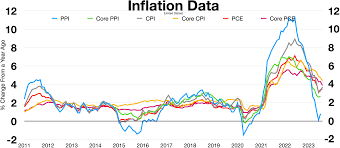

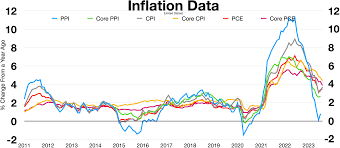

Today’s Focus: U.S. Consumer Price Index Release – How Will Early Rate Cut Expectations Shift?

Today, the U.S. Consumer Price Index (CPI) for July will be released. Yesterday’s U.S. Producer Price Index (PPI) showed a sharper-than-expected slowdown, leading to a rise in U.S. stock markets and selling pressure on the dollar in the forex market. As a result, the probability of a significant 50 basis point rate cut in September […]

Stock Rally and Yen Weakness: US CPI Awaits Amid Early Rate Cut Expectations

This week, stock markets worldwide are showing upward momentum. Yesterday, major US stock indices all rose by more than 1%, and the Nikkei 225 also hit new record highs for consecutive days. Today, the Nikkei 225 has again reached a new peak. Several factors are driving this excitement, with the expectation of an early rate […]

Trading Summary for May 13 – May 17: Total Profit +5,907 USD. USD Plummets on US CPI! How Will the Market React to This Week’s UK, Canada, and Japan CPI Releases?

Trading Summary for May 13 – May 17: Total Profit +5,907 USD The much-anticipated US CPI was calmer than expected, leading to a significant USD selling trend. Although the trade directions were correct, the USD experienced significant volatility immediately after the data release. This resulted in substantial losses as gold and AUD buy positions hit […]

oday, all eyes are on the release of the US Consumer Price Index (CPI) for March, which is expected to be a significant event.

Today, all eyes are on the release of the US Consumer Price Index (CPI) for March, which is expected to be a significant event. Market consensus forecasts suggest a year-on-year increase of +3.4% (compared to the previous +3.2%), with the core CPI expected to rise by +3.7% (compared to the previous +3.8%). The reaction of […]

Directional clarity remains elusive in the forex market post-US CPI release, with fluctuations leading to indecision.

Directional clarity remains elusive in the forex market post-US CPI release, with fluctuations leading to indecision. While there was initially a dollar buying reaction, subsequent intense swings saw a return to dollar weakness. Short-term financial markets have already priced in a potential US rate cut starting in June, and this sentiment has remained unchanged even […]

Yen Eases Off, Focus Shifts to Dollar Market as US Consumer Price Index Released Today

In the Tokyo market, the yen’s strength has eased off. While market speculation regarding the Bank of Japan’s March negative interest rate removal has increased, there have been no direct references from BOJ Governor Ueda today. Rather, remarks expressing concerns about weak consumption have led to movements in favor of yen depreciation. Attention in the […]

Market Calm as Tokyo and Chinese Markets Remain Closed, Ahead of Tomorrow’s US CPI Release

The beginning of the week sees Japan observing a substitute holiday for National Foundation Day, while China and Hong Kong are closed for the Lunar New Year. Trading during Tokyo and Asian hours remains subdued. The dollar-yen range has held steady between 149.08 and 149.32, while the euro-dollar has remained within a narrow range of […]

Focus on U.S. Consumer Price Index, Expectations for Direction in the Dollar Exchange Rate upon Release

Today, the eagerly awaited December U.S. Consumer Price Index will be released. This week, the forex market’s attention is centered on this key indicator, yet the dollar exchange rate has not shown a clear direction. The U.S. Consumer Price Index is expected to stop declining from the previous year’s +3.1% to +3.2%. Meanwhile, the Core […]

After Passing the U.S. Employment Statistics at the End of Last Week, Focus Shifts to the U.S. CPI on the 11th – Today’s Market Appears Slow

The foreign exchange market at the beginning of the week has seen relatively quiet price action. USD/JPY is trading in the 144 yen range, while EUR/USD is in the 1.09 range. Despite the stronger-than-expected nonfarm payrolls data from the U.S. at the end of last week, the market didn’t exhibit a one-sided buying spree in […]

Dollar Selling Eases After US CPI, but Upside Momentum Limited

The biggest topic of the week so far has been the US Consumer Price Index (CPI). The market reacted sharply to the slight deceleration in year-on-year growth that fell just below market expectations. This led to a significant drop in US Treasury yields and a substantial decline in the dollar, strengthening the belief in a […]