**EUR/USD Strong Sell**

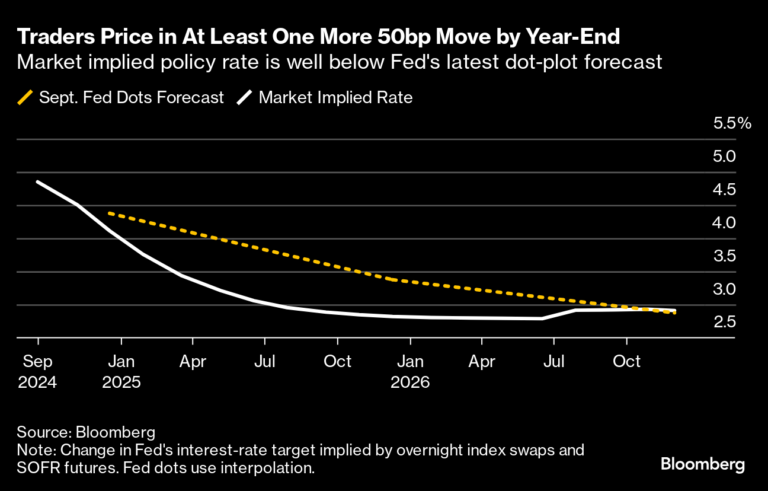

During the Asian session, EUR/USD is showing slight growth as it attempts to break above 1.0830. Market participants are holding off on taking new positions ahead of significant macroeconomic data releases this week. At 16:00 (GMT+2) today, Federal Reserve Chairman Jerome Powell is scheduled to speak before Congress, where he may comment on the anticipated rate cuts by the end of 2024. The market expects one to two 25-basis point cuts starting from the September meeting. On Thursday, inflation data for June will be released, with expectations of a slowdown from 3.3% to 3.1% year-over-year. Germany is also set to release similar statistics, forecasting a decrease from 2.4% to 2.2% year-over-year. Political instability following the parliamentary election results in France is also affecting the euro.

**GBP/USD Strong Sell**

The pound is exhibiting sideways movement around 1.2800. Although it hit a new high since June 12 the previous day, it lost momentum towards the end of the session. The Labour Party’s victory in the UK parliamentary elections has provided some support for the pound, but its impact is gradually waning. The weakness of the US dollar, following a disappointing employment report last Friday, is supporting the growth of the GBP/USD pair. Non-farm payrolls decreased from 272,000 (revised to 218,000) in June to 206,000, and average hourly earnings fell from 4.1% to 3.9% year-over-year. On Thursday, the UK’s May GDP data will be released, with expectations of an increase in economic growth from 0.0% to 0.2%.

**NZD/USD Sell**

The New Zealand dollar is showing mixed movements against the USD, trading around 0.6125. It saw some upward movement early in the week due to the weaker US dollar but has since continued to adjust. Market participants are awaiting new drivers. Today’s focus is on Federal Reserve Chairman Jerome Powell’s congressional testimony, which is expected to provide clues about future monetary policy. The Reserve Bank of New Zealand’s interest rate decision is scheduled for tomorrow, with rates expected to remain at 5.50%.

**USD/JPY Strong Buy**

The USD/JPY pair is trading around 160.70, attempting to recover from the high recorded at the end of last week, influenced by weak US employment data. Non-farm payrolls fell from 272,000 to 218,000 in June, and average hourly earnings decreased from 4.1% to 3.9% year-over-year. In Japan, bank lending data showed a 3.2% year-over-year increase in June, and wage growth accelerated from 1.6% to 1.9%, although it fell short of the 2.1% forecast.

**XAU/USD Buy**

During the Asian session, gold prices are recovering from yesterday’s decline, currently testing around 2370.00. Federal Reserve Chairman Jerome Powell is scheduled to speak before Congress at 16:00 (GMT+2) today, where he is expected to provide hints about potential changes to monetary policy this year. Non-farm payrolls decreased from 272,000 to 218,000, and inflation statistics to be released later this week are expected to show a slowdown from 3.3% to 3.1% year-over-year.