**EUR/USD – Sell**

EUR/USD is attempting to break 1.0750, continuing last week’s bullish momentum. Today’s German inflation data is expected to show a slowdown, with the HICP forecasted to drop from 2.8% to 2.6% year-on-year. ECB President Lagarde is also scheduled to speak, potentially providing comments on macroeconomic statistics. In the US, the ISM Manufacturing Index is expected to rise from 48.7 points to 49.0 points.

**GBP/USD – Buy**

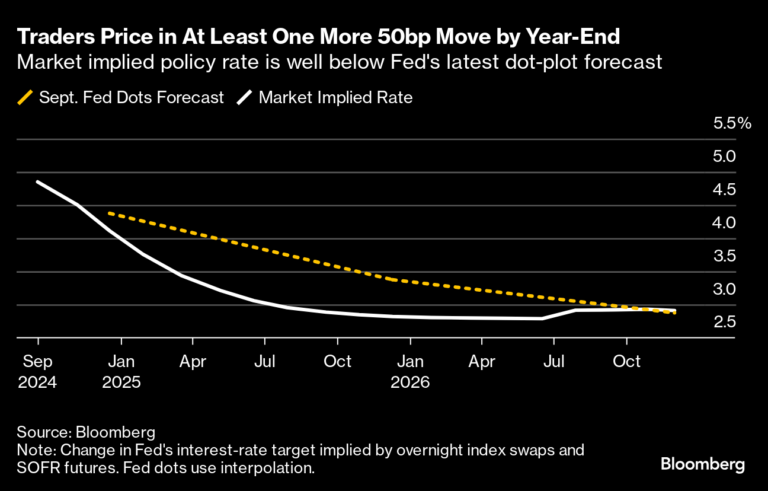

GBP/USD shows a steady rise around 1.2665. Last week’s PCE data decelerated as expected, increasing the likelihood of the Federal Reserve easing monetary policy in September. Core PCE fell from 2.8% to 2.6% annually and from 0.3% to 0.1% monthly. The Bank of England may delay its dovish shift due to inflation concerns. Today’s consumer credit statistics are expected to show an increase in net lending to individuals from £310 million to £330 million.

**AUD/USD – Strong Buy**

AUD/USD is attempting to break 0.6665, supported by improved Australian consumer confidence and strong inflation data released last week. Mixed economic data from China also influences the pair; the Caixin Manufacturing PMI rose to 51.8 points, while the Non-Manufacturing PMI fell to 50.5 points. In the US, the PCE data release this week is expected to show a core PCE slowdown to 2.6% annually.

**USD/JPY – Strong Buy**

USD/JPY is trying to break through 161.00, with the US dollar remaining strong as the Federal Reserve is unlikely to lower borrowing costs this year. The PCE data released on Friday showed core inflation slowing to 2.6% annually. Japan’s CPI slightly increased in June, but the CPI excluding food and energy fell to 1.8%.

**Gold/USD – Strong Buy**

Gold/USD shows mixed movements around 2315.00. Investors are watching Federal Reserve members’ comments closely, with attention on the PCE data to be released on Friday. The core PCE is expected to slow to 2.6% annually. Accelerating inflation in Canada may also impact gold prices.