Adjust the initial lot size according to your capital and risk/reward.

Here’s a guide for your lot size:

For capital of $15,000, a micro account is recommended because it allows for more precise lot sizes, leading to quicker profit increases through compound interest. Once your capital exceeds $15,000, consider transitioning to a standard account.

If you have a standard account (for capital over $15,000):

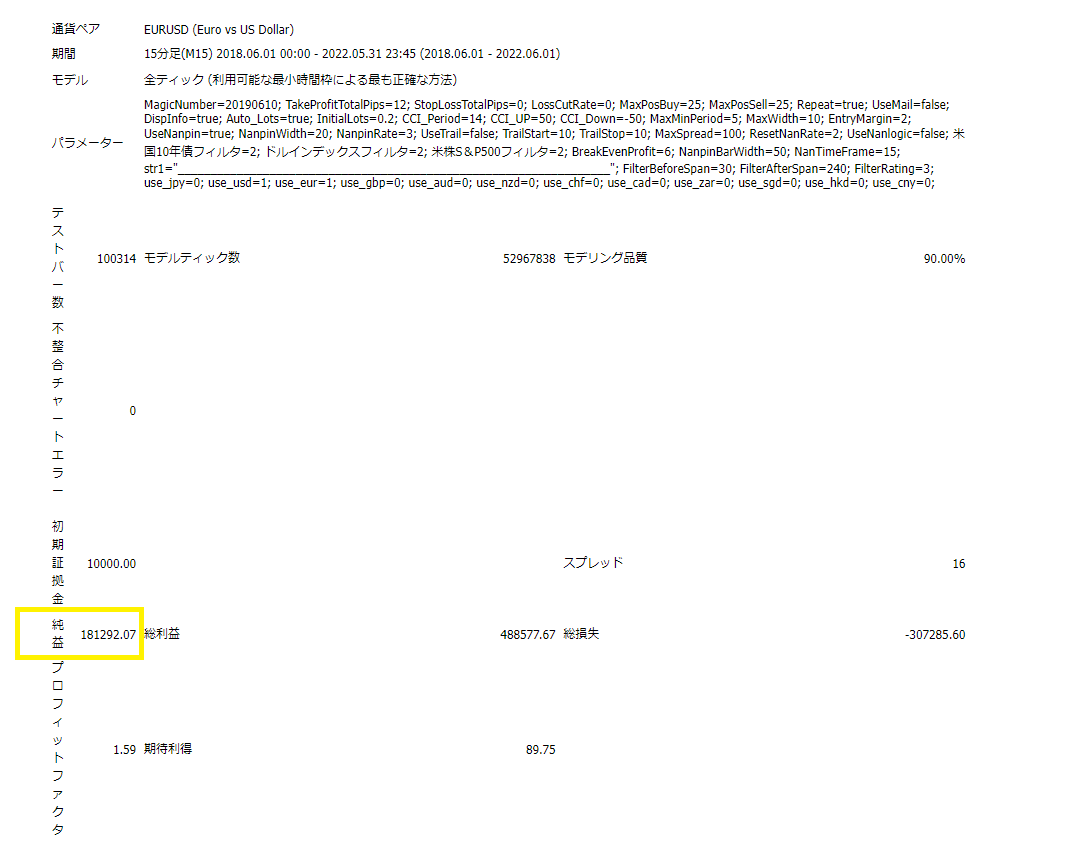

- For medium risk: With $10,000 in capital, use 0.2 lot

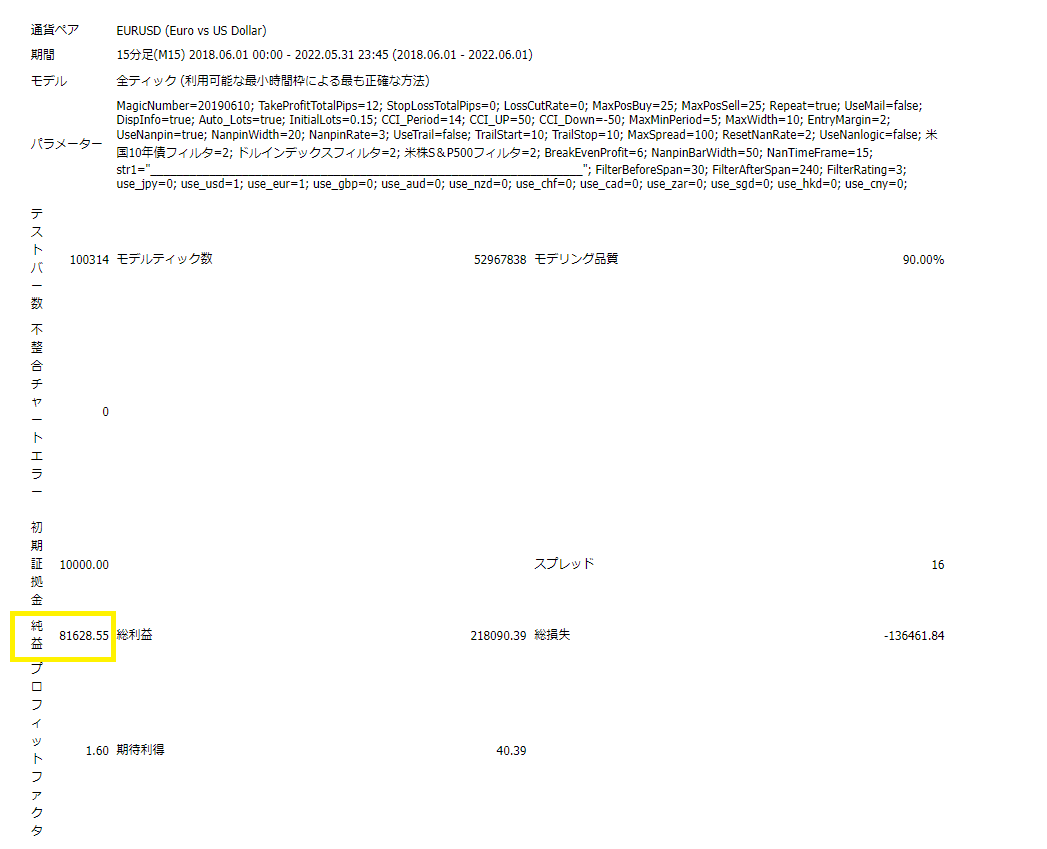

- For low risk: With $10,000 in capital, use 0.15 lot

If you have a micro account (for capital under $15,000):

- For medium risk: With $1,000 in capital, use 2 lots

- For low risk: With $1,000 in capital, use 1.5 lots

Approximate Value: For Capital of $10,000

Note: Adjust only the initial lot value based on your capital and risk/return balance.

-

Medium Risk, Medium Return (Approximate Monthly Interest Rate: 12%) This setting can help you navigate through economic conditions like the Ukrainian war. It could multiply your capital by 19.1 in 4 years! (Initial monthly interest rate: ~12%, average monthly interest rate: ~37.7%) While a function to stop new position entries during major announcements is available, the backtest can’t consider this, increasing the risk. We estimate the risk to be about 70% of the backtesting value. The timeframe is 15 minutes.

2. Low Risk, Low Return This is a safer setting designed to survive turbulent economic conditions like the Ukrainian war. It could multiply your capital by 8.1 in 4 years! (Initial monthly interest rate: ~7%, average monthly interest rate: ~17%) Despite having a function to stop new position entries during significant announcements, the backtest can’t account for this, thus increasing the risk. The risk is estimated to be about 70% of the backtesting value.