🗞️ Amid Crosscurrents, Market Focus Shifts to Japan’s Lower House Election and U.S. Data

🗞️ Amid Crosscurrents, Market Focus Shifts to Japan’s Lower House Election and U.S. Data This week’s market remains nervous and unstable. The sharp plunge and rebound in gold and silver from late last week into the start of this week, along with wider swings in crude oil, clearly signaled aggressive speculative flows. While price action […]

This Week Again: A Political Market

This Week Again: A Political Market Nervous trading driven by renewed Trump tariffs and Japan’s general election outlook This week’s market has once again started with politics as the main driver. There are two major factors: President Trump Prime Minister Takaichi ◆ Japan Side: Prime Minister Takaichi and the Dissolution Election Regarding Prime Minister Takaichi, […]

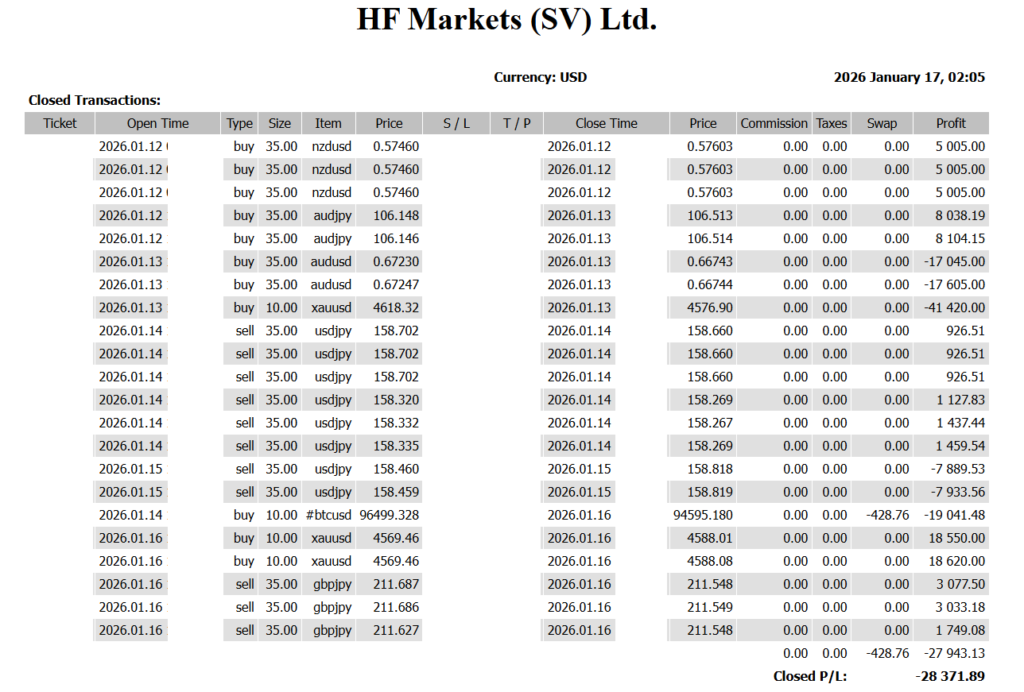

-28,371 USD The Yen Under Dual Control of “Politics and the U.S.” – Late January Marks the Entrance to a Trend Market

The Yen Under Dual Control of “Politics and the U.S.” – Late January Marks the Entrance to a Trend Market ✅ Trade Summary (Jan 12 – Jan 16) 📊 Weekly P/L: -28,371 USD 📉 Market Overview This week was a market where “the direction was right, but the entry points were extremely difficult.”The view toward […]

Long position entered for AUDJPY at 103.90.

Long position entered for AUDJPY at 103.90. Stop Loss: 103.43.

Long position entered for BTCUSD at 92114.98.

Long position entered for BTCUSD at 92114.98. Stop Loss: 89850.00

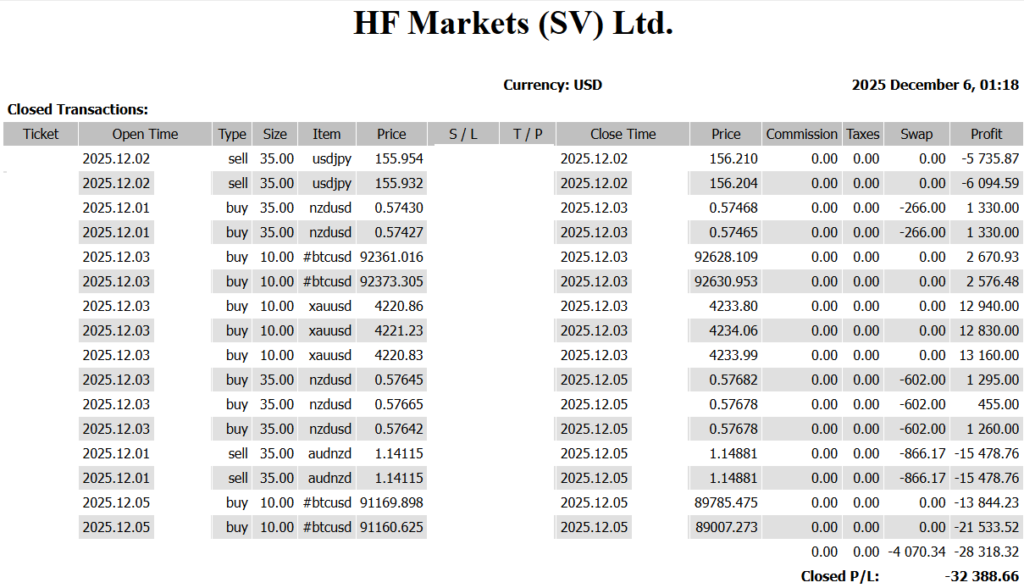

📉 -32,388 USD|BTC Crash, NZD Weakness, Dollar Rebound — A Difficult, Mismatched Week

📉 -32,388 USD|BTC Crash, NZD Weakness, Dollar Rebound — A Difficult, Mismatched Week ✔ Trade Results (Dec 1–5) Total: -32,388 USD This week brought a rare combination of three factors that simply didn’t align: NZD long expectations failed completely BTC crashed → triggering sharp yen buying USD didn’t weaken — instead rebounding mid-week A […]

🟣 Market Shifts Into “Relief Rebound” Mode — USD/JPY Locked in a Mid-154 Tug of War

🟣 Market Shifts Into “Relief Rebound” Mode — USD/JPY Locked in a Mid-154 Tug of War Market Flow: Risk Concerns Temporarily Recede As U.S. lawmakers move closer to an agreement to avert a government shutdown,global markets have entered a “worst-case scenario avoided” relief phase. Equities saw buying return—particularly in tech—and risk assets broadly recovered. In […]

✅ USD/JPY Pulls Back — Signs of a Short-Term Correction as “Takaichi Trade” Momentum Fades

✅ USD/JPY Pulls Back — Signs of a Short-Term Correction as “Takaichi Trade” Momentum Fades 💴 USD/JPY: Short-Term Correction Mode Today’s Movement:USD/JPY fell into the upper ¥151 range, pressured by a wave of yen buying following remarks from Japan’s Minister of Economy, Shinai, who said he is “closely monitoring the impact of yen weakness” and […]

✅ Will the Dollar-Buying and Yen-Selling Trend Continue? U.S. Officials’ Remarks Take Center Stage Tonight

✅ Will the Dollar-Buying and Yen-Selling Trend Continue? U.S. Officials’ Remarks Take Center Stage Tonight 💵 Dollar Strength and Yen Weakness Accelerate — USD/JPY Nears 153 The FX market’s dollar-buying and yen-selling momentum shows no sign of stopping, with USD/JPY now approaching the 153 level. In just a few days, the pair has surged from […]

📉 US ADP Employment Report Turns Negative → Dollar Selling

📉 US ADP Employment Report Turns Negative → Dollar Selling 🏛 Key Context: With parts of the US government shut down, this week’s official Nonfarm Payrolls (NFP) release is likely to be postponed.👉 That makes the ADP employment report the market’s only timely gauge of labor market conditions. 📊 ADP Results: –32,000 jobs (vs. forecast […]