This week, the market seems to be in a state of stagnation, sandwiched between last week’s US employment statistics and the upcoming focus on the US Consumer Price Index next week. The market is unfolding with position adjustments, and confidence in the correlation between the US dollar and US bond yields has decreased. It’s clear that we need more solid fundamental materials.

Economic indicators to be released in the foreign markets later include Germany’s Consumer Price Index (final) for October, Eurozone Retail Sales for September, US MBA Mortgage Applications for October 28 – November 3, Canada’s Housing Construction Permits for September, and Wholesale Inventories (final) for September, among others. These indicators are relatively low in terms of market attention.

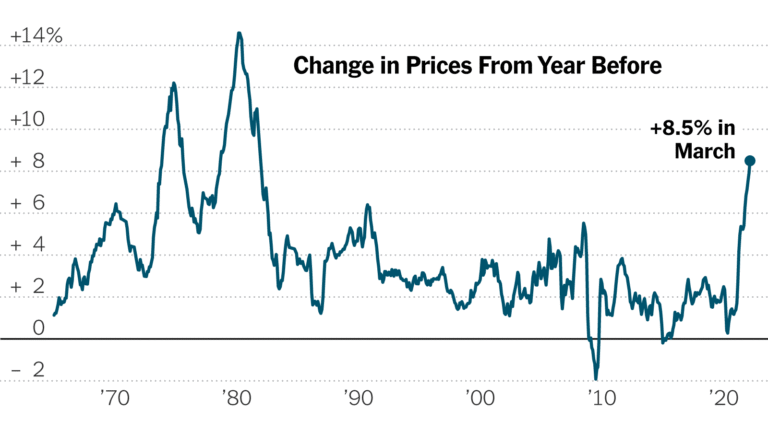

Amidst this, it seems that the market is seeking market-moving information from a series of statements by financial officials. Yesterday, Neel Kashkari, President of the Minneapolis Fed, unequivocally denied discussions of rate cuts. He expressed doubts about whether we have done enough, considering that economic activity is heating up, and suggested the need for additional measures. Officials like Lael Brainard and Robert Kaplan hinted at the possibility of inflation settling at levels higher than 2%. Since the US employment statistics last week, the US dollar has seen adjustments after the selling trend.

Today, there are scheduled speaking opportunities for many US financial officials, including Mary C. Daly, President of the San Francisco Fed, Jerome Powell, Chair of the Federal Reserve, John C. Williams, President of the New York Fed, Richard H. Clarida, Vice Chair of the Federal Reserve, and Loretta J. Mester, President of the Cleveland Fed, among others. Their speeches and participation in events will be the focus.

Turning to the ECB-related news, ECB Vice President Luis de Guindos stated yesterday that the Eurozone is expected to see a slowdown or stagnation in GDP growth for the fourth quarter. He mentioned the economic slowdown. Today, events and speeches are scheduled for Philip R. Lane, Chief Economist at the ECB, Mārtiņš Kazāks, Governor of the Latvian central bank, Pierre Wunsch, Governor of the National Bank of Belgium, Gabriel Makhlouf, Governor of the Central Bank of Ireland, Jens Weidmann, President of the Deutsche Bundesbank, Pablo Hernández de Cos, Governor of the Bank of Spain, and Boris Vujčić, Governor of the Croatian National Bank, among others.

In the early London session, ECB Consumer Inflation Expectations for September will be released. In August, the three-year-ahead outlook rose for the second consecutive month to 2.5%. The one-year-ahead outlook increased from 3.4% in July to 3.5%. Christine Lagarde, ECB President, recently expressed a strong commitment to achieving the 2% inflation target by 2025, but inflation expectations suggest that the target may not be met. If today’s numbers show another increase, there is a possibility that expectations of additional rate hikes by the ECB may reignite.

It’s expected that today’s market will continue to remain range-bound without major economic indicators. The focus will be on Bitcoin, maintaining a buying perspective.