This week has been filled with important events such as the BOJ meeting, ECB meeting, and the latest US GDP report, but both the USD and JPY markets have failed to establish a clear direction.

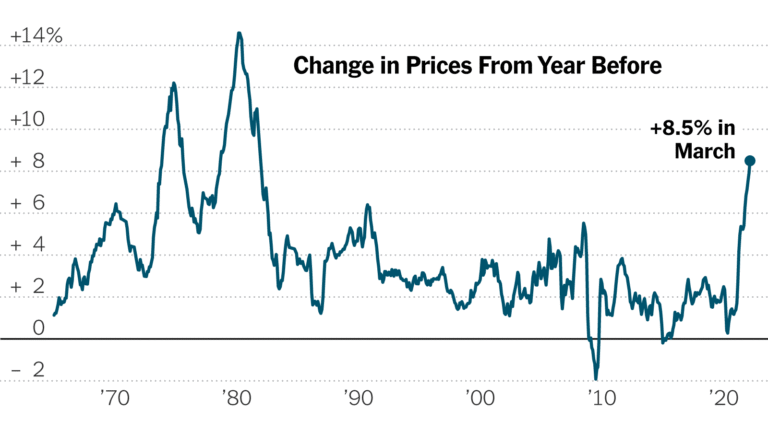

The USD index has been fluctuating between its 200-day and 10-day moving averages, showing volatile movements but lacking a strong upward momentum. The US GDP preliminary reading for the fourth quarter came in at +3.3% on a year-on-year basis, with personal consumption at +2.8%, surpassing market expectations. However, the deflator only grew by +1.5%, indicating a slowdown in inflation. This report did not provide a decisive boost to the USD. Looking ahead, next week will bring significant events such as the FOMC meeting and US employment statistics, which could continue to keep the markets in a state of confusion.

The JPY market saw a pause in the yen’s depreciation trend, with a slight correction. As expected, the BOJ left its policy interest rate unchanged at its meeting. During Governor Kuroda’s press conference, he expressed confidence that the likelihood of achieving the inflation target is gradually increasing. While he did not provide specific timing for removing negative interest rates, the positive impression he conveyed to the market led to yen buying. Despite a temporary rise in US bond yields, expectations of removing negative interest rates have boosted Japanese government bond yields. However, a clear trend towards JPY appreciation has yet to be confirmed.

At the ECB meeting, the main policy rates were left unchanged as anticipated. During ECB President Lagarde’s press conference, she reaffirmed her suggestion of starting rate hikes in the summer, which she had hinted at during the Davos conference. Initially, this statement was intended to discourage market expectations of a rate hike in March. However, given the series of weak economic data in the Eurozone, the market is starting to interpret it as a green light for rate hikes. The EUR has been in a gradual decline, forming a downward trend.

As we move past these events, the question is how the global markets will behave today. Key data to watch includes US personal income and spending for December, as well as the PCE Deflator for December. The PCE Deflator is expected to be +2.6% on a year-on-year basis, similar to the previous reading, while the Core Deflator is expected to slow down from +3.2% to +3.0% on a year-on-year basis. Personal income is expected to grow by +0.3% on a month-on-month basis, slightly lower than the previous +0.4%, while personal spending is expected to accelerate to +0.5% from the previous +0.2%. The key point will be whether the solid consumption, as indicated in yesterday’s GDP preliminary reading, continues.

In terms of speeches and events, ECB officials will be prominent. Speeches and conference attendance by ECB President Panetta, ECB President Simkus of Lithuania, ECB President Kazaks of Latvia, and ECB President Vujcic of Croatia are scheduled. The ECB Expert Survey will also be released. We will be watching to see if the selling pressure on the EUR that followed yesterday’s ECB meeting continues and checking the statements of hawkish members.

Regarding your trading update, it seems you experienced a stop-out on your EURJPY short position due to the EUR rebound. It’s essential to have a well-defined trading strategy and risk management plan in place. Currently, your only open position is the BTCUSD long. Considering the medium to long term, there is a high probability of another upward wave coming. Your anticipation of large-scale buying during the downturn aligns with the news about whales accumulating Bitcoin at lower prices, with $38,000 acting as significant support.

Today’s focus is on the release of the US PCE Deflator, an important inflation indicator. It could lead to significant movements in the USD, so it’s a key event to monitor.