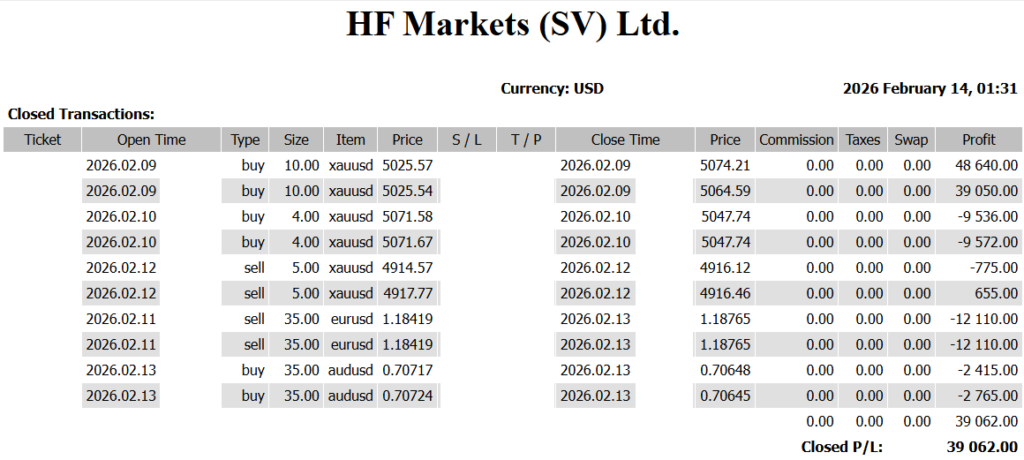

💰 +39,062 USD 🇯🇵 Japan CPI × 🇺🇸 U.S. PCE — Will USD/JPY Return to the 150s?

💰 +39,062 USD 🇯🇵 Japan CPI × 🇺🇸 U.S. PCE — Will USD/JPY Return to the 150s? ✅ Weekly Trade Review (Feb 9 – Feb 13) 📊 Weekly P/L: +39,062 USD 📉 Weekly Summary — GOLD Led, FX Played Support This week had a very clear structure. GOLD delivered both range and directional clarity. The […]

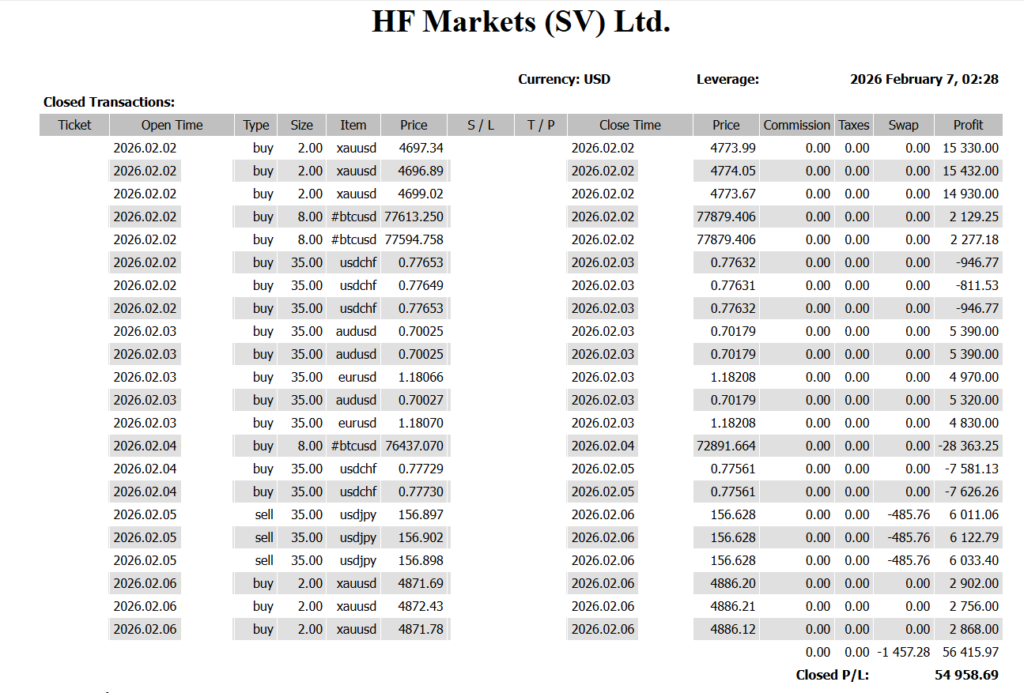

+54,958 USD 🗞️ A Week Where Politics Shook the Market — and Real Demand Determined the Landing

+54,958 USD🗞️ A Week Where Politics Shook the Market — and Real Demand Determined the Landing— Early February, “taking only what the market offered amid rough seas” — ✅ Weekly Trading Summary (Feb 2–Feb 6) 📊 Weekly P/L: +54,958 USD Overall market conditions were volatile, but this was a week where clear separation between markets […]

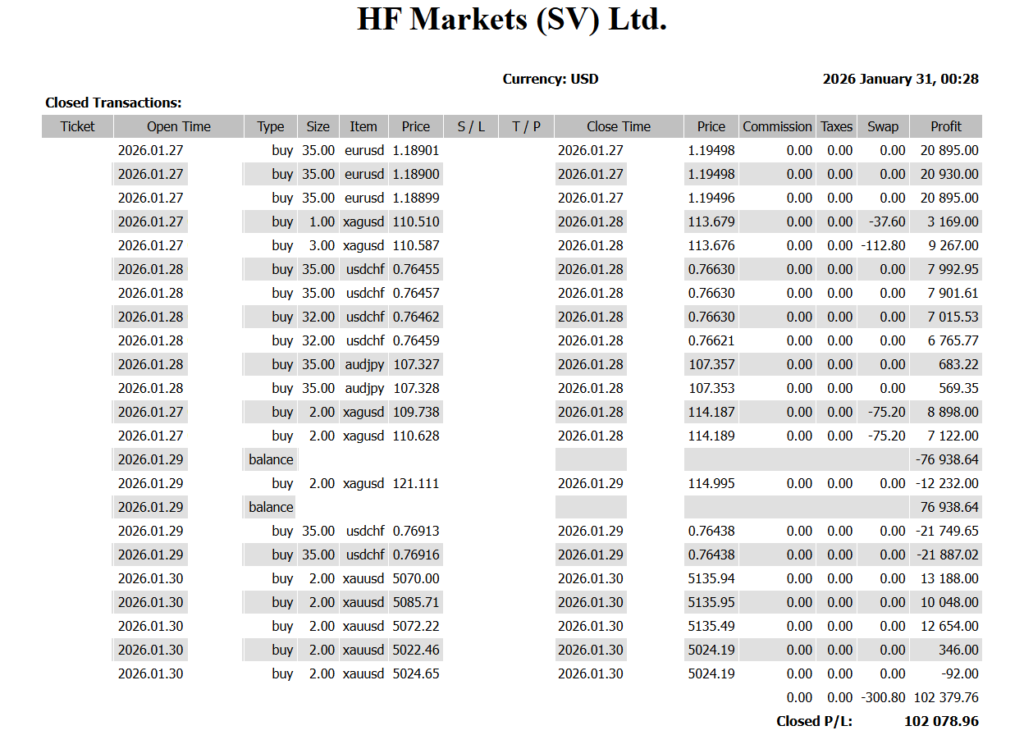

+102,078 USD | From Dollar Distrust to Dollar Reversal — The Moment Market Sentiment Shifted

+102,078 USD | From Dollar Distrust to Dollar Reversal — The Moment Market Sentiment Shifted ✅ Trade Results (Jan 26–Jan 30)📊 Weekly Total: +102,078 USD A turbulent week where we didn’t fight the waves — we rode them. There were losing trades.But losses were cut quickly and remained small.Winning trades were allowed to run. This […]

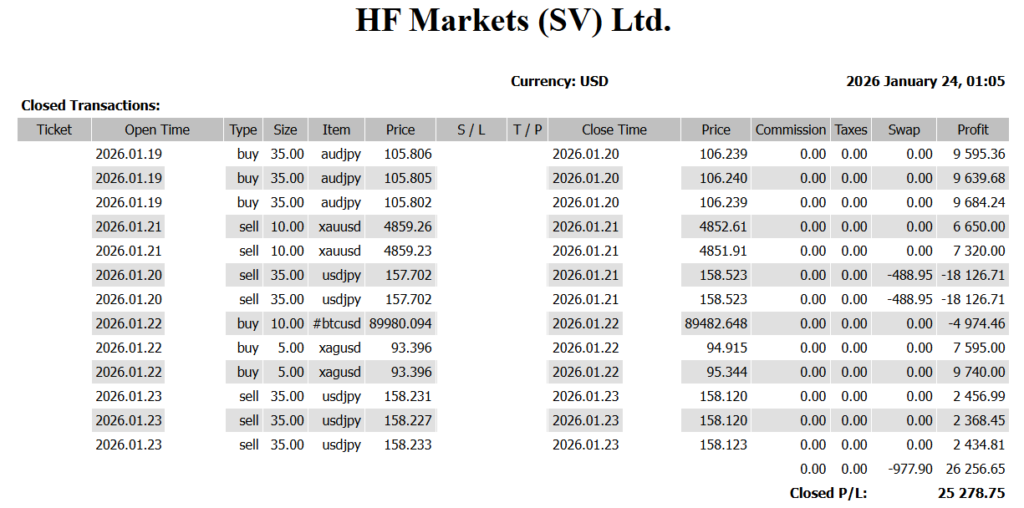

+25,278 USD “A Week Where Yen Selling and Distrust in the Dollar Collide — The Market Shifts from ‘Direction’ to a ‘War of Endurance’”

✅ Trading Results (Jan 19 – Jan 23) 📊 Weekly Total: +25,278 USD 📌 Market Overview This week was not about building a trend. It was a battle of attrition, where risk factors existed simultaneously for each major currency. For the yen: → Japan’s fiscal concerns and election mode made it vulnerable to selling. […]

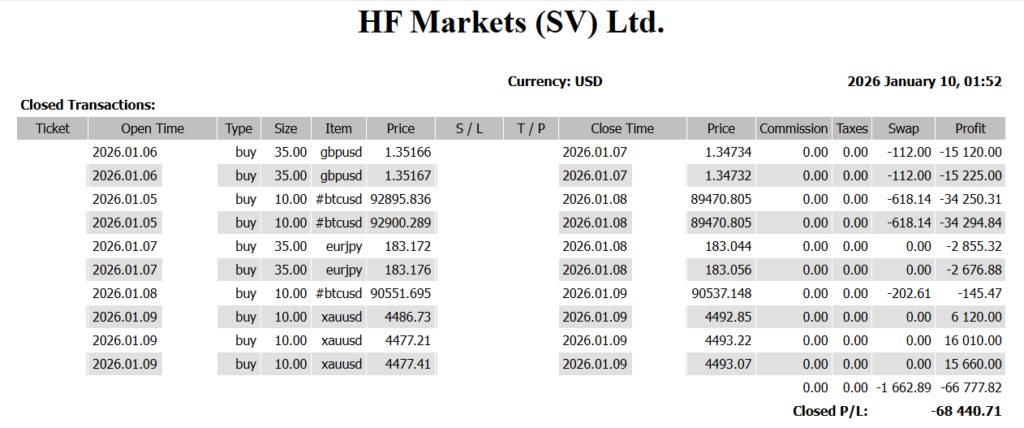

Capital Abandoned Currencies and Fled to Gold — A Week When the Market Clearly Showed Its “Safe Haven”

Capital Abandoned Currencies and Fled to Gold — A Week When the Market Clearly Showed Its “Safe Haven” 📊 Trading Results (Jan 5 – Jan 9) Weekly P/L: -68,440 USD This was not a week to “read currencies.” It was a week to watch where money was escaping to. And the answer was simple. Capital […]

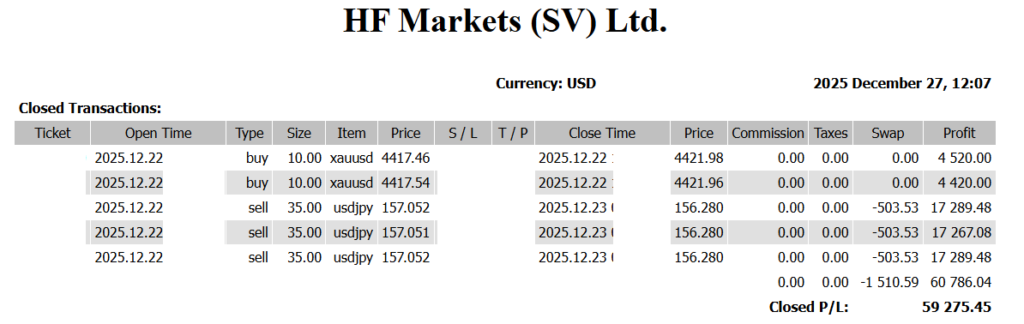

💰 +59,275 USD — Flash-Crash Risk! “How to Win Even in Thin Holiday Markets” — Year-End Strategy

💰 +59,275 USD — Flash-Crash Risk! “How to Win Even in Thin Holiday Markets” — Year-End Strategy Period: Dec 22–26, 2025Weekly P/L: +59,275 USD 🎯 Trade Review A decisive turning point came from Finance Minister Katayama’s strong warning against yen weakness. His remarks — “We will firmly respond to excessive FX moves.”“Intervention remains fully on […]

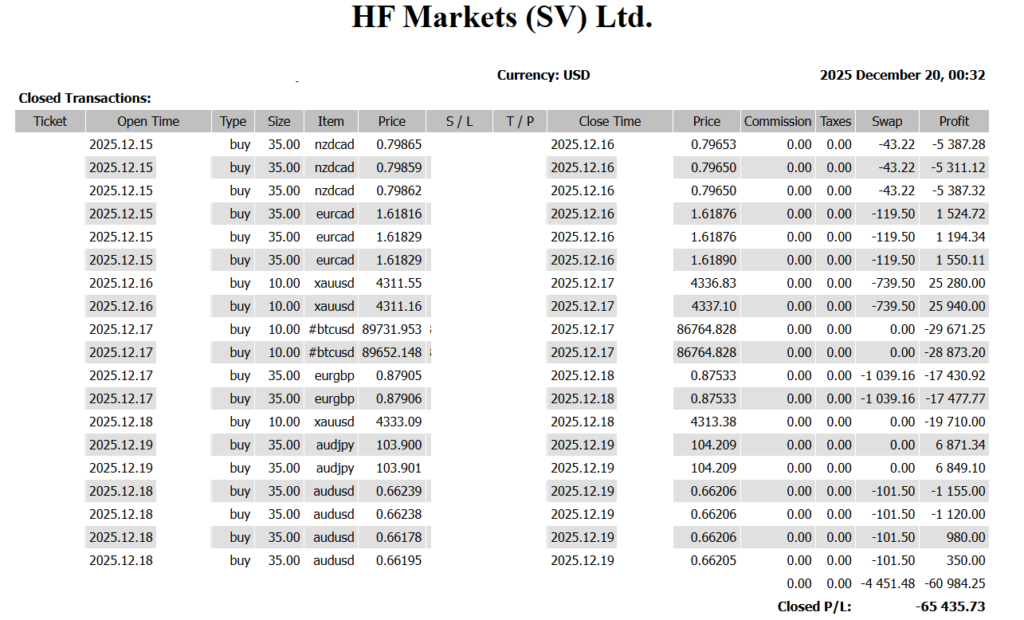

✅ -65,435 USD Even After a Rate Hike, the Yen Weakened — What the BOJ Meeting Revealed About the Yen’s Fragility, and Where the Next Edge Lies —

✅ -65,435 USD Even After a Rate Hike, the Yen Weakened — What the BOJ Meeting Revealed About the Yen’s Fragility, and Where the Next Edge Lies — Trading Results (Dec 15–Dec 19) 📊 Weekly Total: -65,435 USD 📊 FX Market Review Notes Scope: Price action review for the week of Dec 15 / Strategic […]

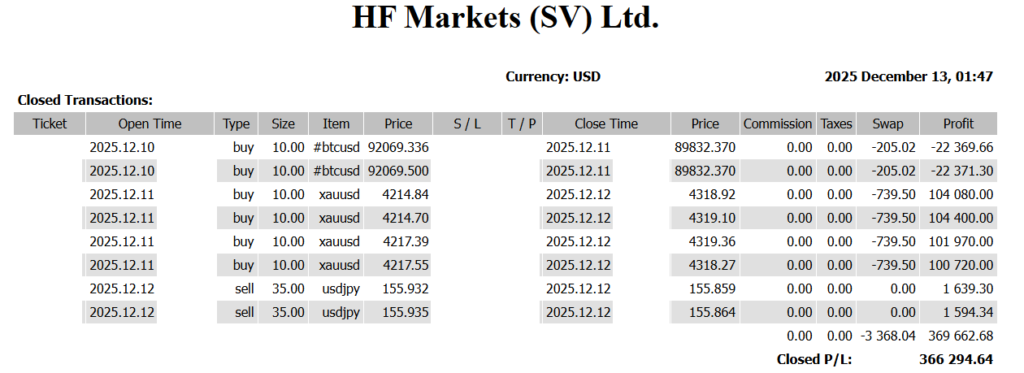

🏆 +366,294 USD | USD Selling × Falling Yields × Gold Surge A Week Where the “Trades You Were Supposed to Take” Lined Up Perfectly After the FOMC

🏆 +366,294 USD | USD Selling × Falling Yields × Gold Surge A Week Where the “Trades You Were Supposed to Take” Lined Up Perfectly After the FOMC 🏆 +366,294 USD USD selling × declining interest rates × rising gold— A week where post-FOMC textbook trades worked flawlessly — ✅ Trading Results (Dec 8–Dec 12) […]

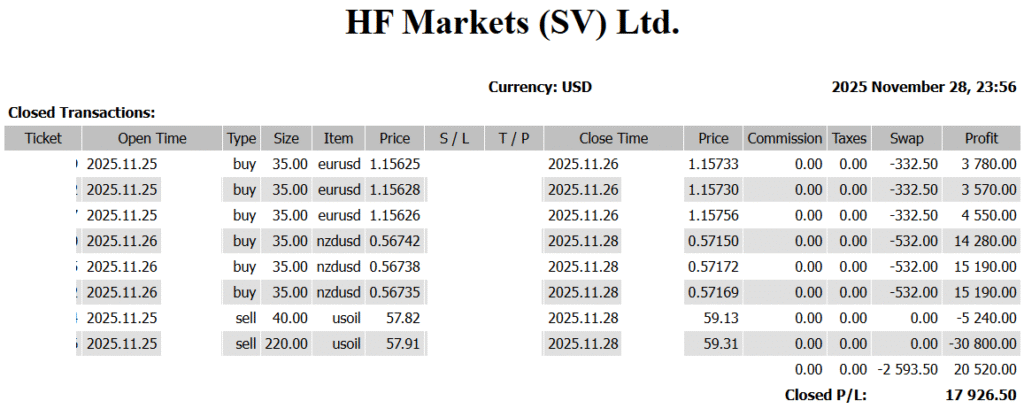

💹 +17,926 USD – Fed Rate-Cut Odds at 90%, BoJ Turns Hawkish, Japan’s Fiscal Expansion

💹 +17,926 USD – Fed Rate-Cut Odds at 90%, BoJ Turns Hawkish, Japan’s Fiscal Expansion A “Multi-Theme Market” Where NZD and Gold Take Center Stage** Weekly Performance (Nov 24–28) 📊 +17,926 USD This week’s FX market was defined by three major forces pulling in different directions—the U.S., Japan, and Oceania—creating one of the most complex […]

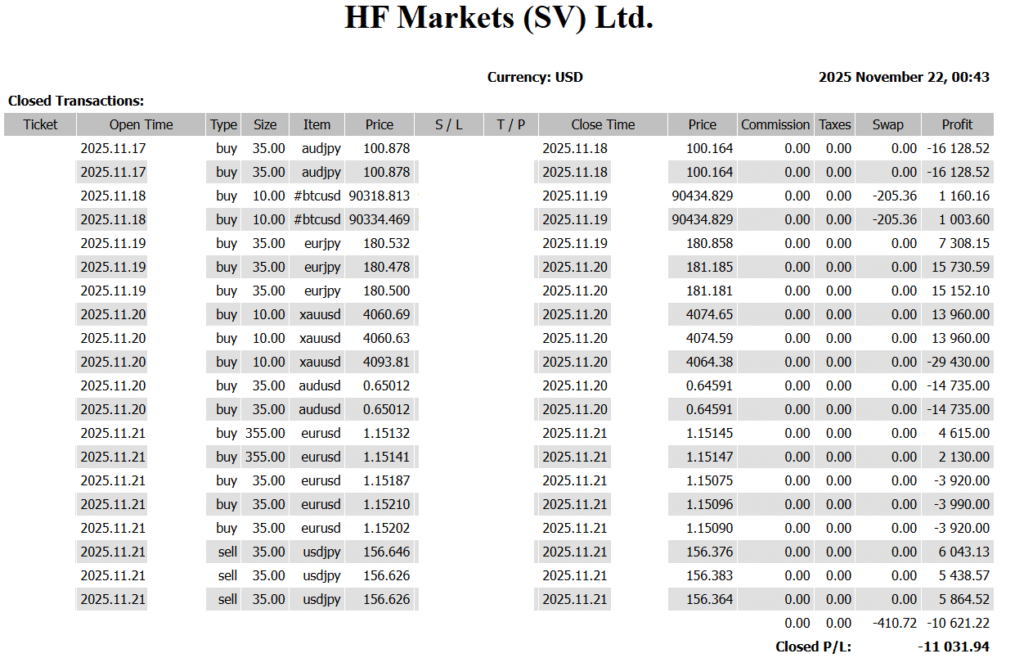

📉 -11,031 USD | A Volatile Week Caught Between Intervention Fears and Renewed Yen Selling

📉 -11,031 USD | A Volatile Week Caught Between Intervention Fears and Renewed Yen Selling 🧾 Weekly Trading Performance (Nov 17–21)Total P/L: -11,031 USDWith no clear directional bias, the week was marked by sharp back-and-forth flows between dollar buying and yen selling, creating a highly volatile and difficult trading environment. 💹 Weekly FX Outlook (Week […]