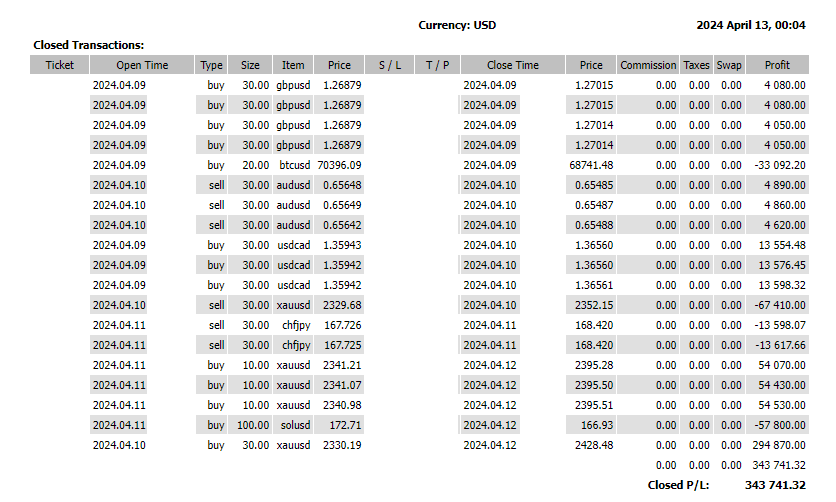

From April 8 to April 12, the total trading was +343,741 USD.

It was a week where gold buying performed well.

The notable U.S. CPI was higher than expected, and while the U.S. dollar continues to be strong, gold rose to a record high regardless. The recent situation in the Middle East was a trigger, but the medium to long-term trend for gold has been rising, so this can be seen as just an acceleration of that trend.

With the EU and other countries moving towards a mood of lowering interest rates, there is a high possibility that gold prices will continue to rise this year. After the gold adjustment, we plan to buy again.

The focus for the future is on the following three points:

[Scenario of Oil Exceeding $100] Finally, a major attack by Iran, retaliation against Israel, and the UAE targeted, possibly leading to a blockade of the Strait of Hormuz.

The situation in the Middle East has become more tense. The loss of some of Russia’s oil production capacity has a significant impact, and oil prices are rising. The possibility of exceeding $100 is conceivable. There is a heightened sense of alertness that Iran, or its proxy forces, will launch a large-scale attack on Israel in the coming days. There is also a possibility of the Strait of Hormuz being blocked, and concerns that oil-related facilities in the United Arab Emirates (UAE), which has diplomatic relations with Israel, may be targeted.

Given that more than 90% of Japan’s oil imports come from the Middle East, this surge in oil prices could have a significant impact on the recently sensitive Japanese yen. If oil prices lead to inflation, this would mean pressure for a stronger yen. With the possibility of intervention by the Bank of Japan, the Japanese yen is seen as a buy.

Additionally, risk-averse gold is attracting buyers, surpassing the record high of $2400. However, it dropped nearly $100 from the high over the weekend, and further adjustments are expected at the beginning of the week.

U.S. Core CPI exceeds expectations for three consecutive months – possibility of delayed U.S. interest rate cuts

In March, the U.S. Consumer Price Index (CPI) statistics showed that the core index, excluding volatile food and energy, exceeded market expectations for the third consecutive month, suggesting that inflationary pressures are strengthening again. This indicates that the expected start of U.S. interest rate cuts this year might be delayed.

David Kelly, Chief Global Strategist at J.P. Morgan Asset Management, said on Bloomberg Television, “The door to a June rate cut slammed shut. With that, the possibility has completely disappeared.”

Expectations for U.S. rate cuts are now retreating to start in September. The strong U.S. dollar is expected to continue.

Hong Kong’s Bitcoin spot ETF, expected massive inflow of funds from China

The authorities in Hong Kong are expected to approve the listing application for spot ETFs for cryptocurrencies Bitcoin and Ethereum as early as next Monday. Bloomberg reported on the 12th that the first approval might be announced as early as next week.

If approved in Hong Kong, it would make it the first city in Asia to offer Bitcoin and Ethereum ETFs, and this could serve as an important case for regulators in Japan, Singapore, South Korea, and others to consider in the future.

According to the report, a subsidiary of China’s asset management company Harvest Fund Management Company, as well as Bosera Asset Management Co. and HashKey Capital, are expected to receive approval to operate as issuers of Bitcoin and Ethereum ETFs.

HashKey Capital had just announced a strategic partnership with Bosera International on April 6th. Livio Weng, CEO of HashKey, said on Friday this week that if on-chain staking issues are resolved, approval for Ethereum’s spot ETF is near.

The Bitcoin spot ETF in Hong Kong is expected to see an inflow of up to 25 billion U.S. dollars from mainland China. With the Bitcoin halving approaching, this is a nervous time, but it is expected to support Bitcoin.

P.S.

Today is April 14, but just a few hours ago, Iran launched missiles at Israel.

Since Israel has declared that it will retaliate if attacked, further retaliatory attacks are likely to continue.

The market from the 15th is likely to be highly volatile, so prepare yourself mentally.

As a trader, it is important to focus on trading, regardless of the morality of the situation.

Have a good weekend (^^)”