🧭 Market Notes for Today: Yen weakness continues, but caution is needed near the highs

🧭 Market Notes for Today: Yen weakness continues, but caution is needed near the highs The week begins with a mild risk-on tone across markets.USD/JPY is gradually climbing from the high-153s toward the 154 handle, and cross-yen pairs are also trading firm. Supportive factors for the market: Progress in U.S. budget negotiations → Government […]

✅ This Week in the Dollar Market: “Lack of Clear Direction”

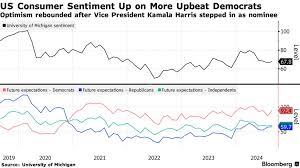

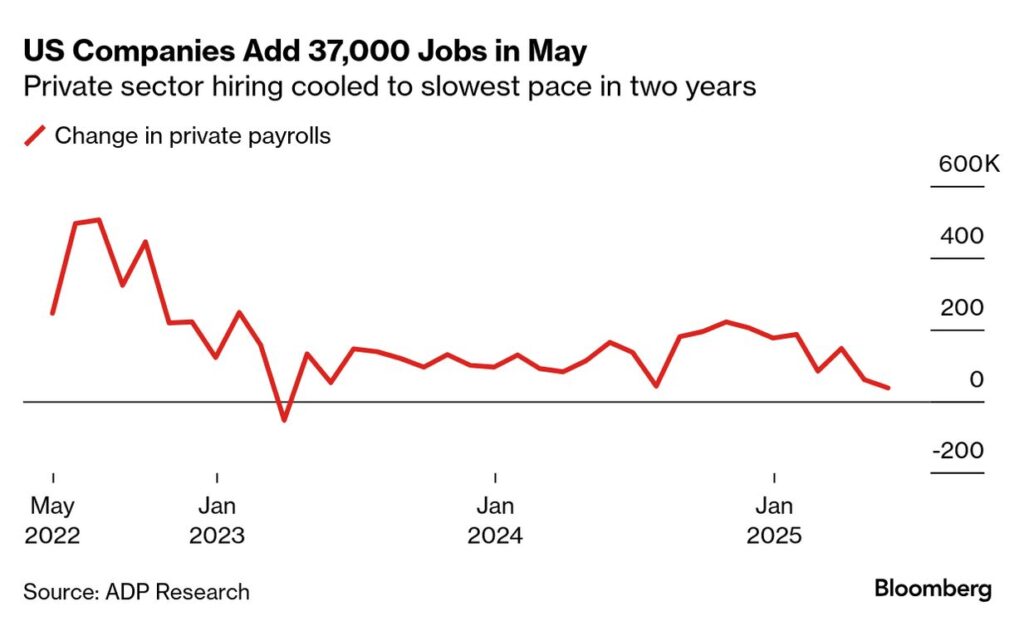

✅ This Week in the Dollar Market: “Lack of Clear Direction” Unstable Price Action Driven by Alternative Employment Indicators With the U.S. government shutdown continuing, key macro data such as Nonfarm Payrolls and PCE cannot be released.As a result, the market is reacting more to private-sector employment and sentiment indicators, creating choppy, directionless trading. Indicator […]

✅ Today’s Main Event: Bank of England (BOE) Policy Meeting — The key focus is “How many members shift to the rate-cut camp”

✅ Today’s Main Event: Bank of England (BOE) Policy Meeting— The key focus is “How many members shift to the rate-cut camp” 🇬🇧 BOE: Rate Hold Expected — but the vote split is what matters The policy rate itself is widely expected to remain unchanged.However, recent UK data has softened, increasing the possibility that more […]

✅ Risk Sentiment Softens in Equities, FX Awaits Data — ADP in Focus Today

✅ Risk Sentiment Softens in Equities, FX Awaits Data — ADP in Focus Today 📉 Equities: AI Profit-Taking & Monthly Rebalancing Weigh on Sentiment Equity markets remain generally unstable in early November.High-flying AI-related names are seeing increased profit-taking as investors grow cautious at elevated valuations. Following the recent FOMC meeting, markets shifted toward the view […]

✅ Yen Pauses as Tokyo Reopens — USD/JPY Heavy Near ¥154, Reversal Selling Dominates

✅ Yen Pauses as Tokyo Reopens — USD/JPY Heavy Near ¥154, Reversal Selling Dominates 💹 USD/JPY: Verbal Intervention Triggers Yen Rebound; Dips to ¥153 Handle TemporarilyFollowing the three-day weekend, Tokyo markets reopened to see USD/JPY retreat from ¥154.48 to the low ¥153s.Despite the ongoing yen weakness trend, the pair met heavy resistance above ¥154,prompting profit-taking […]

✅ Quiet Start to the Week — Yen Selling Persists as USD/JPY Holds Around ¥154

✅ Quiet Start to the Week — Yen Selling Persists as USD/JPY Holds Around ¥154 💹 USD/JPY: Calm Opening, Yen Carry Still in PlayTokyo markets opened quietly on Monday due to the Culture Day holiday, resulting in thin liquidity.Following last week’s strong dollar-buying and yen-selling momentum,USD/JPY remains firm in the upper ¥154 range (154.10–154.30),hovering near […]

✅ Market Pauses After Major Events — USD/JPY Holds in the ¥154 Range Amid Month-End Adjustments

✅ Market Pauses After Major Events — USD/JPY Holds in the ¥154 Range Amid Month-End Adjustments 💹 USD/JPY: Taking a Breather After Heavy Event Week, Short-Term Overheating SeenThis week featured an intense lineup of major central bank meetings — the FOMC, BOJ, ECB, and Bank of Canada — all delivering results largely in line with […]

✅ USD/JPY Surges to Upper ¥153s After U.S.-Japan Meetings — “High-Pressure Economy” under PM Takaichi and BOJ’s Caution Collide

✅ USD/JPY Surges to Upper ¥153s After U.S.-Japan Meetings — “High-Pressure Economy” under PM Takaichi and BOJ’s Caution Collide 💹 USD/JPY: Yen Selling Accelerates Post-Events, Hitting Highest Level Since FebruaryUSD/JPY briefly touched ¥153.89, marking its highest level since February.With the FOMC and BOJ meetings now behind, yen selling and dollar buying momentum have re-emerged. Federal […]

✅ Market Cautious Ahead of FOMC, BOJ, and ECB—USD/JPY Fluctuates Around the Upper 151 Range

✅ Market Cautious Ahead of FOMC, BOJ, and ECB—USD/JPY Fluctuates Around the Upper 151 Range 💹 FX Market: Calm Before the Triple Central Bank WeekIn tonight’s New York session, the U.S. Federal Reserve (FOMC) will announce its policy rate.Tomorrow, both the Bank of Japan (BOJ) and the European Central Bank (ECB) are also set to […]

✅ Takaichi Trade Reignited: Nikkei Breaks 50,000 for the First Time in History, While Yen Weakness Persists Amid Intervention Fears

✅ Takaichi Trade Reignited: Nikkei Breaks 50,000 for the First Time in History, While Yen Weakness Persists Amid Intervention Fears 💹 Stock Market: Policy Optimism Fuels Record-Breaking Rally At the start of the week, the Nikkei 225 surged past the historic 50,000 mark for the first time ever.Investor sentiment was lifted by strong expectations for […]