This time, I will explain in detail how Decentralized Finance works and how to make a profit by using investment and lending .

If you want to make money by using Decentralized Finance, please refer to it.

The point of this article

- An easy-to-understand explanation of how Defi works

- Explaining two ways to make money using Defi

- How much can you earn if you use Defi?

DeFi is basically a decentralized application based on Ethereum’s smart chain .

The reason why this financial product has been attracting attention recently is that it can aim for high profitability .

It offers attractive profitability compared to other financial products, such as being able to actually aim for an annual interest rate of about 20%.

table of contents

- What is Defi (Decentralized Finance)? Explain the mechanism and outline

- How to make money with Defi

- Invest in Defi stocks

- Pool funds for Defi services

- How to Make a Profit by Investing in Defi Brands

- Buy Bitcoin at domestic crypto exchanges

- Send money to overseas cryptocurrency exchanges

- How to make a profit by pooling funds on Defi

- Buy Ethereum on domestic exchanges

- Send the purchased Ethereum to the Ethereum wallet

- Linking Ethereum Wallet with Decentralized Finance Services

- Lend your money on a decentralized exchange

- How much can you earn with Defi

- Recommended brands related to DeFi

- Ethereum (ETH)

- Uniswap (UNI)

- IOST

- Summary of how to start and how to start Defi

What is Defi (Decentralized Finance)? Explain the mechanism and outline

Defi (Decentralized Finance) is an abbreviation for “Decentralized Finance” and refers to applications such as the financial services ecosystem.

Based on the Ethereum blockchain, anyone can access and provide it on the Internet without the need for an administrator .

Defi’s mechanism is a further evolution of blockchain technology, allowing you to manage your financial assets autonomously without the need for a centralized system.

In the conventional blockchain technology, the movement and management of assets was the main, but in Defi, complicated movement and transactions such as financial assets are possible.

Therefore, there is no need to intervene financial institutions when moving or trading assets, and financial asset transactions can be speeded up .

For example, major domestic exchanges are currently categorized as centralized exchanges, which have the problems of high fees and time-consuming deposits and withdrawals.

That problem can be solved with DEX (Distributed Exchange), which is one of DeFi.Glossary

What is DEX …

An abbreviation for Decentralized Exchange, an exchange called a decentralized exchange. It is mainly made using smart contracts on Ethereum and can be used for P2P transactions. On the other hand, the conventional exchange is called CEX (Centralized Exchange).

DEX is attracting a lot of attention because it completes transactions quickly, realizes an exchange with low fees, and guarantees transactions with smart contracts.

The excitement of DeFi in recent years is roughly divided into two.The point of excitement of DeFi

- Price increase of DeFi related stocks

- High interest rate earnings from pooling funds

DEX has long been the focus of attention as a groundbreaking finance system, but it has the flaws of low stocks and low liquidity, so it is not frequently traded as the main trading platform. was.

However, by adopting a mechanism called “Pool” to ensure liquidity, we succeeded in solving the fundamental problem .

By pooling funds, users can receive transaction fees with governance tokens.

In other words, tokens are now automatically distributed just by depositing funds .

With this mechanism, the amount of funds for DEX has increased, and we have succeeded in solving the problems of liquidity and the small number of stocks handled.

In addition, as the volume of transactions on DEX increased, the value of governance tokens also increased, and the price rose significantly when listed on major exchanges.

As a result, the flow of “depositing funds-> getting governance tokens-> soaring token prices” was created, and DeFi such as DEX attracted more attention.

Some of the most popular DEX transactions today are Compound , Uniswap , and PancakeSwap .

How to make money with Defi

There are two main ways to make money using Defi.

- Investing in Defi stocks

- Lending using Defi service

Then, I will explain each of them.

Invest in Defi stocks

The first way is to invest in DeFi related currencies .

Ethereum, which is the basis of DeFi, and governance tokens distributed by exchanges are all bought and sold on exchanges.

In addition, some currencies have seen a sharp rise in prices in recent years, so it is possible to obtain foreign exchange gains by holding those currencies .

| Currency name | Volatility (2020.10-2021.2) |

|---|---|

| Uniswap | + 1200% |

| COMP | + 700% |

| CAKE | + 6300% |

| Balancer | + 500% |

Price fluctuations from November 2020 to February 2021

DeFi started to flourish around the fall of 2020, and prices soared significantly until February 2020 .

In fact, the above currencies can be purchased at overseas exchanges, so it is possible to aim for foreign exchange gains by holding stocks that will grow in the future.

Pool funds for Defi services

The second method is to earn interest income by pooling funds to DeFi .

For example, in “Pancake Swap” that runs on AMM (Automated Market Makers) that runs on BSC provided by Binance, it is possible to earn commission income with tokens called CAKE by pooling funds .

Of course, this CAKE is also traded in the market, and you can make a profit by selling the acquired tokens, or you can manage your assets in a compound interest manner by reinvesting.merit

- No need to stick to the chart and trade

- You can get high interest income

There are two specific benefits.

First of all, you only have to pool (deposit) the funds, so you don’t have to make short-term trades to increase the funds.

Short-term trading often has a negative effect on mental health, and it is not recommended for those who have a main business to invest large amounts of money in short-term trading.

This DeFi is one of the methods of asset management that is mentally less burdensome because you can increase funds without trading .

In addition, it is an attractive investment method as of March 2021 because it can generate higher interest income than other financial products.

The APY (annual interest rate) actually provided by Pancake Swap is summarized below.

| Currency pair | APY |

|---|---|

| USDC / BUSD | 19.81% |

| CAKE / BNB | 151.53% |

| BOR / BNB | 342.46% |

| SUSHI / ETH | 88.24% |

March 1st data for Pancake Swap

You can see that even the combination of stablecoins, which is said to have the lowest permanent loss, has a very high APY of 19%.

Of course, the combination of altcoins is highly variable, so the APY is high, but the risk is high, so be careful.Demerit

- Risk of price fluctuations

- May be affected by government regulations

DeFi offers a higher APY than other financial products, but depending on the currency you deposit, the valuation amount (asset amount based on legal tender) may decrease significantly due to the influence of price fluctuations.

Therefore, if you are starting DeFi from now on, you can reduce the risk by choosing a currency pair of Stablecoin.

Many APYs exceed 100%, which may seem more attractive, but of course the risk of possession increases.

The second disadvantage is that DeFi is a financial product that is still in its infancy, so it is quite possible that it will be regulated by the authorities.

There is a background that ICOs were also turbulent before being regulated, and then ICO regulations were laid down in each country.

Let’s hedge the risk of DeFi with a view to being influenced by the government depending on future movements .

How to Make a Profit by Investing in Defi Brands

Linking Ethereum Wallet with Decentralized Finance Services

If you can transfer your purchased Ethereum to your Ethereum wallet, you will need to connect MetaMask with your Decentralized Finance service.

Please note that the Pancake Swap introduced earlier has different specifications from other Ethereum-based AMMs because it is an AMM that runs on Binance’s smart chain.

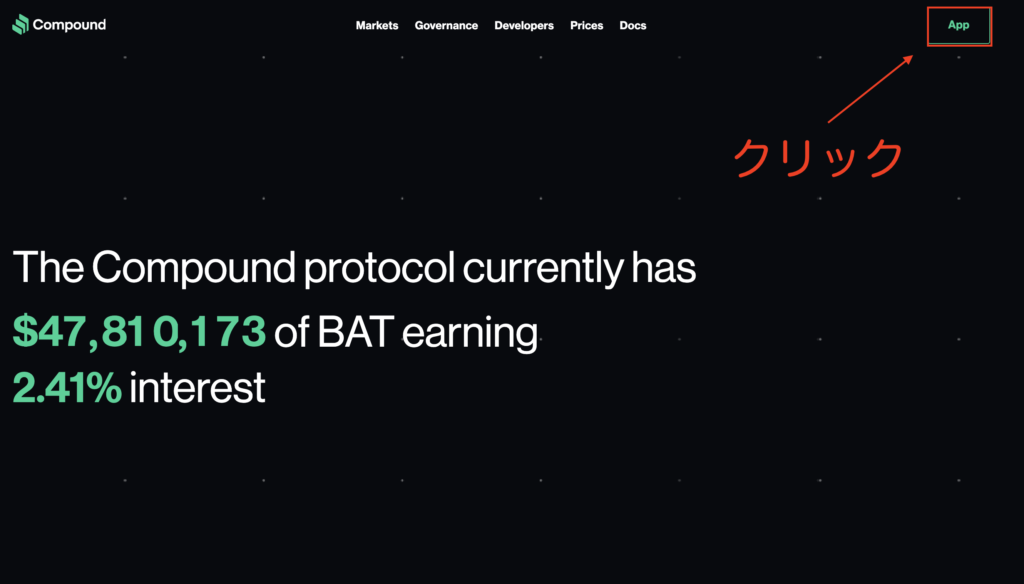

In the case of AMM deployed on the normal Ethereum smart chain, you can select from the “APP” button and cooperate.

The above is Compound that provides Lending DeFi, but when you move to the official website of Compound, there is a button called APP in the upper right.

Click here to select a wallet that you can partner with, so select “Metamask” to partner.

It also explains in detail how to start and use Com pound, so please check it out as well.

Lend your money on a decentralized exchange

Once the partnership is complete, select the tokens you want and pool your money .

Basically, commission income can be received with the Gavanance Token of the service provided .Token example

- Uniswap: UNI

- Compound: COMP

- PancakeSwap: CAKE

You can sell the Governance Tokens you receive as you like, or you can hold them and hold them in anticipation of further price increases.

How much can you earn with Defi

Next, I will explain how much profit you can make with DeFi .

Even if DeFi basically pools APY 15% to 20% stablecoins, profitability depends on the amount of funds.

Therefore, it is difficult to obtain high profits if the amount of funds is small .

It is an attractive financial product for those who have at least 500,000 yen or more.

| period | ROI (Rate of Return) |

|---|---|

| 1 day | 0.06% |

| The 7th | 0.40% |

| 30 days | 1.71% |

| 365 days | 22.97% |

Rate of Return of USDC-BUSD on March 1, 2021

from Pancake Swap

The above is the rate of return when you pool Stablecoin funds.

Let’s also look at the amount of increase when operating for one year divided by fund based on this number .

| Amount of funds | One year later | Increase |

|---|---|---|

| 100,000 yen | 122,000 yen | 22,000 yen |

| 500,000 yen | 610,000 yen | 11,000 yen |

| 1 million yen | 1,220,000 yen | 220,000 yen |

| 3 million yen | 3,660,000 yen | 660,000 yen |

| 5 million yen | 6,100,000 yen | 1,100,000 yen |

| 10 million yen | 12,200,000 yen | 2,200,000 yen |

| 30 million yen | 36,660,000 yen | 6,660,000 yen |

Revenue simulation as of March 1st

If the interest rate as of March continues, the increase in profits will be as shown in the table.

You can see that you can expect a fairly high profitability .

However, keep in mind that the offered APY fluctuates daily and may be lower than the current interest rate depending on the cryptocurrency quote and the amount of pooled funds.

Recommended brands related to DeFi

Here, I would like to introduce some recommended DeFi related brands.

If you are thinking of investing in DeFi related stocks, please refer to it.

Ethereum (ETH)

| Currency name | Ethereum |

| symbol | ETH |

| Price (as of January 18, 2022) | ¥ 370,426 |

| Market capitalization (as of January 18, 2022) | ¥ 43,150,700,310,063 |

| Official site | Ethereum official website |

As you can see from the fact that DeFi is basically based on Ethereum’s smart chain, Ethereum is the basic crypto currency of DeFi.

Due to the above, it is characterized by being particularly popular among DeFi-related brands.

As of January 2022, it boasts the second largest market capitalization after Bitcoin and has become a representative of Altcoin.

Uniswap (UNI)

| Currency name | Uniswap |

| symbol | UNI |

| Price (as of January 18, 2022) | ¥ 1926.60 |

| Market capitalization (as of January 18, 2022) | ¥ 1,115,090,382,093 |

| Handling exchange example | Not handled at domestic crypto currency exchanges |

| Related article | What is Uniswap? |

Uniswap is one of the DEXs (Distributed Exchanges) that does not require a central administrator and can trade 24 hours a day.

Also, as a major feature, the operation itself is for non-profit purposes, so there are almost no fees.

It is one of the DeFi-related stocks that are expected in the future.

IOST

| Currency name | Io Estee |

| symbol | IOST |

| Price (as of January 18, 2022) | ¥ 3.29 |

| Market capitalization (as of January 18, 2022) | ¥ 59,474,531,853 |

| Official site | IOST official website |

IOST uses PoB ( Proof of Believability ), a unique consensus algorithm that can achieve decentralization .

By adopting this unique consensus algorithm, PoB, high-speed processing power and decentralization are possible.

Since PoB has a big influence on DeFi, IOST is getting a lot of attention as a DeFi related stock.