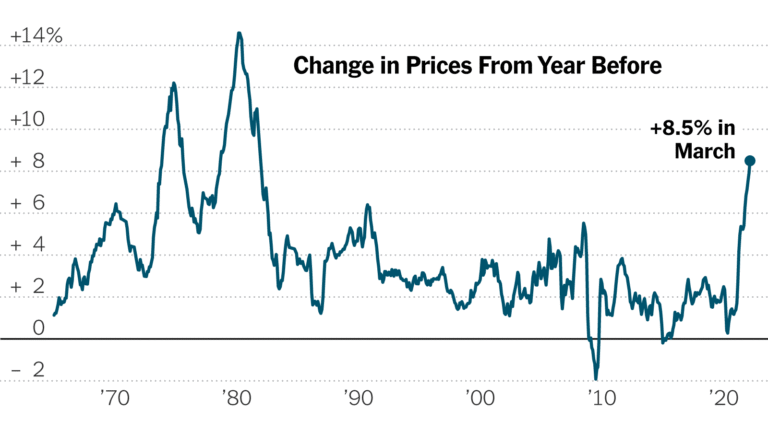

The US consumer price index (CPI) for March will be announced today. It is a notable indicator that is almost decisive for the interest rate outlook of the US FOMC in May. According to the market forecast in advance, the year-on-year growth is expected to slow down sharply from +6.0% in the previous year to +5.1%. On the other hand, core year-on-year growth is expected to be +5.6%, a slight increase from the previous +5.5%. As the overall numbers show a downward trend, the point will be what the core index will be.

According to the CME FedWatch at this point, a 25bp rate hike is factored in at 69.5% and a 30.5% hold, with no major changes from the previous day.

If the US CPI headline year-on-year change and core year-on-year change show the same trend, whether strong or weak, it is expected to have a strong impact on the market. A strong number would almost confirm a 25bp hike.

On the other hand, what if all the weak numbers come out? It seems that it is necessary to carefully watch how much the market will increase the level of deferred speculation. If it stays at about 50-50, I think there is a good chance that the Fed will raise interest rates one more time, as the Fed said recently. However, it will affect future terminal rate observations.

It is difficult to imagine the market reaction in the event of other mixed results. Although the dollar index has slowed down since March, the 21-day moving average line is holding down the top. Currently, it is in balance. The dollar is likely to find its direction between the recent weak dollar level and the 21st line.

(Source: Minkabu)

Pay attention to the movement of the USD after the US CPI. I want to follow this flow.