All Eyes on U.S. Employment Report: How Strong is Job Growth?

Today, the June U.S. employment report will be released. As a major event heading into the weekend, it has garnered significant market attention. The focus will be on the growth in non-farm payrolls, with the market consensus forecast expecting an increase of 190,000. Job growth has consistently exceeded expectations this year, except for April. The […]

Attention on US Employment Statistics, Potential Shift in Dollar Weakness Trend This Week

Today, the March US employment statistics will be released. Alongside the US Consumer Price Index, it’s one of the most crucial fundamental indicators for the dollar market. The consensus market expectation for the highly anticipated non-farm payroll employment figure is a slight decrease from February’s 275,000 increase to 214,000. The unemployment rate is expected to […]

The New Year’s market has kicked off with a rebound in the dollar, particularly noticeable in the USD/JPY pair. From the late 140s earlier this week, it has surged to the mid-145s. It has been steadily climbing by over 1 yen per day.

On the side of the stronger dollar, rising US bond yields have been providing support. The FOMC meeting minutes indicated a view that high-interest rates could persist for a longer period. Despite expectations of rate cuts by the end of the year, the impact was not as significant as the dovish shock during the FOMC […]

Will Dollar Selling Continue After the FOMC? Focus on US Employment Data Today

This week, following announcements like the FOMC and the US quarterly Treasury bond auction plan, US bond yields have decreased. Dollar selling has expanded in the latter part of the week. However, when looking at the overall picture of the US Dollar Index for October, it has not broken free from the range between the […]

Today is the day of the U.S. employment statistics release, and market attention has abruptly shifted to this event.

The market expectations for the September data are as follows: an unemployment rate of 3.7% (previously 3.8%), non-farm payroll employment increased by 170,000 (previously 187,000), average hourly earnings increased by +4.3% YoY (previously +4.3%), and increased by +0.3% MoM (+0.2%) among others. The market is expected to react initially by comparing the results with these […]

Dollar Index Decline Takes a Pause, Neutral Market Ahead of US Employment Data

This week, the Dollar Index had been showing a downward trend following a series of weak US economic indicators. However, yesterday saw a rebound in the Dollar, primarily driven by a drop in the Euro-Dollar pair. Market sentiment suggests a cautious approach as investors await the results of tonight’s US employment data. The August US […]

USD buying has eased as the market awaits US employment data

Today, employment data for both the United States and Canada will be released. The highly anticipated US non-farm payrolls are expected to increase by around 200,000 jobs, which is similar to the previous increase of 209,000 jobs. However, employment figures are often subject to surprises, so it’s best to wait for the actual results before […]

June’s decision: Hold or Rate Hike? Today’s US Employment Statistics will be the litmus test.

Today, the focus will be on the US Employment Statistics. It is a crucial indicator that will help determine whether the June FOMC will hold interest rates or opt for a rate hike. Market expectations suggest a slight slowdown from the previous increase of 253,000 non-farm payrolls, with an estimated increase of around 200,000. […]

Risk aversion mood may continue into the weekend, US employment statistics to be released today

This week, policy interest rate announcements have followed one after another, with the US FOMC and the ECB Governing Council taking the stage. The FOMC raised interest rates by 25 basis points, suggesting a halt in future rate hikes, but stopped short of explicitly stating so. Hopes for an interest rate cut in the […]

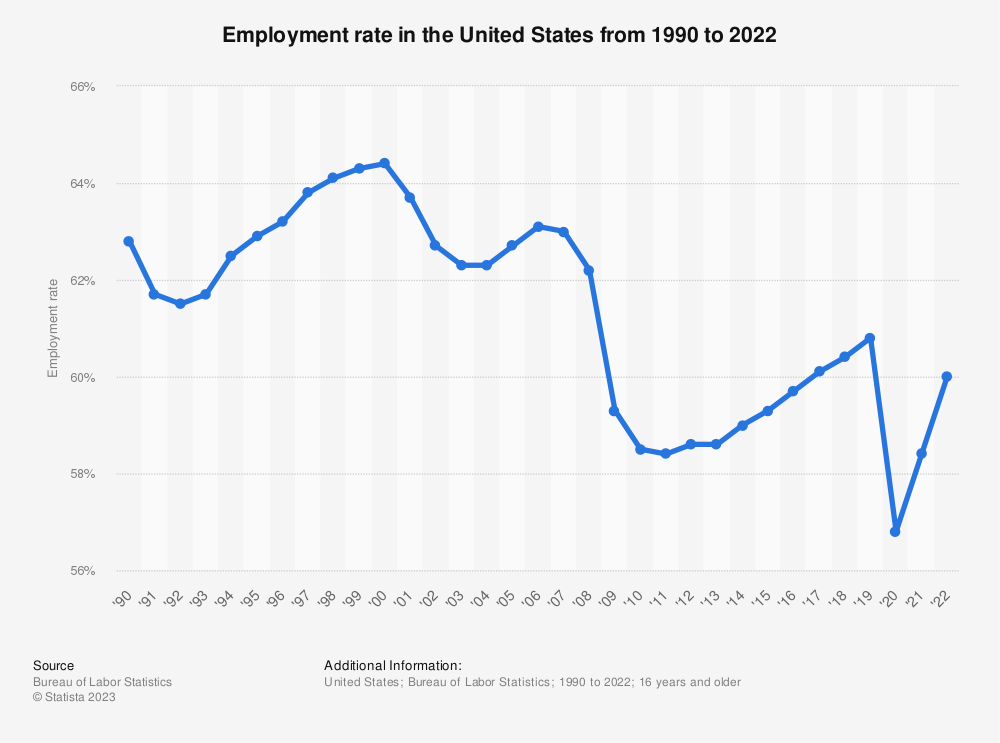

Dollar rises sharply, US employment statistics are strong across the board, dollar yen to 130 yen level

The dollar has surged in response to the results of the January US employment statistics. The number of employees increased to 517,000, more than double the market forecast of 190,000. The previous figure was also revised upward from 223,000 to 260,000. The unemployment rate fell unexpectedly to 3.4%, the lowest level on record. The labor […]