GoldenBoy EA Telegram channel!

https://t.me/+wN80MiU5XQlmODA9

Installing Forex expert advisors (EA) follows nearly the same pathway as that of custom indicators, with the minor difference that the EA files are attached to the “Experts” folder and not the Indicators folder. This is how it is done. Again, the assumption is that the EA was coded within the MQL4 environment, as only EAs coded with the MQL4 can be added are compatible with the MT4 platform.

Step 1: Transferring files

1. Create or download an EA. Keep note of the location of where you saved it.

2. Select and copy the EA file you wish to install.

3. Look for the MetaTrader4 folder. This is normally located in the C: drive.

4. Paste the files into the Experts folder. A window requesting admin permission may appear; if so, just click Continue.

Step 2: Installing the EA on the MT4 platform

1. Launch your MT4 platform.

2. Look for the Expert Advisors section under the Navigator panel at the left side of the platform. Click on the Plus sign and the available EAs should be listed there.

3. Click on the EA you want to install and drag it onto one of the charts on your platform.

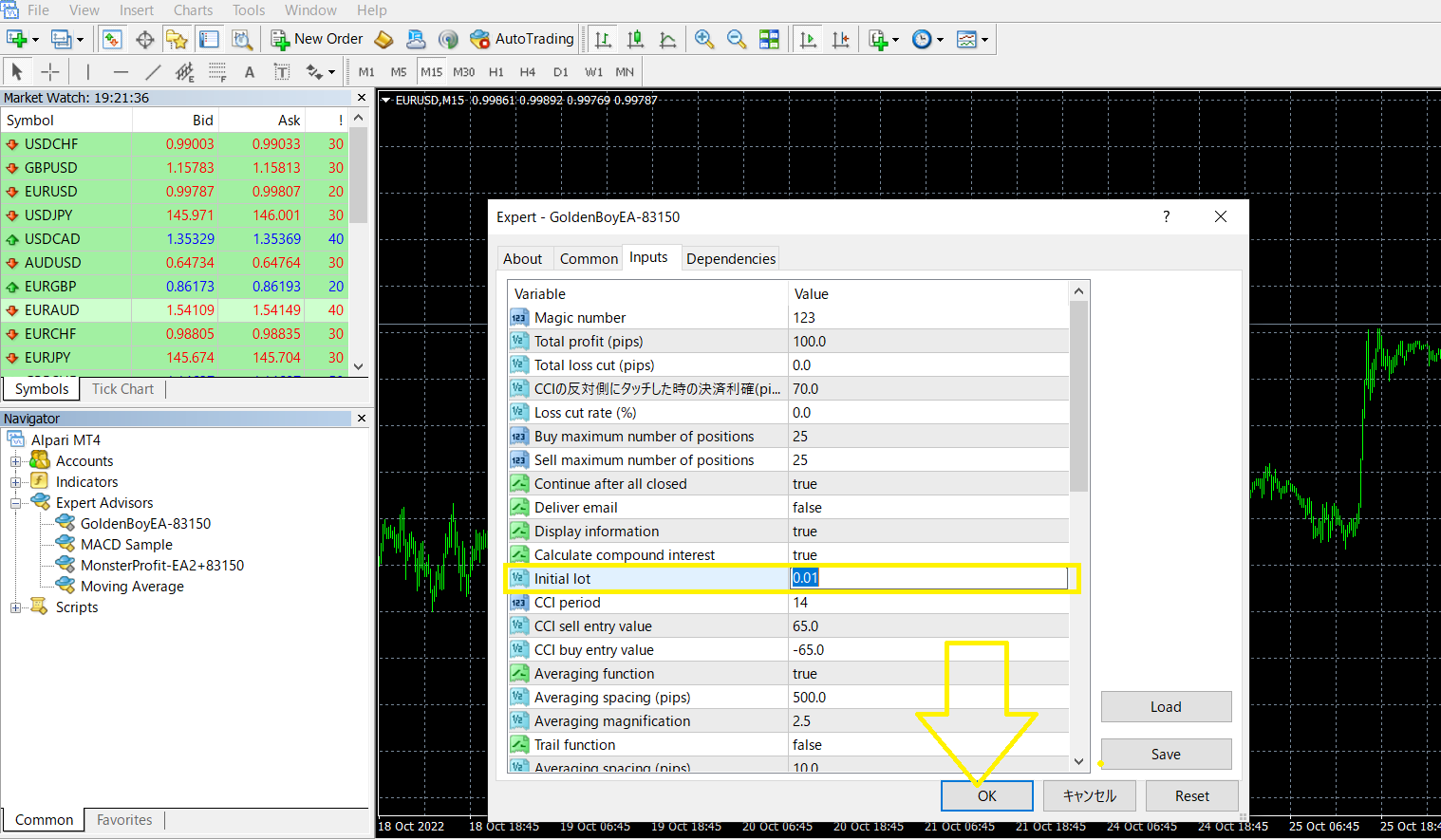

When adding an EA to the chart, go to the Navigator menu on the left hand side of the platform interface, click on the + sign beside Expert Advisors to show the attached EAs. Click on the one to be added to the platform. This opens a pop-up window where the trader can set the parameters within which the EA will function. When this is concluded, click OK to attach the EA.

Step 3: Adjusting the settings

1. A pop-up box will appear showing the settings of your EA.

2. Make sure that all the settings and alerts are correct before clicking OK.

3. Chose the correct Chart. 15mins, GOLD(XAUUSD)

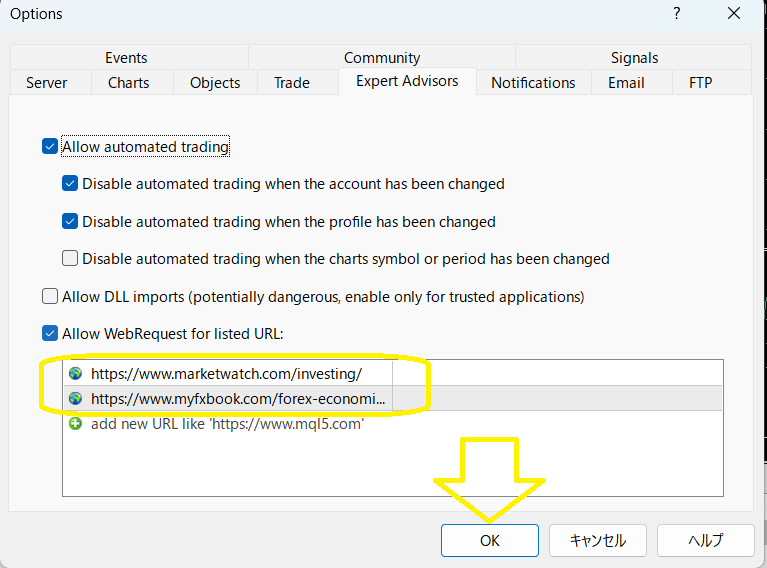

Step4: Insert 3URL

Click MT4 Top Tool ⇒ Options ⇒ Expert Advisor ⇒ Insert URL below

Add the following 2 URL to the URL list that allows WebRequest .

https://www.marketwatch.com/investing/

https://www.myfxbook.com/forex-economic-calendar/

Please change the Initial lots, depend on your Initial Fund.

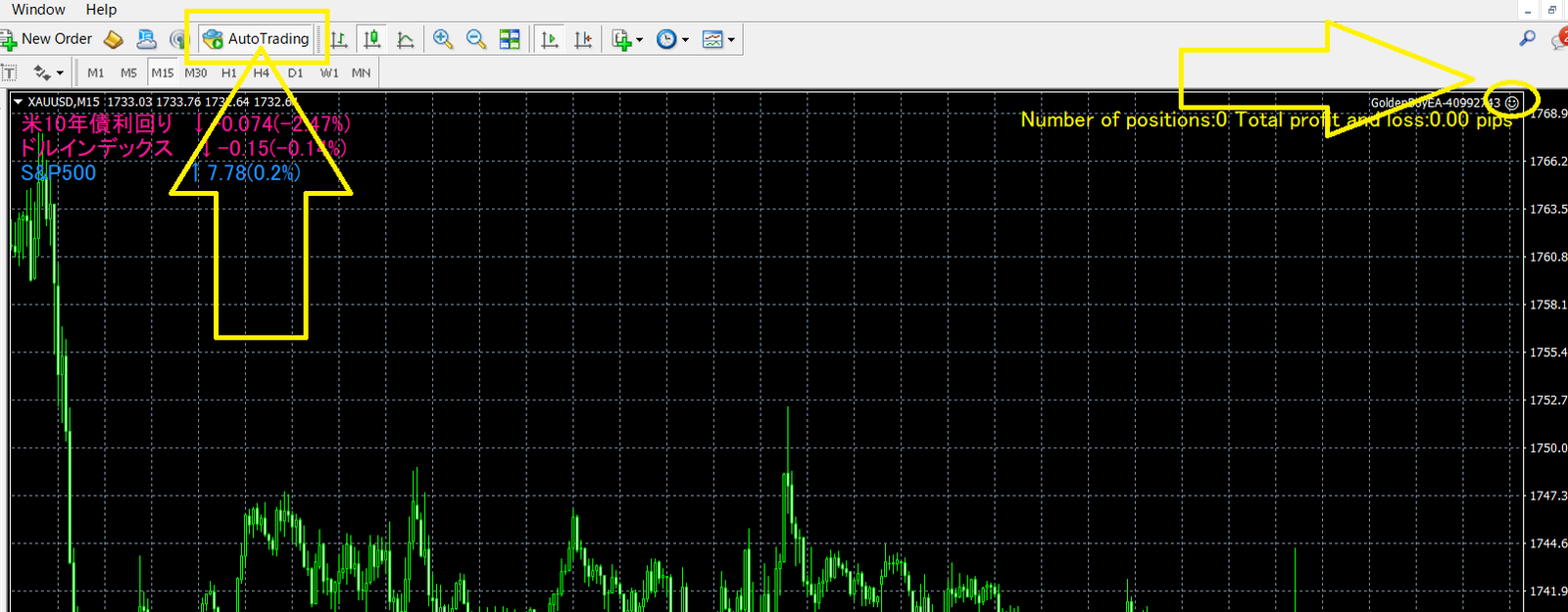

Click the automatic trading tab, and when the face on the upper right of the chart changes to the Smile mark, the automatic trading start is complete.

By continuing to start MT4 on the desktop cloud as it is, EA will automatically repeat buying and selling.

Parameter setting, reference value

* Please adjust the initial lot size according to the risk-reward ratio.

Standard account:

Low risk: 0.01 lots for $2,000 capital

Medium risk: 0.01 lots for $1,000 capital

High risk: 0.01 lots per $500 capital

Micro account:

Low risk: 1 lot for $2,000 capital

Medium risk: 1 lot for $1,000 capital

High risk: 1 lot per $500 capital

※ In terms of maximizing compound interest, a micro account is more advantageous for amounts less than $15,000.

Approximate value: In the case of funds of 2,000 dollars

-

Change only the initial lot value according to the funds and risk / return.

〇 Middle risk / middle return (monthly interest rate around 25%)

Time frame: 15 minutes

- When the index is announced, a new position entry stop function is attached.

- As a market situation judgment function, entry points are carefully selected using the correlation between the US 10-year bond yield and the US dollar index.

Magic number = 123

Total profit (pips) = 100

Total loss cut (pips) = 0

Settlement profit when touching the other side of CCI (pips) = 70

Stop-loss rate (%) = 0

Max buy positions = 25

Max sell positions = 25

Continue trade = true

Deliver mail = false

Display information = true

Compound interest = true

Initial lot = 0.02 (changed according to funds and risk / return)

CCI period = 14

CCI sell entry value = 65

CCI buy entry value = -65

averaging function = true

averaging spacing (pips) = 500

averaging magnification = 2.5

trail function = false

Trail Start Profit (pips) = 10

Depth of loss cut on trail (pips) = 10

Allowable spread (pips) = 100

Restoring the Price averaging coefficient Number of Price averaging times = 2

Whether to apply the logic of the initial entry to Price averaging = true Settlement profit (pips) = 70

Candlestick width that can be picked up (pips) = 500

Time axis of Price averaging candlestick = 5 mins

〇 High risk and high return (monthly interest 100-300%)

Time frame: 15 minutes

- When the index is announced, a new position entry stop function is attached.

- As a market situation judgment function, entry points are carefully selected using the correlation between the US 10-year bond yield and the US dollar index.

- Magic number = 123

Total profit (pips) = 100

Total loss cut (pips) = 0

Settlement profit when touching the other side of CCI (pips) = 70

Stop-loss rate (%) = 0

Maximum number of positions Buy = 25

Maximum number of positions Sell = 25

Whether to continue at all payments = true

Whether to deliver mail = false

Whether to display information = true

Whether to calculate compound interest = true

Initial lot number = 0.04 (changed according to funds and risk / return)

CCI period = 14

CCI sell entry reference value = 65

CCI buy entry reference value = -65

Whether to use the Price averaging function = true

Price averaging spacing (pips) = 500

Price averaging magnification = 2.5

Whether to use the trail function = false

Trail Start Profit (pips) = 10

Depth of loss cut on trail (pips) = 10

Allowable spread (pips) = 100

Restoring the Price averaging coefficient Number of Price averaging times = 2

Whether to apply the logic of the initial entry to Price averaging = true Settlement profit (pips) = 70

Candlestick width that can be picked up (pips) = 500

Time axis of Price averaging candlestick = 5 mins

〇 Low risk low return (monthly interest rate around 10%)

Time frame: 15 minutes

- When the index is announced, a new position entry stop function is attached.

- As a market situation judgment function, entry points are carefully selected using the correlation between the US 10-year bond yield and the US dollar index.

- Magic number = 123

Total profit (pips) = 100

Total loss cut (pips) = 0

Settlement profit when touching the other side of CCI (pips) = 70

Stop-loss rate (%) = 0

Maximum number of positions Buy = 25

Maximum number of positions Sell = 25

Whether to continue at all payments = true

Whether to deliver mail = false

Whether to display information = true

Whether to calculate compound interest = true

Initial lot number = 0.01 (changed according to funds and risk / return)

CCI period = 14

CCI sell entry reference value = 65

CCI buy entry reference value = -65

Whether to use the Price averaging function = true

Price averaging spacing (pips) = 500

Price averaging magnification = 2.5

Whether to use the trail function = false

Trail Start Profit (pips) = 10

Depth of loss cut on trail (pips) = 10

Allowable spread (pips) = 100

Restoring the Price averaging coefficient Number of Price averaging times = 2

Whether to apply the logic of the initial entry to Price averaging = true Settlement profit (pips) = 70

Candlestick width that can be picked up (pips) = 500

Time axis of Price averaging candlestick = 5 mins

Revenue image from backtesting

Low risk low return

Average monthly interest 52% (10.3 times in about one and a half years!) $ 10,000 ⇒ $ 103,784

- In the back test, the risk is increasing because the US 10-year bond yield and the US dollar index cannot be taken into consideration as the market conditions. Roughly, it is assumed that the risk will be reduced to about 30% of the back test.

High risk and high return

Average monthly interest 309% (8.7 times in about two and a half months!) $ 10,000 ⇒ $ 877,298

- In the back test, the risk is increasing because the US 10-year bond yield and the US dollar index cannot be taken into consideration as the market conditions. Roughly, it is assumed that the risk will be reduced to about 30% of the back test.4