+41,186 USD Yen Strength Driven by Domestic Bond Auctions and U.S. Fiscal Risk

✅ [FX Market Review]Yen Strength Driven by Domestic Bond Auctions and U.S. Fiscal RiskKey Theme for the Week of May 26: “Auctions × Data” 📆 Period: May 19 (Mon) – May 24 (Sat)💹 Weekly Realized P/L: +41,186 USD 🔍 Market Recap Gold prices rose steadily, supported by a solid dollar-selling trend, and we were able […]

+191,827 USD Achieved! RBA Rate Cut & U.S.-Japan Trade Talks Hold the Key!

+191,827 USD Achieved! RBA Rate Cut & U.S.-Japan Trade Talks Hold the Key! 📈 Weekly Performance Report | May 12–16, 2025 💰 Total Profit: +191,827 USD! Markets turned risk-on following news of U.S.-China tariff easing, with the Australian dollar reacting particularly strongly. But the real game begins now—RBA rate cuts and U.S.-Japan negotiations are […]

💰 +66,969 USD – Don’t Sell USD/JPY Yet! Powell’s Cautious Stance on Rate Cuts Shifts the Tide

💰 +66,969 USD – Don’t Sell USD/JPY Yet! Powell’s Cautious Stance on Rate Cuts Shifts the Tide ✅ Trading Results (May 5–9) 📊 Weekly Profit: +66,969 USD 🌟 Weekly Market Summary USD Strength Resumed after FOMC and rising U.S. yields BOE Cut Rates, but GBP rose on UK–US trade agreement Australian Dollar Firm after election […]

💥 Will a Fed Rate Cut Trigger a Bitcoin Explosion? Two Scenarios Diverge at the $97,000 Line

💥 Will a Fed Rate Cut Trigger a Bitcoin Explosion? Two Scenarios Diverge at the $97,000 Line ✅ Trading Results (April 28 – May 2, 2025) Weekly P/L: -$61,083 A week swayed by a directionless market. 🌐 Market Overview 🏦 Japan: Yen Weakness Becomes Clearer The Bank of Japan kept policy rates unchanged but revised […]

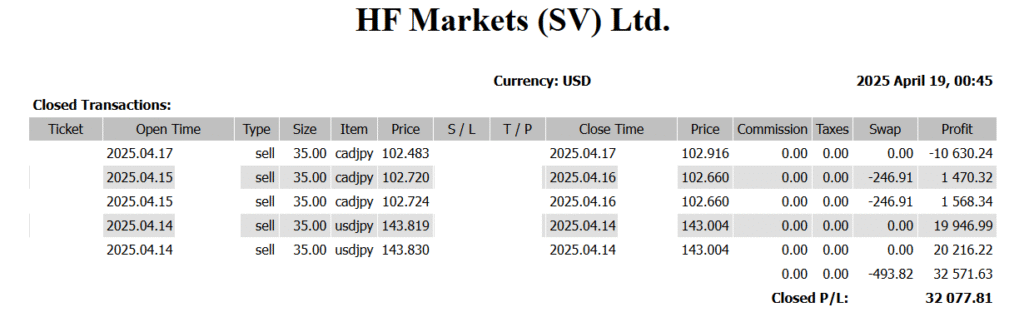

Weekly Total: +32,077 USD — Is This the Start of a Trend Reversal? A Break Below 142.00 in USD/JPY Could Change Everything | Weekly Strategy & Key Events

Weekly Total: +32,077 USD — Is This the Start of a Trend Reversal? A Break Below 142.00 in USD/JPY Could Change Everything | Weekly Strategy & Key Events USD/JPY (US Dollar / Japanese Yen) Outlook: The pair is in a search-for-direction phase driven by trade talks and inflation indicators. 📌 Key Watchpoints: Japan–US Finance Ministers’ […]

– $102,010 – “Entering the Trade Regime Phase” — US-Japan Negotiations Set to Shape FX Trends –

📈 Weekly Forex Outlook (Week of April 14, 2025) – $102,010 – “Entering the Trade Regime Phase” — US-Japan Negotiations Set to Shape FX Trends – 📆 Key Economic Events (JST) Date Indicator / Event Impacted Currency Tue, Apr 15 RBA Meeting Minutes, Canada CPI AUD, CAD Wed, Apr 16 UK CPI, BoC Rate […]

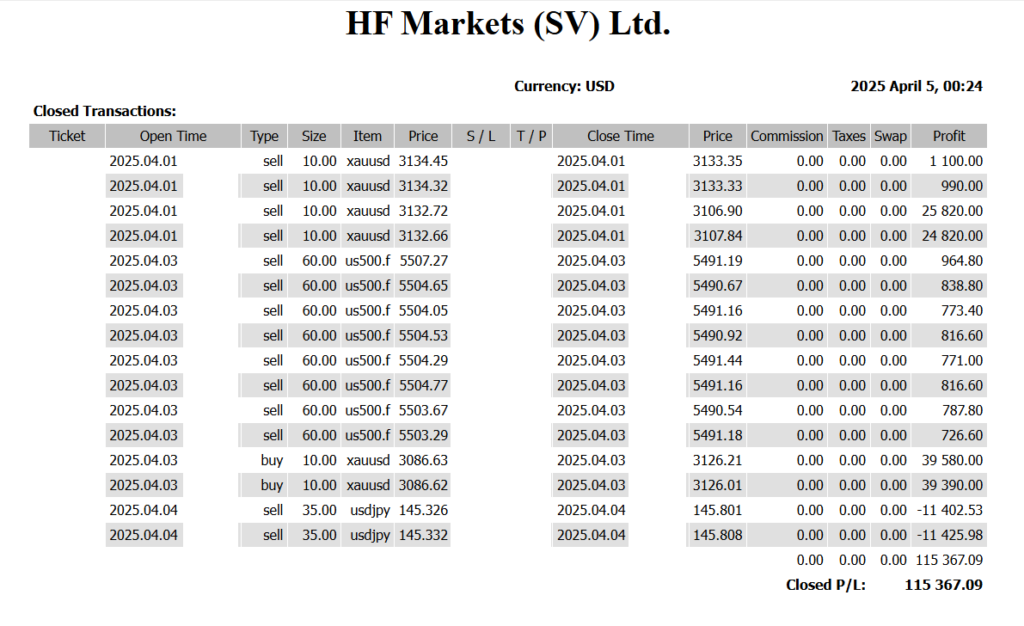

+115,367 USD – Wins Both Short and Long ── Fully Aligned with the Gold Market

+115,367 USD – Wins Both Short and Long ── Fully Aligned with the Gold Market 🏆 Wins Both Short and Long ── Fully Aligned with the Gold Market Weekly Trading Results (March 31 – April 4, 2025) ✅ Weekly Profit: +115,367 USD 📈 Strategy: “Flexible Trading” aligned with U.S. tariff risks and inflation themes led […]

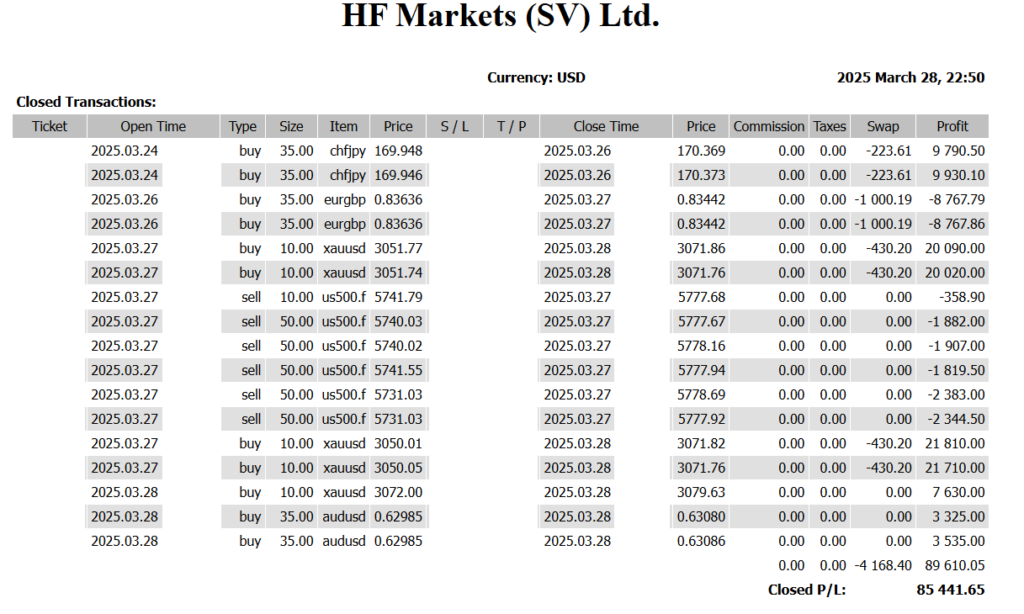

+$85,441 | March 24–28 Weekly Recap “Warning: Explosive Volatility in USD/JPY Driven by Auto Tariff Risk”

+$85,441 | March 24–28 Weekly Recap “Warning: Explosive Volatility in USD/JPY Driven by Auto Tariff Risk” 🔭 [FX Outlook: Week of March 31, 2025] ■ USD/JPY Trend: Rally Pauses – High Volatility Expected Amid Tariffs & Key U.S. Data April 2: Expected imposition of U.S. auto tariffs on China → Retaliation risk may trigger yen […]

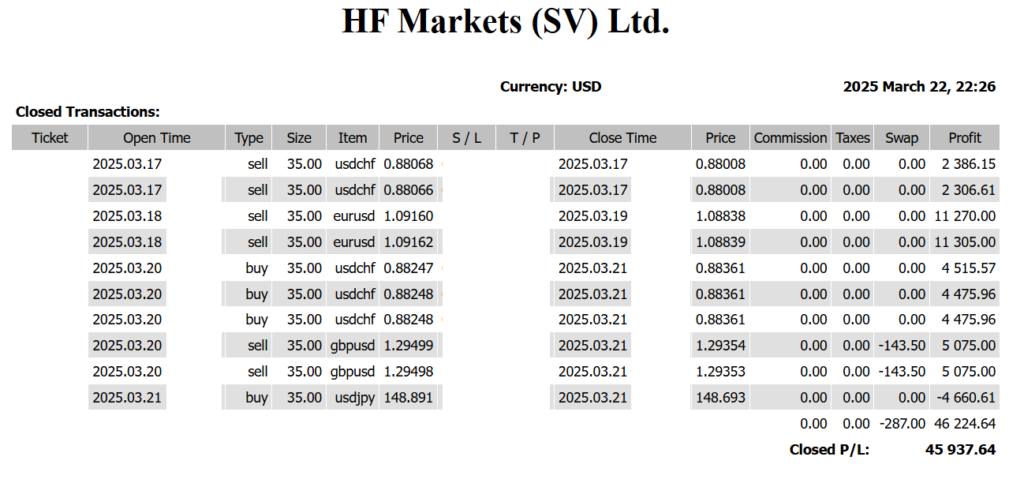

+$45,037 USD|A Week Defined by a Tug-of-War Between Currencies

+$45,037 USD|A Week Defined by a Tug-of-War Between Currencies Trading Results from March 17–21, 2025: +$45,037 USD 📈 Forex Outlook for the Week of March 24 USD/JPY Outlook: Nervous and lacking clear direction. Key Events: U.S. PMI, Durable Goods Orders, PCE. Trade policy developments also in focus. EUR/USD Outlook: Heavy upside pressure; market in a wait-and-see […]

March 2025 -101,747 USD

VIP SIGNAL +78,020 USD – “Awaiting BOJ & FOMC Decisions: What’s Next for USD/JPY?” 📉 USD/JPY Declines as U.S. Economy Weakens! Next Support? -$162,462 Loss 📉 -17,305 USD: USD/JPY Faces Volatility Amid US Economic Data and Policy Shifts