Today, the US Consumer Price Index for April will be announced. It is well known for its high market attention due to its timeliness as an inflation indicator in the US. In the current market, concerns about the US regional bank failures and sell-offs have subsided, and there is no excessive reaction to the tightening of the Federal Reserve’s lending stance. Although the US government debt ceiling issue is a concern, the market seems to have strong expectations for a resolution just before the deadline.

In the meantime, the unexpectedly strong US employment statistics have pushed back the anticipation of an early rate cut. At this point, the market expectation for the next June FOMC meeting is about 75% for interest rates to remain unchanged, and about 25% for an additional rate hike. For July, about 55% expect rates to remain unchanged, about 27% expect a rate cut, and slightly over 15% expect an additional rate hike.

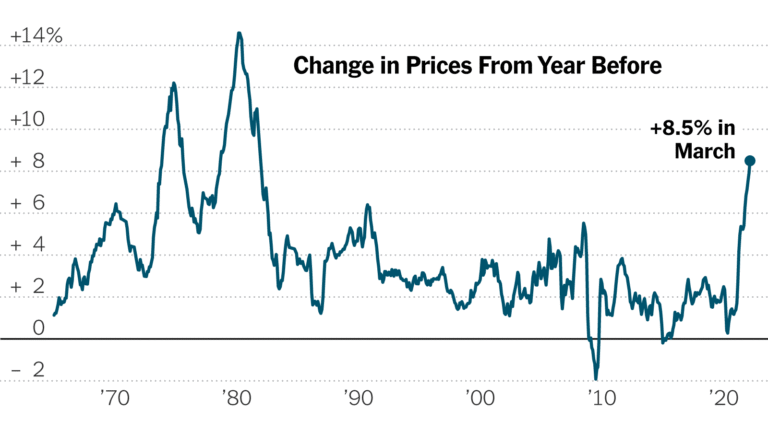

Market expectations for today’s US Consumer Price Index are at +5.0% YoY, the same level as the previous figure, and core YoY is expected to be +5.5%, slightly slowing down from the previous +5.6%. Also, of interest is the MoM, with an expectation of +0.4%, accelerating from the previous +0.1%. The core MoM is expected to slightly slow down to +0.3% from the previous +0.4%. It’s unclear whether the monthly inflation will slow down unless the MoM turns negative.

Although it is a range-bound market, it is expected that a significant trend will emerge at today’s US Consumer Price Index (CPI) announcement. We would like to follow the flow after that.