5.0% from the previous +5.3%. On the other hand, the month-on-month CPI is expected […]

Waiting for US FOMC, check out Chairman Powell’s press conference

Today, there is a focus on the US Federal Open Market Committee (FOMC). Following the release of the US Consumer Price Index (CPI) yesterday, over 90% of the market has already priced in a decision to keep rates unchanged in today’s meeting. However, given the resilience of the core index, rate hike expectations for […]