U.S. Employment Data in Focus Again Today

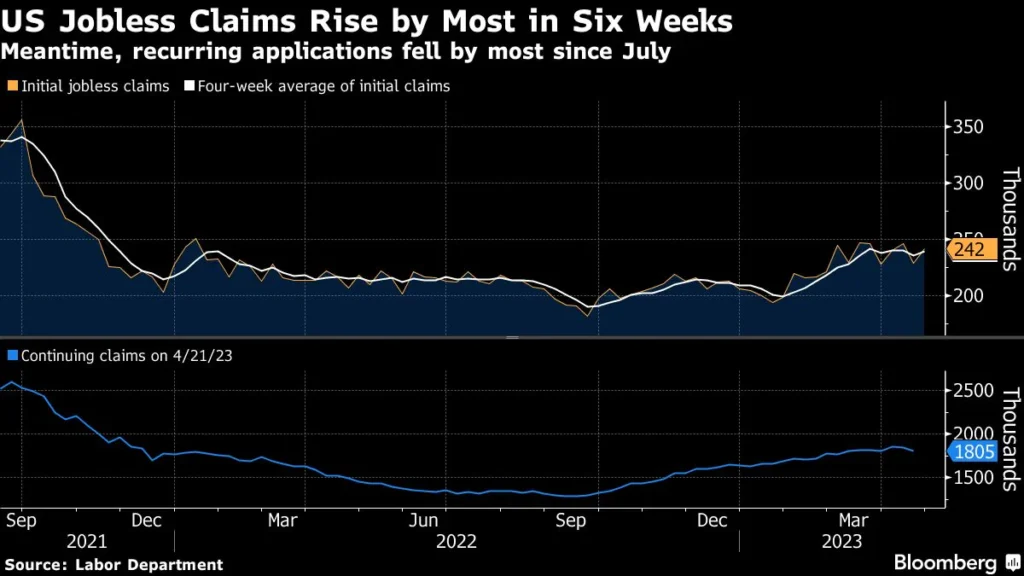

U.S. Employment Data in Focus Again Today — Jobless Claims and Unit Labor Costs Ahead, With Eyes on Tomorrow’s U.S. Jobs Report This week, the market’s initial reaction to the Venezuela-related crisis has largely run its course.Crude oil and precious metals have shifted into a corrective phase, and the post-crisis surge in: Safe-haven buying Risk-off […]

Mixed Drivers as Geopolitical Risks Intersect — Focus Shifts to U.S. Indicators, Led by the ADP Employment Report

Mixed Drivers as Geopolitical Risks Intersect— Focus Shifts to U.S. Indicators, Led by the ADP Employment Report At the start of the new year, financial markets have opened on a firm note, particularly equities.Despite rising geopolitical risks surrounding Venezuela, there is little sense of pessimism in stock markets. Rising resource and precious-metal prices Persistent strength […]

🌐 Dollar Buying Wave Pauses — Euro Rebounds as Focus Shifts to U.S. Jobs Data

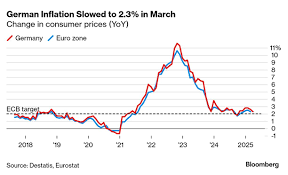

🌐 Dollar Buying Wave Pauses — Euro Rebounds as Focus Shifts to U.S. Jobs Data — Slowing German inflation quietly weighs on the euro (London) The dollar rally that gathered momentum into the New Year is finally cooling.On the back of concerns over Venezuela and potential spillovers into Latin America, the market had been in […]

🟦 New Year Opens With Dollar Strength — USD/JPY Hovering Near 157

🟦 New Year Opens With Dollar Strength — USD/JPY Hovering Near 157 The first trading session of 2026 has begun quietly — but with a clear bias toward dollar buying.The firm tone seen into year-end has simply carried over into the new year. USD/JPY: pushing into the 157s, testing higher levels EUR/USD: softening into the […]

The Market’s Real Attitude in a Flat Tape — Waiting for the Next Trigger

The Market’s Real Attitude in a Flat Tape — Waiting for the Next Trigger ✅ Trading Results (Dec 29 – Jan 2) 📊 Weekly Total: 0 JPY (0 USD) Main Account: 0 USD Small Account: 0 USD Summary:With year-end liquidity extremely thin, the risk-reward simply didn’t justify entries — we finished the period flat (no […]

🎍 New Year Trading Begins — Still Thin Liquidity, First Stop: UK & Eurozone PMI

🎍 New Year Trading Begins — Still Thin Liquidity, First Stop: UK & Eurozone PMI The new year’s trading has kicked off, but market liquidity has not fully returned yet. Tokyo: closed for the New Year holidays Closed markets: New Zealand / China / Thailand / Switzerland / Russia 👉 Meaningful participation will likely resume […]

📈 Middle East & Ukraine in the Background — Quiet, Tactical Trading Ahead of FOMC Minutes in NY

📈 Middle East & Ukraine in the Background — Quiet, Tactical Trading Ahead of FOMC Minutes in NY ■ Market Overview: Commodity Currencies Hold Up, But Overall Tone Remains Cautious During Tokyo and Asian trading, FX markets were relatively calm.The yen drifted slightly weaker, but the standout theme was: Resilience in commodity currencies such as […]

📈 Markets on Hold as Ukraine Developments Are Watched — Profit-Taking in Precious Metals Triggers a Pullback in AUD

📈 Markets on Hold as Ukraine Developments Are Watched — Profit-Taking in Precious Metals Triggers a Pullback in AUD ■ Overall Market: Cautious Tone, Direction Still Limited FX markets started the week cautiously, with traders closely monitoring progress in peace negotiations over Ukraine. Talks between President Trump and President Zelensky failed to reach agreement on […]

📰 Testing Whether the Yen-Weakness Trend Can Really Hold

📰 Testing Whether the Yen-Weakness Trend Can Really Hold — Directionless Trading, But the Bias Remains in Focus — 1️⃣ Market Summary Because of Christmas holidays, Europe is closed and U.S. trading is extremely thin.With liquidity low, USD/JPY is drifting, searching for direction around the upper 155 area. During Tokyo trading, softer Tokyo CPI triggered yen selling and dollar buying, pushing […]

📰 Christmas Eve Market — With Liquidity Drying Up, It’s Headlines — Not Prices — That Move the Market —

📰 Christmas Eve Market — With Liquidity Drying Up, It’s Headlines — Not Prices — That Move the Market — ■ Market Overview: Entering One of the Quietest Sessions of the Year Christmas Eve on December 24 brings shortened trading hours across Europe and the U.S.In practical terms, markets are close to “near-empty” conditions. Most […]