14th in November 2024,Today’s Options

Today’s Options EUR/USD (in EUR) 1.0550: €1.1 billion 1.0600: €1.4 billion 1.0650: €2.5 billion 1.0750: €1.7 billion 1.0850: €1.3 billion GBP/USD (in GBP) 1.2665: £438 million 1.3080: £576 million USD/JPY (in USD) 154.50: $884 million 155.00: $593 million 156.50: $596 million USD/CHF (in USD) 0.8660: $600 million AUD/USD (in AUD) 0.6500: AUD 479 million 0.6600: […]

Dollar Strength Continues, Trump Trade Accelerates with Triple Red Effect

Dollar Strength Continues, Trump Trade Accelerates with Triple Red Effect The U.S. dollar continues to surge, with the dollar index reaching a new high for the year. Yesterday, the Republican Party secured a majority in the U.S. House of Representatives, completing the “Triple Red” scenario where all three branches of government are controlled by the […]

Entered a buy position on NZD/USD at 0.5943. buy position on NZD/CHF at 0.5237(This is Only half of our entries and 5mins late)

Entered a buy position on NZD/USD at 0.5943 with a stop at 0.5916. Entered a buy position on NZD/CHF at 0.5237 with a stop at 0.5213. This post is Half of all our entry and 5 mins late. If you want the full signal (entry and close info with Real time), please check […]

12th in November 2024, Today’s Options

Today’s Options EUR/USD (in EUR) 1.0600: €1.8 billion 1.0625: €1.1 billion 1.0725: €2.3 billion 1.0740: €935 million 1.0750: €2.3 billion 1.0800: €1.1 billion 1.0825: €762 million GBP/USD (in GBP) 1.3000: £412 million USD/JPY (in USD) 152.00: $536 million 155.00: $1.1 billion USD/CHF (in USD) 0.8700: $436 million 0.8750: $654 million 0.8800: $843 million AUD/USD (in […]

Entered a sell position for GOLD (XAU/USD) at 2749.88. (This is Only half of our entries and 5mins late)

Entered a sell position for GOLD (XAU/USD) at 2749.88. Stop loss is set at 2762.00. The technical analysis indicates that it is overbought, so I’m aiming for short-term selling. This post is Half of all our entry and 5 mins late. If you want the full signal (entry and close info with Real time), […]

Chinese Economic Stimulus Measures Bring Relief, Quietly Approaching the Weekend

Chinese Economic Stimulus Measures Bring Relief, Quietly Approaching the Weekend This week, the U.S. dollar has been strengthening, especially after U.S. retail sales surpassed expectations, reinforcing the impression of the U.S. economy’s strength in the market. As a result, expectations for significant interest rate cuts by U.S. financial authorities have diminished. The market is starting […]

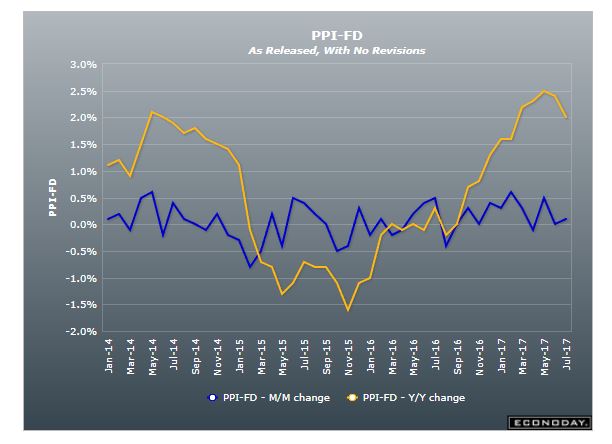

Continued Dollar Buying Trend: Focus on US Producer Price Index (PPI)

Continued Dollar Buying Trend: Focus on US Producer Price Index (PPI) This week, the trend of dollar buying has strengthened. The cautious stance on rate cuts from the recent US FOMC meeting, along with stronger-than-expected US employment data, has diminished expectations for significant rate cuts in November. Yesterday’s US CPI also slightly exceeded market expectations, […]

+43,828 EUR in a week with FX Auto Trade, GoldenBoy EA 5th in October 2024 #eaforex #trading

U.S. FOMC Decides on 50bp Rate Cut! Uncertainty Cleared, But What’s Next for the Dollar?

U.S. FOMC Decides on 50bp Rate Cut! Uncertainty Cleared, But What’s Next for the Dollar? The U.S. FOMC announced a significant 50 basis point rate cut, as expected. Chair Jerome Powell indicated that the focus of future policies will shift from inflation control to employment conditions, with the market anticipating an additional 75 basis points […]

Entered Sell Position: USD/CHF at 0.8663

Entered Sell Position: USD/CHF at 0.8663, Stop at 0.8707 (This is Only half of our entries and 5mins late) This post is Half of all our entry and 5 mins late. If you want the full signal (entry and close info with Real time), please check Forex Top Team VIP signal ↓ VIP SIGNAL