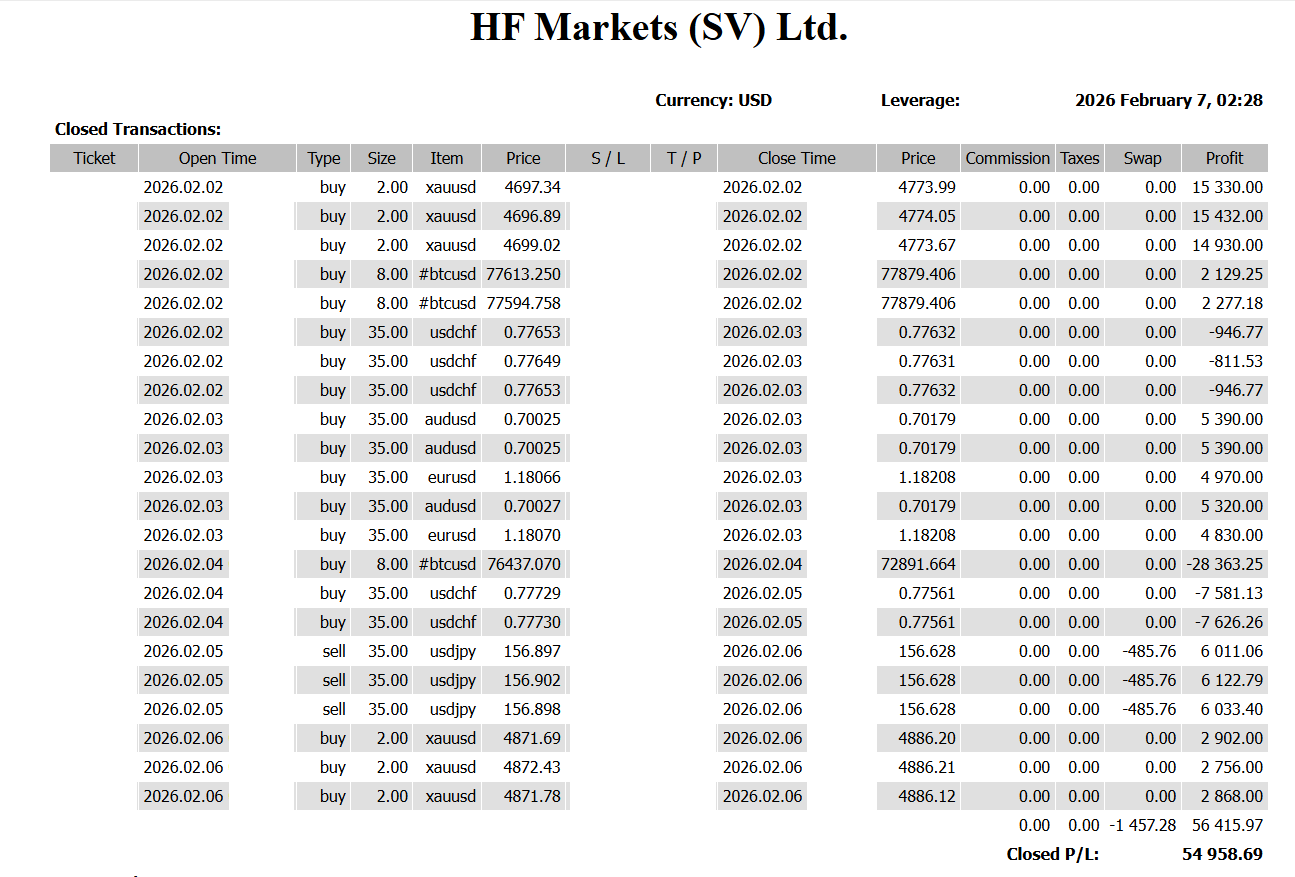

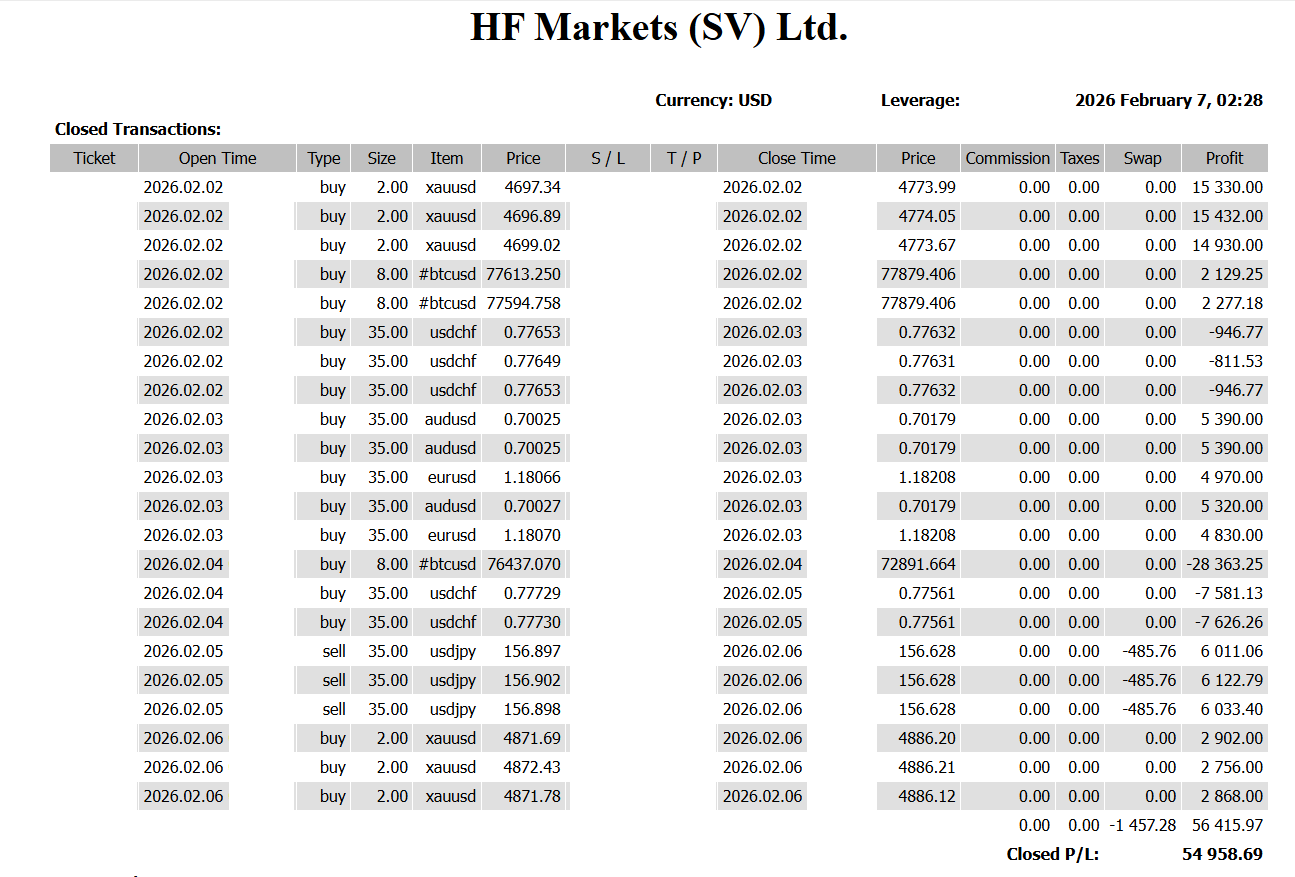

+54,958 USD 🗞️ A Week Where Politics Shook the Market — and Real Demand Determined the Landing

+54,958 USD🗞️ A Week Where Politics Shook the Market — and Real Demand Determined the Landing— Early February, “taking only

+54,958 USD🗞️ A Week Where Politics Shook the Market — and Real Demand Determined the Landing— Early February, “taking only

📊 Technical Analysis — February 6, 2026 Bottom line first: “Broad-based yen weakness continues. Cross-yen pairs are in a full

Today’s Option Landscape — February 6, 2026 (NY Cut) Spot Levels EUR/USD: 1.1798 USD/JPY: 156.80 GBP/USD: 1.3570 USD/CHF: 0.7760 USD/CAD:

🗞️ Lower House Election vs. Weakening U.S. Employment — USD/JPY Pauses After Its Latest Rally This week’s FX market has

Today’s Option Map — Feb 5, 2026 (NY Cut) ■ EUR/USD (Spot 1.1785) Thu 05/02 Expiries 1.1700 (1.4B) 1.1705 (667M)

🗞️ USD/JPY Eyes 157 as U.S. Labor Data Takes Center Stage The FX market is seeing simultaneous dollar strength and

My Current Rationale for Buying BTC on the Dip I received questions about why I’m stepping in on the buy

Today’s Option Map — Feb 4, 2026 (NY Cut) ■ EUR/USD (Spot 1.1834) Wed 04/02 Expiries 1.1600 (2.2B) 1.1800 (1.2B)

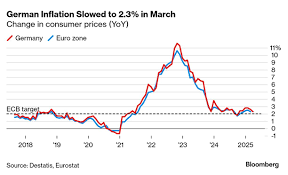

🗞️ Amid Crosscurrents, Market Focus Shifts to Japan’s Lower House Election and U.S. Data This week’s market remains nervous and

📊 Technical Analysis — February 3, 2026“EUR and GBP in short-term correction; Cross-yen pairs and Gold retake center stage.” 💱