May 2025 +$299,982

VIP SIGNAL +41,186 USD Yen Strength Driven by Domestic Bond Auctions and U.S. Fiscal Risk +191,827 USD Achieved! RBA Rate Cut & U.S.-Japan Trade Talks Hold the Key! 💰 +66,969 USD – Don’t Sell USD/JPY Yet! Powell’s Cautious Stance on Rate Cuts Shifts the Tide 💥 Will a Fed Rate Cut Trigger a Bitcoin Explosion? […]

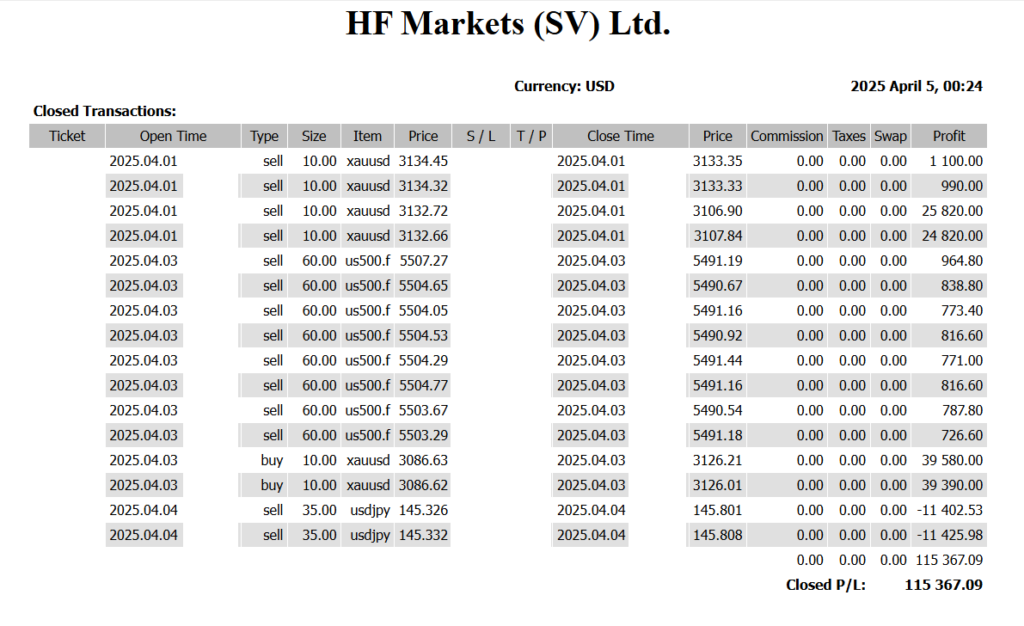

April 2025 +149,829 USD

Home Weekly Total: +32,077 USD — Is This the Start of a Trend Reversal? A Break Below 142.00 in USD/JPY Could Change Everything | Weekly Strategy & Key Events – $102,010 – “Entering the Trade Regime Phase” — US-Japan Negotiations Set to Shape FX Trends – +115,367 USD – Wins Both Short and Long ── […]

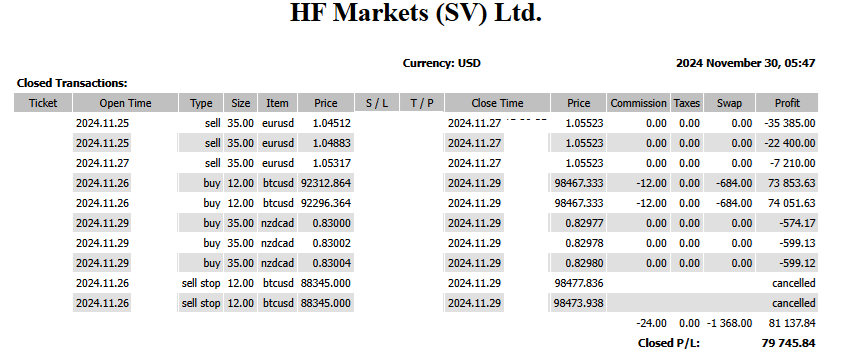

+79,745 USD! Market Fluctuations Due to Trump’s Tariff Statements, Bitcoin Benefits

+79,745 USD! Market Fluctuations Due to Trump’s Tariff Statements, Bitcoin Benefits Trade Results for November 25–29, 2024: Total profit: +79,745 USD The Bitcoin buy position performed excellently, and the week ended with a significant profit. Although a stop-loss occurred on EUR/USD shorts, the overall result was positive. Weekly Highlights: Bitcoin: Strong buying demand driven by […]

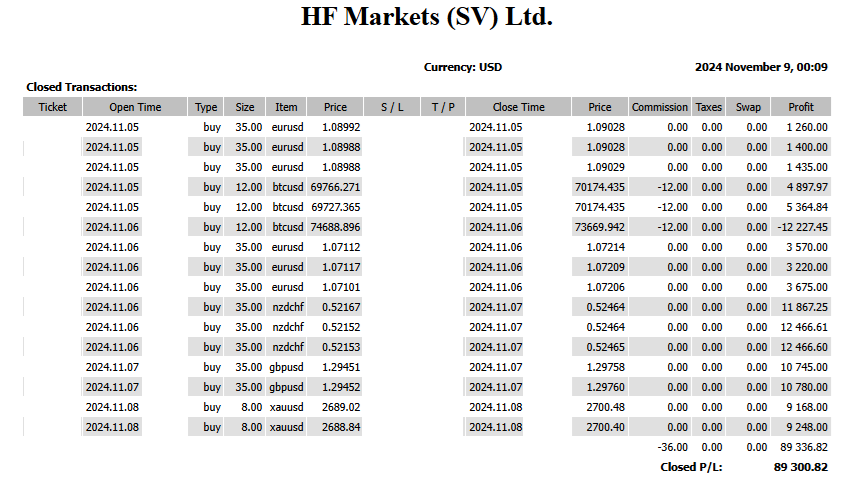

November 2024 +121,771 USD

Home

September 2024 +227,813 USD

VIP SIGNAL +111,986 USD: Will the U.S. CPI Trigger a Big Move? Strategy Ahead of the September FOMC +5,631 USD USD and CAD Selling Wave Arrives! Key Points and Future Outlook Yen Strengthening! Exploring Market Movements After Ishiba’s Election and Opportunities to Sell the Dollar

August 2024 +252,205 USD

VIP SIGNAL +141,981 USD Yen Strengthening! BoJ’s Next Move and USD/JPY Outlook: FX Weekly Forecast for August 5, 2024~ +176,529 USD Profit: Accelerated Dollar Selling on US Rate Cut Expectations? Focus on CPI to Determine the Next Move! -7,555 USD: Middle East Situation and Japan’s CPI Hold the Key! A Detailed Analysis of Future USD/JPY Strategies […]

July 2024 +249,485 USD

VIP SIGNAL +$127,371 Will the Yen Continue to Depreciate? Focus on U.S. CPI and Powell’s Speech! Yen Surges on Trump Remarks! Market Shaken by Dollar Intervention! Total +52,810 USD/Week FX Weekly Forecast July 22, 2024 +69,304 USD: BOJ’s Bond Purchase Reduction Plan and Rate Hike Discussions in Focus! Trading Results from July 22-26 and Future Outlook

+57,174 USD In a week with Discretionary Trading 20th In Janusry 2024

Dollar Strength and Yen Weakness Continue, Limited Movement Ahead of the Weekend

The trend of the strengthening US dollar that began at the start of the year accelerated after the release of the US Consumer Price Index (CPI) yesterday, briefly reaching 146.41 yen. However, it pulled back to pre-CPI levels and experienced a strengthening of the yen in Tokyo on the morning of the 12th, reaching 144.85 […]

Dollar Selling Eases After US CPI, but Upside Momentum Limited

The biggest topic of the week so far has been the US Consumer Price Index (CPI). The market reacted sharply to the slight deceleration in year-on-year growth that fell just below market expectations. This led to a significant drop in US Treasury yields and a substantial decline in the dollar, strengthening the belief in a […]