💹 European PMIs: UK and Germany Lose Momentum, France Stands Alone — USD/JPY Stalls in a Pre-Weekend, Exhausted Market

💹 European PMIs: UK and Germany Lose Momentum, France Stands Alone — USD/JPY Stalls in a Pre-Weekend, Exhausted Market — Position-trimming ahead of the long weekend weighs on USD/JPY, but the upside “spark” is not gone ■ USD/JPY: Pre-holiday unwinding dominates, but upside potential still remains Tokyo trading ahead of the long weekend saw participants […]

📝 December FOMC Rate-Cut Expectations: “Dipped, Then Rebounded Slightly”

📝 December FOMC Rate-Cut Expectations: “Dipped, Then Rebounded Slightly” Because the September U.S. jobs report was delayed due to the government shutdown, its release showed a mixed picture: Nonfarm payrolls: +119k (vs. +51k expected) → strong Unemployment rate: 4.4% (vs. 4.3% expected) → unexpected rise Previous two months: revised down a total of -33k The […]

💹 Dollar Strength / Yen Weakness Remains Intact — Market Focus Turns to U.S. Nonfarm Payrolls

💹 Dollar Strength / Yen Weakness Remains Intact — Market Focus Turns to U.S. Nonfarm Payrolls ■ USD/JPY: Every Dip Bought, Pushing Toward the Upper 157s USD/JPY carried its overseas momentum into domestic trading,with persistent buying lifting the pair to 157.69. Intervention concerns remain in the background, but their effectiveness is fading: Japanese officials’ comments […]

Yen Selling Accelerates After the Meeting Between the Finance Minister and BOJ Governor

Yen Selling Accelerates After the Meeting Between the Finance Minister and BOJ Governor Why the Yen Continued to Weaken — Summary of Key Drivers The latest meeting between the Finance Minister and the BOJ Governor offered none of the yen-supportive signals the market was hoping for.Instead, it reaffirmed the existing policy framework that has allowed […]

💹 A Broad Correction Sweeps Through Risk Assets — “Bad Yen Weakness” Quietly Deepens in FX Markets

💹 A Broad Correction Sweeps Through Risk Assets — “Bad Yen Weakness” Quietly Deepens in FX Markets— USD/JPY Holds Firm in the Mid-155s as Underlying Yen-Selling Pressure Persists ■ Market Overview: Investor Risk Appetite Retreats Further This week’s market has clearly shifted into a corrective phase for risk assets.The sharp selloff in AI-related stocks that […]

💵 Dollar Strength Persists at the Weekly Open — Global Risk-Off Sentiment Deepens While USD/JPY Holds Firm

💵 Dollar Strength Persists at the Weekly Open — Global Risk-Off Sentiment Deepens While USD/JPY Holds Firm ✅ Market Overview The Asian session opened the week by fully carrying over the strong risk-off tone seen late last week.Major equity indices in Tokyo, Shanghai, and Hong Kong all traded lower, reflecting a clear return of investor […]

⚠️ U.S. Rate Outlook Clouds Over — Risk-Off Hits Equities, USD/JPY Stalls at the 154 Handle

⚠️ U.S. Rate Outlook Clouds Over — Risk-Off Hits Equities, USD/JPY Stalls at the 154 Handle 📰 Market Overview U.S. equities reversed sharply lower after the previous day’s rebound, with all three major indices posting steep declines. The market tone is shifting from “rate-cut optimism” to “renewed disappointment,” prompting investors to turn cautious. Key […]

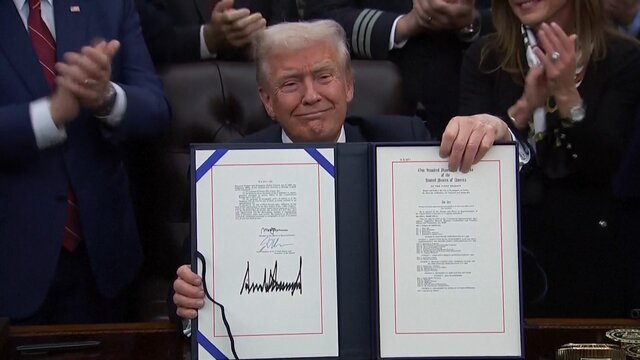

📰 U.S. Government Shutdown Averted — Market Focus Shifts to “Economic Data Resumption” USD/JPY Pauses After Initial Surge

📰 U.S. Government Shutdown Averted — Market Focus Shifts to “Economic Data Resumption”USD/JPY Pauses After Initial Surge ✅ Market Overview The U.S. Congress has passed a temporary stopgap funding bill, officially ending the government shutdown following President Trump’s signature.With this political risk now removed, markets have regained stability and risk-off sentiment has eased for the […]

📈 Focus Shifts to Post-Stopgap Budget Developments — Market Sentiment Under Watch

📈 Focus Shifts to Post-Stopgap Budget Developments — Market Sentiment Under Watch ✅ Market Overview The U.S. House of Representatives is expected to vote on the stopgap budget bill tomorrow (6:00 a.m. Japan time on the 13th).With Republicans holding an advantage and President Trump signaling willingness to sign,the government shutdown is now seen as nearly […]

🧭 Market Notes for Today: Yen weakness continues, but caution is needed near the highs

🧭 Market Notes for Today: Yen weakness continues, but caution is needed near the highs The week begins with a mild risk-on tone across markets.USD/JPY is gradually climbing from the high-153s toward the 154 handle, and cross-yen pairs are also trading firm. Supportive factors for the market: Progress in U.S. budget negotiations → Government […]