Monitoring for Sustained Dollar Strength, Focus on Today’s PMI Data

Since the latter half of May, the trend has been towards a stronger dollar. While the broader trend of dollar weakness from April remains, the dollar index has reached short-term resistance at the 10-day moving average, indicating a slowdown in the pace of dollar depreciation. Yesterday’s FOMC minutes came across as more hawkish than expected, […]

Yesterday, the Tokyo market was closed for Labor Thanksgiving Day, and the New York market was closed for Thanksgiving, leaving the dollar market without guidance from US Treasury yields.

Yesterday, the Tokyo market was closed for Labor Thanksgiving Day, and the New York market was closed for Thanksgiving, leaving the dollar market without guidance from US Treasury yields. It appeared that the recent market movements were mostly due to position adjustments. Today, US stock and bond markets resume trading, albeit with shortened sessions. With […]

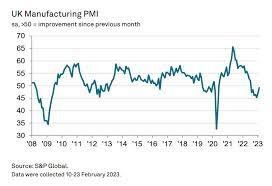

Pound Plummets as UK PMI Flash Readings Deteriorate in Both Manufacturing and Services Sectors

The British pound has experienced a sharp drop as a reaction to the deteriorating UK PMI flash readings for August, which showed a decline in both the manufacturing and services sectors. The GBP/USD pair fell below the 1.27 level to a new low around 1.2675, while GBP/JPY plummeted from around 185 to approximately 184.24. Even […]

The US Dollar Index has experienced a significant increase and has surpassed its 10-day moving average.

The US Dollar Index has seen a substantial rise. In the Tokyo market, it started with a steady upward movement near the previous day’s closing level (102.386). During the London session, it climbed towards 102.70 and reached the 10-day moving average (102.692). As the London session progressed, it gained momentum and reached a high of […]

The previous day’s weak US economic indicators did not change the US’ aggressive attitude toward interest rate hikes, and today US orders for durable goods

The US PMI preliminary figures for August announced the day before showed a particularly sharp decline in the non-manufacturing sector. At 44.1, it was the second lowest since the pandemic hit in the first half of 2020. In addition, the number of newly built homes sold in the US in July decreased by 12.6% from […]

Dollar selling reaction to weakness in US service industry PMI

the US PMI for the August survey was released, and the service industry PMI dropped to 44.1 more than expected, prompting stronger dollar selling. The dollar/yen fell to the 136 yen level and the euro/dollar was bought back to the high $0.99 level. Preliminary US PMI (August) 22:45manufacturing industryResult 51.3Forecast 52.0 Last time 52.2 Non-manufacturingResult […]

The dollar will continue to depreciate, or the US index will not be strong.

Recently, the dollar index has been on a downward trend. Following the sharp rise in the US consumer price index, the market has begun to factor in a 1.00% rate hike for the US FOMC. At this time, the dollar’s appreciation peaked out. There was also a symbolic phenomenon such as the Eurodollar parity cracking. […]

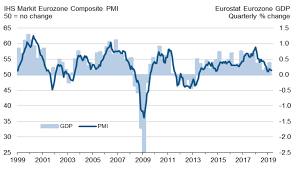

Last week, a series of weak PMI announcements

In the latter half of last week, weak PMIs from Europe and the United States were announced one after another. The market was nervous each time, with the worsening business sentiment in Europe such as Germany selling euros and buying dollars, and the sharp deterioration of US non-manufacturing PMI selling dollars and buying euros. The […]

France, Germany, UK, Europe, PMI are all good

Eur is bought. It responds to an unexpected improvement in the French PMI preliminary figures for June. The manufacturing industry was 52.1 (preliminary forecast 46.0), and the non-manufacturing industry was 50.3 (preliminary forecast 45.2), both higher than expected. The composite index was also 51.3 (preliminary forecast 46.8). Following the French announcement, Germany’s PMI preliminary figures […]

May US pre-manufacturing PMI improved to 39.8 from expected 38

With this, it is assumed that tonight will be more inclined to the trend of higher oil prices, higher US stock prices, and risk-on. Currently, the power balance in 15 minutes is AUD = EUR > NZD > CAD > USD = GBP > CHF > JPY