📊 Technical Analysis — February 25, 2026

📊 Technical Analysis — February 25, 2026 🧭 Market Structure “A full-fledged JPY-weak trend market. Cross-yen pairs are the main

📊 Technical Analysis — February 25, 2026 🧭 Market Structure “A full-fledged JPY-weak trend market. Cross-yen pairs are the main

🗞️ FX Options Overview — February 25, 2026 ■ EUR/USD 1.1900 (~5.1B) ★ Largest 1.1850 (~2.2B) 1.1800 (~3.9B) 1.1750 (~1.8B)

🗞️ USD and JPY Both Weaken — Will the Trend Continue Overseas? 🎯 Today’s Theme Tokyo saw a mixed market:

🗞️ Direction Unclear Amid Trump Tariff Turmoil — Can the Dollar Rally Resume? 🎯 Today’s Theme Tariffs and geopolitical risks

📊 Technical Analysis — February 23, 2026 📊 Market Overview “Short-term USD-led rebound, while cross-yen pairs and metals stay strong

🗞️ FX Options Overview — February 23, 2026 📍 Spot Levels EUR/USD: 1.1828 USD/JPY: 154.37 GBP/USD: 1.3534 USD/CHF: 0.7720 USD/CAD:

🗞️ Dollar Selling Dominates as Trump Tariff Uncertainty Weighs on Markets 🎯 Today’s Focus Uncertainty surrounding new Trump-era tariffs is

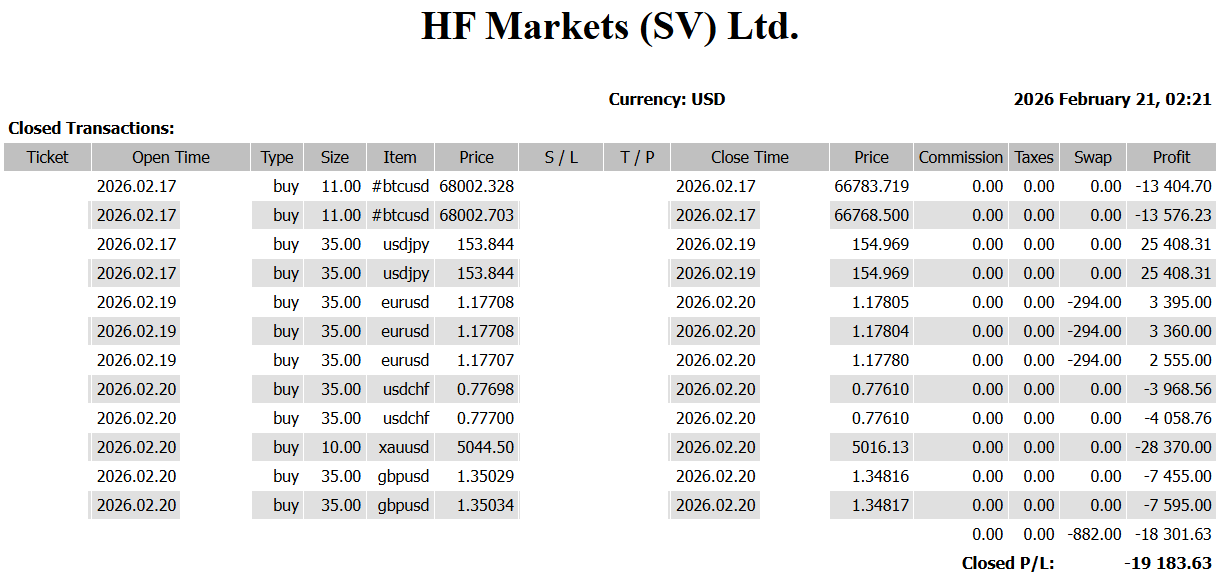

−19,183 USD Middle East × Tariffs × Intervention | Toward a Volatile Late February 📊 Weekly Performance Review Period: February

📊 Technical Analysis — February 20, 2026 🧭 Market Structure “Short-term risk-on rebound. Higher timeframes still at a crossroads.” After

🗞️ FX Options Overview — February 20, 2026 📍 Spot Levels EUR/USD: 1.1760 USD/JPY: 155.08 GBP/USD: 1.3457 USD/CHF: 0.7751 USD/CAD: