📊 Technical Analysis – February 16, 2026

📊 Technical Analysis – February 16, 2026 Conclusion “The dollar is rebounding short-term, but daily charts remain structurally divided.Cross-yen pairs

📊 Technical Analysis – February 16, 2026 Conclusion “The dollar is rebounding short-term, but daily charts remain structurally divided.Cross-yen pairs

FX Option Expiries Overview – February 16, 2026 📍 Spot Levels EUR/USD: 1.1861 USD/JPY: 153.18 GBP/USD: 1.3634 USD/CHF: 0.7685 USD/CAD:

🗞️ Lunar New Year Holiday & U.S. Market Closure — Watching the BOJ Meeting 🎯 Today’s Theme Monitoring the content of

📊 Technical Analysis — February 13, 2026 🔎 Conclusion “Short-term dollar rebound × Daily timeframe dollar downtrend intact.This is a

📊 FX Options Overview — February 13, 2026 🔎 Spot Levels EUR/USD: 1.1852 USD/JPY: 153.46 GBP/USD: 1.3595 USD/CHF: 0.7702 USD/CAD:

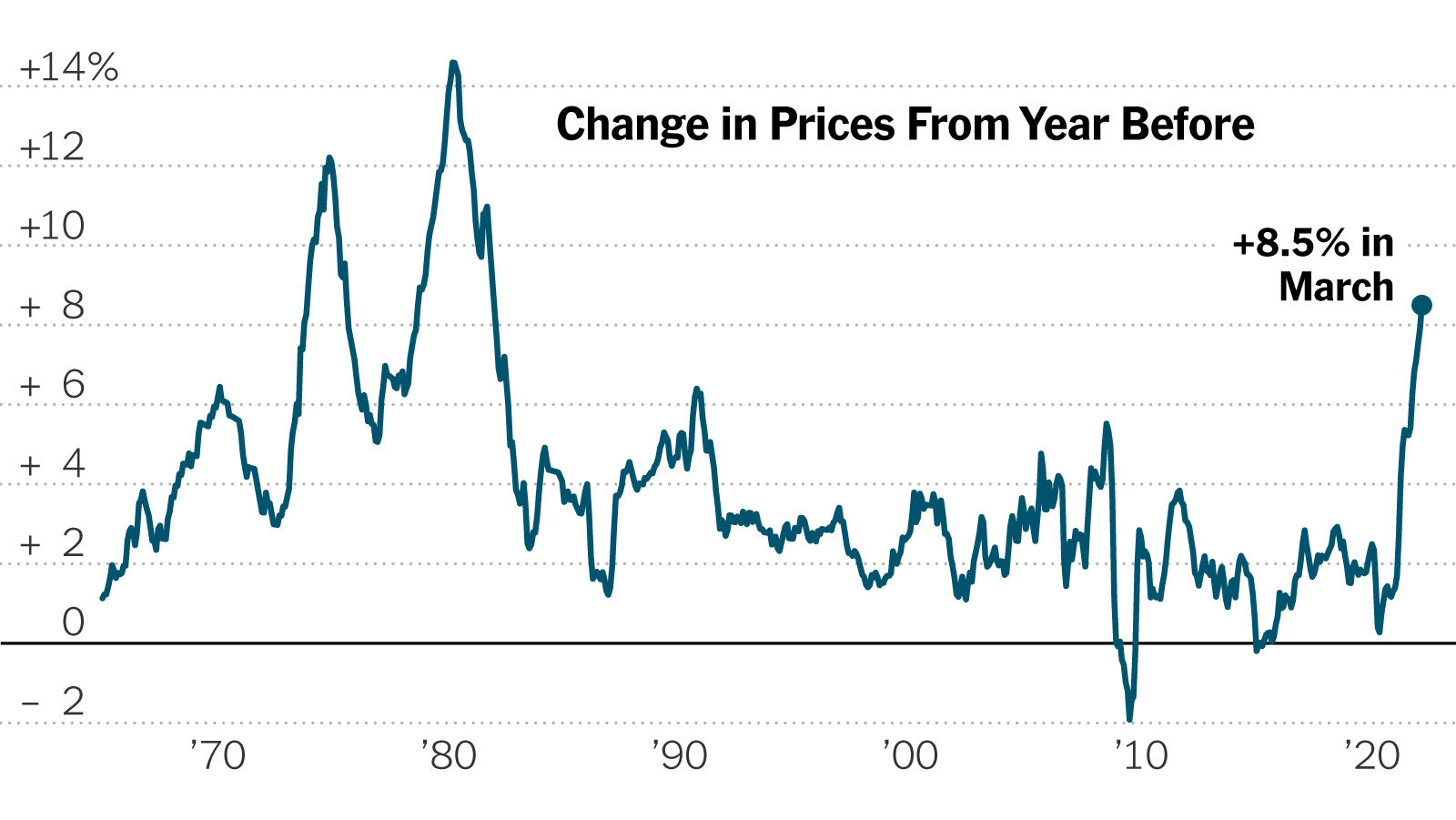

🗞️ Market Awaiting U.S. CPI — Searching for Direction 🎯 Today’s Focus January U.S. CPI The market is in full

📊 Technical Analysis — February 12, 2026 Conclusion “The broader USD downtrend remains intact.Short-term consolidation is underway.NZD and AUD are

Today’s Option Landscape — February 12, 2026 Spot Levels EUR/USD: 1.1856 USD/JPY: 153.36 GBP/USD: 1.3612 USD/CHF: 0.7719 USD/CAD: 1.3588 AUD/USD:

🗞️ Will Yen Strength Continue? — This Week’s Key Focus ■ Yen Appreciation Accelerates — Political Stability and Short Covering