The market situation of material shortage is likely to start at the beginning of the week. The US market will be closed due to the Juneteenth transfer holiday. It lacks clues such as US bond trends, making it difficult to move. It will be while watching the adjustment of the stock market.

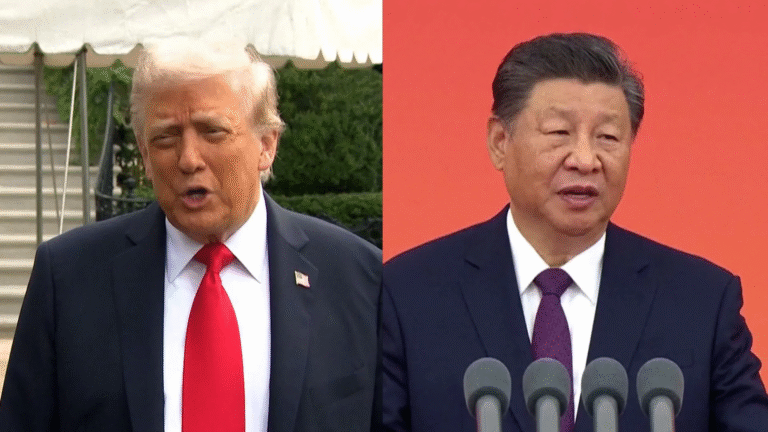

The difference in financial stance between Japan and the United States has become a major theme that pushes up the dollar / yen pair. Among them, the upper price has been suppressed in the middle of the 135 yen range since the latter half of last week, and the movement of further increase has stopped. That said, short-term long positions are likely to be lighter to some extent. Last week, there was a big adjustment sale to the mid-131 yen level, but at the moment it has returned to the level of 135 yen. Since there are few trading participants today and the market is thin, I would like to assume that there is a possibility that it will try to break out of the resistance level.

The economic indicators to be announced in overseas markets after this are only the euro area construction industry output (April) scheduled, and there are no plans to announce the attention indicators.

On the other hand, there are many plans related to remark events. Regarding ECB, ECB President Christine Lagarde will attend the European Parliament’s Economic and Financial Commission. Recently, statements outside the formal ECB board, such as blogs and announcements of policy policies at extraordinary meetings, are often driving the market. I want to keep in mind today as well. Remarks by Central Bank Governor Muller Estonia, Governor Bisco I, Governor Centeno Portugal, Governor Kazarks and Latvia, and Chief Economist Lane ECB are also planned.

It is assumed that the yen will continue to depreciate. This week, we will focus on CADJPY, CHFJPY, and USDJPY in the yen.