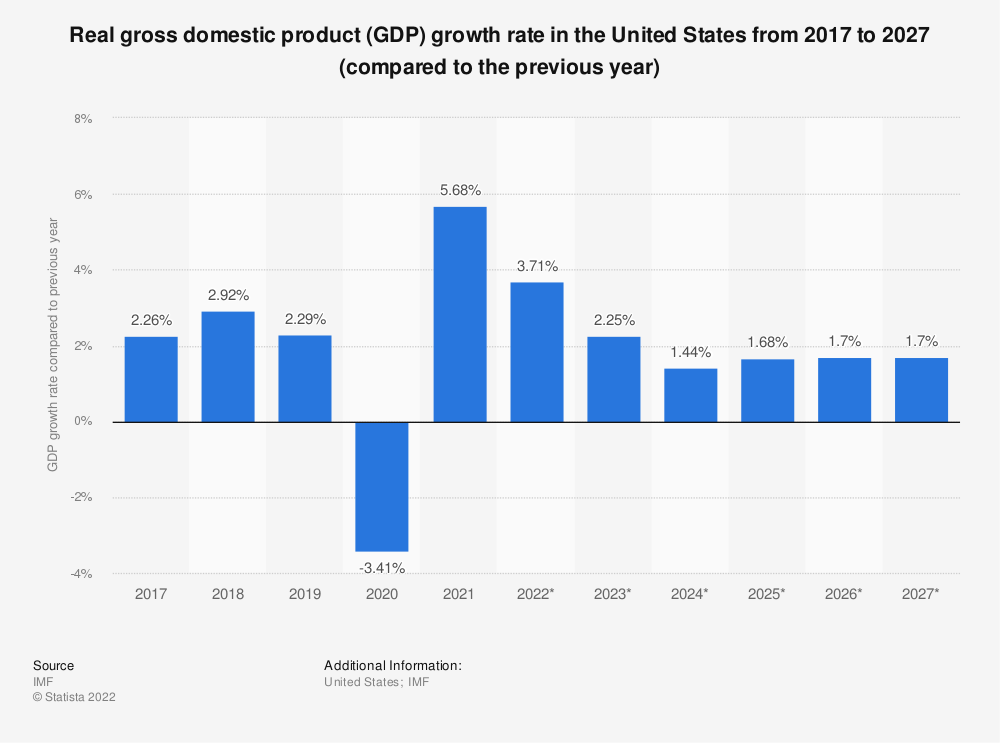

Today is the announcement of the US GDP preliminary figures, attention is paid to the growth rate and price-related indicators

Preliminary US GDP figures for the fourth quarter of last year will be announced today. It is attracting attention as a figure that indicates the trend of the US economy at the end of last year. The market is forecasting an annual growth rate of +2.6% compared to the previous quarter, which is expected […]

The September FOMC 75bp rate hike speculation in the money market has increased, and the growth of the GDP deflator has accelerated

In response to the higher-than-expected revision of the US GDP in the second quarter, US bond yields have risen and dollar-buying has spread. Expectations for a 75bp rate hike at the next FOMC in the short-term money market rose to 62.5%. 50bp is down to 37.5%. The upward revision of the GDP deflator from the […]

Euro area GDP will be reduced by 40% annually, and there is a view that it will be a blow over the United States

This week, GDP announcements in the second quarter are being made one after another. It was announced today that the euro area preliminary figures were -12.1% YoY. Replacing this with the year-on-year rate gives -40.3%. The US figures released yesterday were a year-on-year rate of -32.9%. A simple comparison shows that the euro area has […]